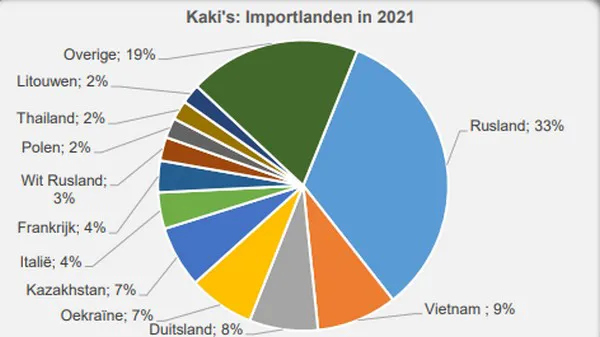

A limited number of countries dominate the global persimmon market. China is, by far, the biggest producer; Spain, the leading exporter. Azerbaijan and Uzbekistan export significant quantities, but almost all their persimmons go to Russia or other countries in that region. China accounts for 11% of exports, but, there too, they mostly stay in the region.

Russia is, by far, the top importer, with Vietnam second and then Germany. Other larger importing countries are Ukraine, Kazakhstan, Italy, France, Belarus, Poland, Thailand, and Lithuania. The Netherlands and Belgium are minor players.

EU imports 90% from Spain

In the EU, Spain rules the persimmon market. In 2021, all European Union countries (incl. products for re-export) imported 153,000 tons of this fruit. That was less than in the two previous years when it topped 180,000 tons. In 2021, of the 153,000 tons of EU imports, about 15,000 tons were re-exports. In that year, European Union countries imported 133,000 tons from Spain. Around 90% of all imports into EU countries were thus Spanish persimmons.

The Spanish product is marketed under Spanish PersiMon, a trade name for Spanish persimmons with a protected designation of origin (PDO). The name is deliberately spelled with one "m" to distinguish it from the Internationally commonly used name persimmon. The PDO guarantees the fruit is of the Rojo Brillante variety and comes from the Ribera del Xúquer region, where it was first discovered.

Other EU suppliers

Besides the 133,000 tons the EU27 countries got from Spain, only around 5,500 tons of persimmons were imported from other countries. Italy, with 2,750 tons, Portugal, with 1,100 tons, and South Africa, with 550 tons, were the other suppliers of some significance. Last year, Germany was the largest importer within the European Union. It took 45,000 tons. Italy (24,000 tons), France (20,000 tons), Poland (13,000 tons), and Lithuania (12,500 tons) follow.

The Netherlands and Belgium are minor players

Eurostat figures show that, in 2021, the Netherlands imported 4,800 tons of persimmons. In 2020, that exceeded 6,400 tons; in 2019, it exceeded 7,300 tons. Three-quarters of those came from Spain. South Africa and Germany were next, but volumes were limited, at 540 and 500 tons, respectively.

Based on various countries' export figures, it seems the Netherlands took more. Spanish figures show it should be 7,500 tons and, in South Africa's case, 1,200 tons. All countries' exports to the Netherlands totaled 9,200 tons last year and almost 14,000 tons in 2020. Belgium imports 2,000 to 2,500 tons of persimmons annually, mainly from Spain. Spanish export figures indicate a larger quantity of roughly 4,000 tons.

Widespread Spanish exports

According to Spain's Ministry of Agriculture, between 450,000 and 500,000 tons of persimmons are grown in that country annually. Of that, 200,000 tons are exported. The number of countries Spanish PersiMons go to many countries. Every year, around 30 countries take more than 1,000 tons each.

Germany, Italy, France, Poland, the Netherlands, the United Kingdom, Portugal, and Morocco are the main buyers. Last year, just under 150,000 tons went to EU countries and almost 40,000 tons to non-EU countries, including, in addition to the United Kingdom and Morocco, Saudi Arabia, Ukraine, Switzerland, and Belarus.

Not many Israeli exports anymore

Israeli persimmons are a unique variety marketed internationally under the name “Sharon”. These days, Israel exports far less Sharon fruit than before. In recent years, the EU has imported, at most, a few hundred tons a year. Israel also exports far less to elsewhere in the world than before. Last year, Israel exported more than €3 million (approximately $3.5 million) worth of persimmons, mostly to Russia. In 2013 and 2014, it was well over $20 million. The Netherlands was then the second largest buyer after Russia.

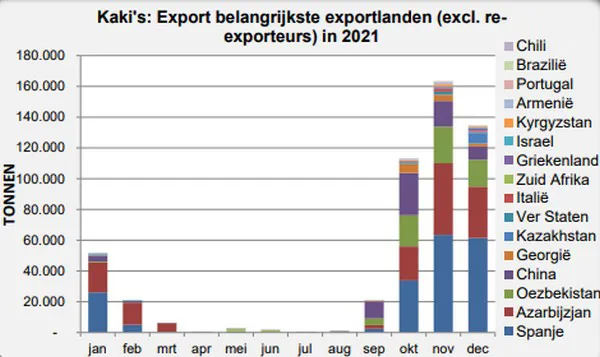

Short season with little non-seasonal supply

The Spanish PersiMon export season runs from October to January, with minimal supply at its edges. Other major exporting countries in Central Asia and China seasons coincide with the Spanish one. South Africa, Brazil, and Chile are the only significant countries exporting persimmons outside those months. South Africa supplies them mainly in May and June, but, as mentioned, in small quantities.

Click here for the background figures.

For more information:

Jan Kees Boon

Fruit and Vegetable Facts

Website: www.fruitandvegetablefacts.com

Email: fruitvegfacts@gmail.com