ZIM Integrated Shipping Services Ltd., a global container liner shipping company, announced today its consolidated results for the three months ended March 31, 2023.

First Quarter 2023 Highlights

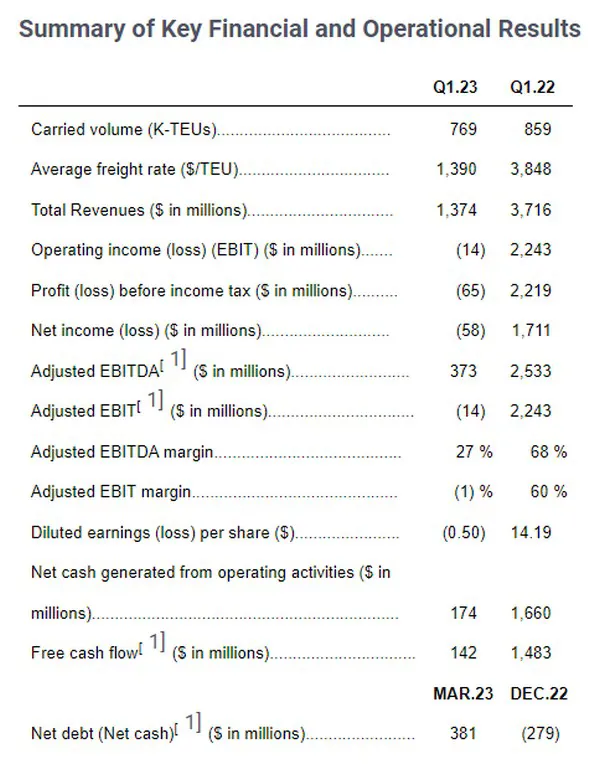

- Net loss for the first quarter was $58 million (compared to net income of $1,711 million in the first quarter of 2022), or a diluted loss per share of $0.50[3] (compared to diluted earnings per share of $14.19 in the first quarter of 2022)

- Adjusted EBITDA for the first quarter was $373 million, a year-over-year decrease of 85%

- Operating loss (EBIT) for the first quarter was $14 million, compared to operating income of $2,243 million in the first quarter of 2022. Reconciliation items between operating income and Adjusted EBIT in the first quarter were negligible.

- Revenues for the first quarter were $1,374 million, a year-over-year decrease of 63%

- Carried volume in the first quarter was 769 thousand TEUs, a year-over-year decrease of 10%

- Average freight rate per TEU in the first quarter was $1,390, a year-over-year decrease of 64%

- Net leverage ratio[1] of 0.1x at March 31, 2023, compared to 0.0x as of December 31, 2022; net debt of $381 million, compared to net cash of $279 million as of December 31, 2022

Eli Glickman, ZIM President & CEO, stated: "Following a record year of Adjusted EBITDA and EBIT generation, ZIM's first quarter results reflected the significant decline in freight rates and weak demand, particularly in the Transpacific trade, that began last year. While the near-term outlook for container shipping remains challenging, the proactive steps we took during the preceding highly lucrative market period better position us now to meet these challenges and we believe our differentiated strategy will ultimately deliver sustainable value for shareholders over the long term."

Mr. Glickman added, "With a focus on enhancing our commercial and operational resilience, we adapted our vessel sourcing strategy to improve our cost structure with the addition of fuel-efficient newbuild tonnage that will overhaul our fleet profile, as well as advance our ESG goals. These include ten 15,000 TEU dual-fuel LNG vessels, which are ideally suited for our core Asia to US East Coast service, and 36 smaller, more versatile vessels, 18 of which are also dual-fuel LNG, that will enable ZIM to operate a fleet best suited for our trades and services. At the same time, our strong balance sheet and ample liquidity further make us confident that the Company will operate from a position of strength even amidst current market headwinds."

For more information:

For more information:

Avner Shats

ZIM Integrated Shipping Services Ltd.

Tel.: +972-4-865-2520

shats.avner@zim.com