Australia's status as a key horticulture exporter is showing signs of recovery, from the ongoing impacts of the COVID-19 pandemic and the trade/freight disruptions, according to new industry data released by Hort Innovation.

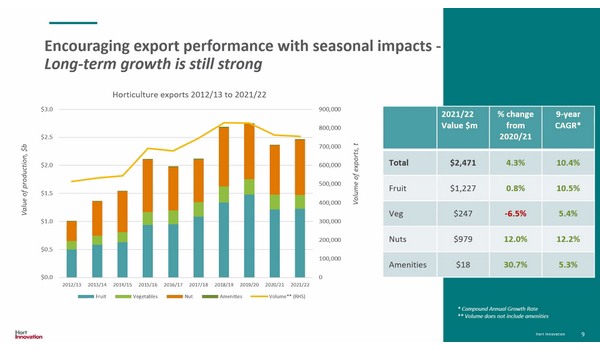

While figures did not quite return to the 2019/20 highs of $2.75billion, this year's exports were up on last year by four per cent to $2.47billion, despite supplying less volume internationally. Managing Director of Freshlogic, who collaborated on the Australian Horticulture Statistics Handbook, Martin Kneebone told today's launch of the report that exports are a huge part of the economic platform of the industry.

"Australia is a serious exporter, we are no longer spectators, speculators - and we are not in and out of markets because we can get better prices locally," Mr Kneebone said. "Those days are gone and we have committed around 50-60 per cent of some of our larger crops to these markets. That's a wonderful example for some of the smaller categories that are just starting off on that journey. We have a finite market locally; we have population growth of around 1-2 per cent, so if we are going to grow our industries it is because we are successful at export, and this is a good start."

Hort Innovation Industry Analyst Lucy Noble added that exports are a fundamental channel to the growth of the horticulture industry.

"Exports make up 11.53 per cent of the overall volumes of horticulture," she said. "So, when we look at the growth that is seen in the value of the industry in the past 10 years, it is incredibly clear that exports have played one of the biggest, if not the biggest, roles in the industry over that time. In terms of looking at the full categories, the values went up for all apart from veg. Table grapes and oranges remain the two highest value fruit exports, representing a combined total of 57 per cent of the fruit export value."

The Horticulture Statistics Handbook is released each February and captures the previous financial year's data across four categories; fruit, vegetables, nuts and other 'greenlife' horticulture (nursery, turf and cut flowers). This year's data did show that despite the rise in production value, volumes across the horticulture sector did decrease by one per cent to 6.55 million tonnes, but were marginally higher than two years ago.

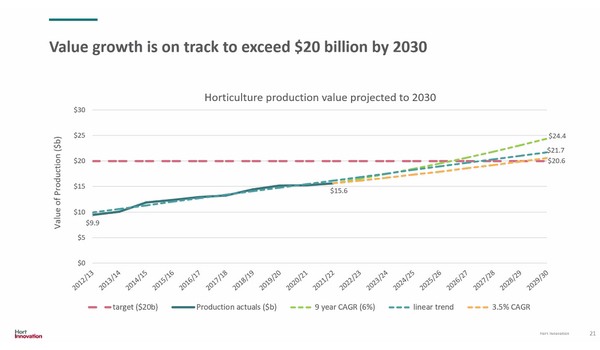

In 2021/22, the production value of Australia’s horticulture industry grew to $15.62billion (up 3% on the previous year), with value growing from $6.15billion in 2012/13.

“Australia is producing 850,000 additional tonnes of produce than we were in 2012/13. This means the industry has added, on average, around $680m in value every year for the past decade,” Hort Innovation Chief Executive Officer Brett Fifield said.

Several fruit categories experienced stronger values in 2021/22, including table grapes (increased by $90m), Watermelons (increased by $27M), Mangoes (increased by $17m), Mandarins (increased by $14m), Lychees (increased by $10m) and nectarines/peaches (increased $8m).

"Overall fruit did end the 2021/22 year weaker, falling by $237.3million (4% down)," Ms Noble said. "However, the evidence here is that fruits that experienced value declines over the last year, still have overall clear growth long-term. That can be seen particularly in blueberries, where in volume and value terms production has tripled over the past 10 years and the production farm gate value is currently over $400million. The nature and maturity of the berry industry is different to that of citrus, but in citrus, we see a compelling story where the value of the industry more than doubled over the same time, while volume increased to a lesser extent."

Strong results for Australian vegetables, despite many challenges

Vegetable production values reached an all-time high of $5.54billion in 2021/22, despite a modest decrease in volume from the previous year. AUSVEG CEO Michael Coote said that while the long-term growth in the vegetable industry has been impressive, the industry has recently been struggling with weather events, higher production costs and labour shortages.

“Weather events, labour shortages and supply chain issues have impacted production volumes of many vegetables, which has been challenging for growers," Mr Coote said. “High production costs and challenges in sourcing labour have also significantly impacted growers' bottom lines, so while the overall production value of many lines is higher than previous years, the profitability of many growers is lower as these increases have not been enough to meet increases in costs."

There were value increases across the board in the vegetable category, including leafy salad vegetables, which increased by 19 per cent ($94.2m), and tomatoes, which increased by 15 per cent ($82.9m). Leafy salad vegetables also reached new production volumes, increasing by 5.3 per cent in 2021/22. This marked the highest year of supply of fresh leafy salad vegetables. Beans had the highest annual production value growth rate of all vegetables, up 64 per cent in 2021/22 and recording its highest production value of $134.4m. Onions also reached new production value highs, exceeding $248.7m.

“It is also important to put this data into perspective, with much of the publicised shortages and supply issues with many vegetable lines occurring late in the data period or in the subsequent financial year,” Mr Coote said. “That being said, when looking at the longer-term growth of the sector, both production volumes and production values have grown strongly, which is a great sign for the ongoing viability of the vegetable industry and for Australian horticulture more generally.”

To view the full Australian Horticulture Statistics Handbook 2021/22, click here.

For more information

Hort Innovation

Phone: +61 2 8295 2300

info@horticulture.com.au

www.horticulture.com.au