The Serbian fruit harvest is producing below-average yields, leading to low stock levels and higher prices for individually quick frozen (IQF) fruit, including raspberries and blackberries.

Industry analysts expect the 2025 harvest to be particularly poor, citing adverse weather conditions throughout the growing season. Forecasts for raspberries indicate that only 40–50% of the crop will be suitable for IQF processing, compared with the average of 60–80%.

Market sources told Expana that prices for IQF raspberries and blackberries have risen month-on-month due to the lack of available volumes. In April, frosts reportedly damaged up to 50% of the raspberry crop. This was followed in May by a late snowfall, which caused further partial losses. More recently, heat waves across much of Europe, combined with June being Serbia's driest month on record, have further impacted the crop. One source told Expana, "All stone fruit is dead. There are some raspberries and blackberries, but not enough."

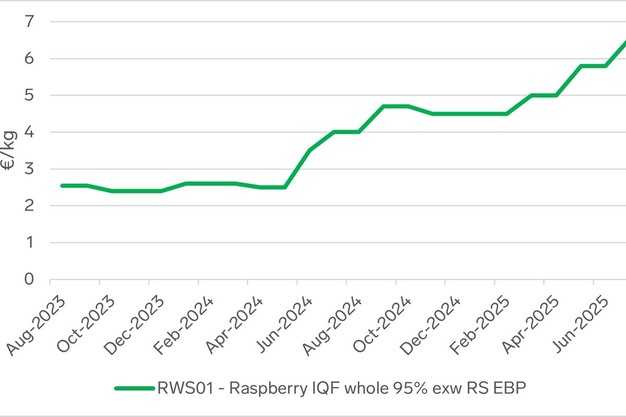

On July 31, Expana Benchmark Prices for IQF raspberry whole 95% EXW Serbia stood at €6.55/kg, up 13% month-on-month and 64% year-on-year, reflecting the tight supply.

According to World Bank data, Serbia was the world's largest exporter of frozen raspberries in 2023. In 2024, the country exported around 80,000 tonnes of raspberries, mostly frozen, according to the Serbian Chamber of Commerce. However, market participants say the industry is now facing its worst season in 50 years, with yields expected to reach only a fraction of a typical harvest.

Source: Mintec/Expana