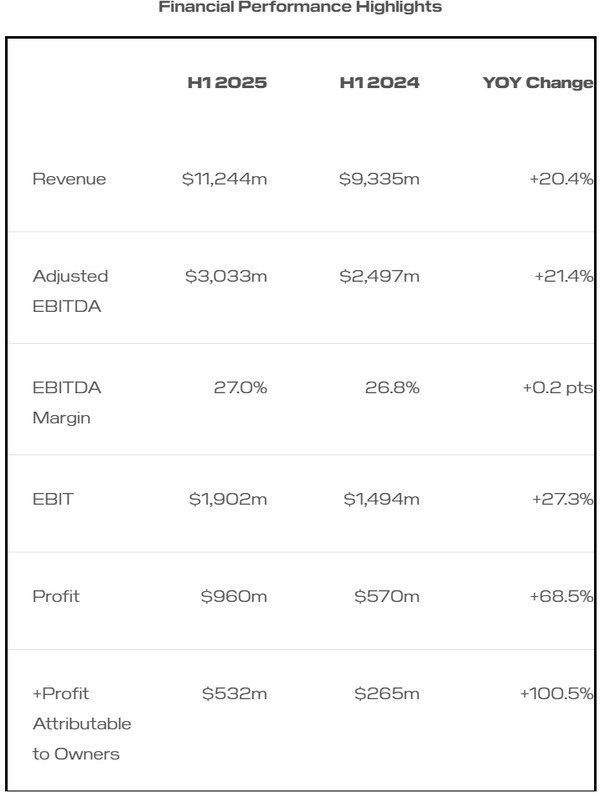

DP World reported a 20.4% year-on-year increase in revenue for the first half of 2025, reaching US$11.24 billion. Adjusted EBITDA rose 21.4% to US$3.03 billion. Container volumes across its global portfolio grew 5.6% on a like-for-like basis to 45.4 million TEU, while terminals under operational control handled 27.4 million TEU, up 7.5% year-on-year.

© DP World

© DP World

Group Chairman and CEO Sultan Ahmed bin Sulayem said: "We are pleased to report strong first-half results, with both revenue and EBITDA growing by over 20%. Ongoing geopolitical tensions, the continued closure of the Red Sea route, and rising uncertainty around global trade tariffs have caused significant disruption across the industry. Despite these challenges, our strategy of delivering integrated end-to-end solutions and operating critical infrastructure in key markets has allowed us to continue supporting cargo owners to move their freight and to deliver a strong set of results."

Capital expenditure in the first half totaled US$1.08 billion, with a full-year target of US$2.5 billion. Investments are directed at Jebel Ali Port, Drydocks World, Tuna Tekra in India, London Gateway in the UK, and Dakar in Senegal, as well as DP World Logistics and P&O Maritime Logistics. The focus remains on enhancing terminal capacity, supply chain integration, and digital capabilities.

Group Deputy CEO & CFO Yuvraj Narayan said: "This performance was underpinned by continued momentum in Ports & Terminals and Marine Services, supported by strong cash generation and a disciplined balance sheet. We remain well-positioned to fund strategic growth, maintain our credit strength, and respond to evolving market conditions."

Through Unifeeder, DP World provides multimodal transport solutions, ensuring connectivity for shipping lines and cargo owners. The freight forwarding platform now covers 300 locations and over 90% of global trade lanes.

© DP World

© DP World

Sultan Ahmed bin Sulayem added, "We continue to enhance our logistics capabilities, allowing us to serve customers seamlessly across the world's major trade lanes. Recent bolt-on acquisitions have expanded our offerings and introduced specialized capabilities aligned with the evolving needs of cargo owners. These investments address supply chain inefficiencies and strengthen connectivity across key corridors, enabling us to deliver more resilient, efficient, and tailored solutions."

Despite macroeconomic pressures and disruptions in shipping corridors, DP World expects strong full-year EBITDA supported by throughput growth, operational leverage in Ports & Terminals, and planned capital expenditure.

"Looking ahead, we remain optimistic about the medium- to long-term outlook for global trade and logistics. As supply chains evolve, DP World is well-positioned to lead the industry in delivering efficient, resilient, and sustainable trade solutions that create long-term value," said Sultan Ahmed bin Sulayem.

To view the full report, click here.

© DP WorldFor more information:

© DP WorldFor more information:

Adal Mirza

DP World

Tel: +971 50 628 7856

Email: [email protected]

www.dpworld.com