“Life remained home-centric in late summer,” said Jonna Parker, team lead, fresh with IRI. “An estimated 78 percent of all meal occasions are being prepared at home.”

- 82 percent of American households bought at least one restaurant meal in September.

- Takeout continues to be big, with 54 percent having ordered meals to go.

- When purchasing groceries, 83 percent of consumers shopped in person.

- Spending continues to be affected by out-of-stocks.

- Price perceptions among consumers remain very high with 94 percent believing grocery prices are somewhat or a lot higher than before. The most popular money-saving measures are looking for sales/deals more often (49 percent), cutting back on non-essentials (43 percent), looking for coupons (30 percent) and buying store-brand items more often (28 percent). “As shoppers are looking for ways to stretch their food dollar, fresh produce can be a budget hero compared to other parts of the meal,” Joe Watson, VP, retail, foodservice & wholesale for IFPA.

“Inflation, drought conditions in the West, Hurricane Ian in the Southeast, record low consumer confidence and more are keeping grocery supply and demand patterns in flux,” Watson noted. “Amid the continued disruption, IRI, 210 Analytics and IFPA remain committed to bringing the industry the latest trends and analysis in fresh produce.”

The price per unit across all foods and beverages in the IRI-measured multi-outlet stores, including supermarkets, club, mass, supercenter, drug and military, increased 14.0 percent over the third quarter of 2022 and 14.3 percent in the month of September (the four weeks ending 9/25/2022).

Fresh produce prices were also up from last year, at +9.3 percent level on a per-unit basis and +9.8 percent on a per-pound basis.

Fresh produce prices were also up from last year, at +9.3 percent level on a per-unit basis and +9.8 percent on a per-pound basis.

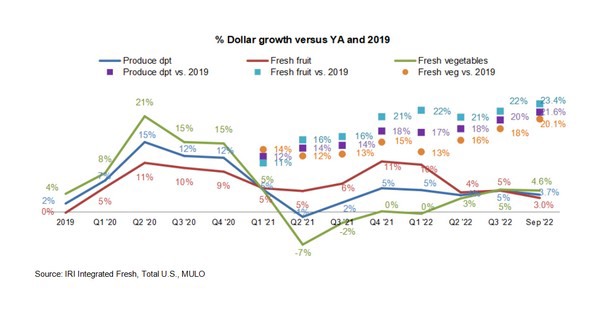

September 2022 fresh produce sales reached $5.7 billion, surpassing the record set the prior year by +3.7 percent.

Fresh produce sales tapered off from $1.497 billion the first full week of September to $1.372 billion the fourth week ending September 25th.

“In September, the fresh share dropped to 80.2 percent,” said Watson.

The below-average growth/inflation for fresh produce meant a drop in the share of fresh fruit and vegetables versus the share represented by frozen (8.1 percent) and shelf-stable (11.7 percent).

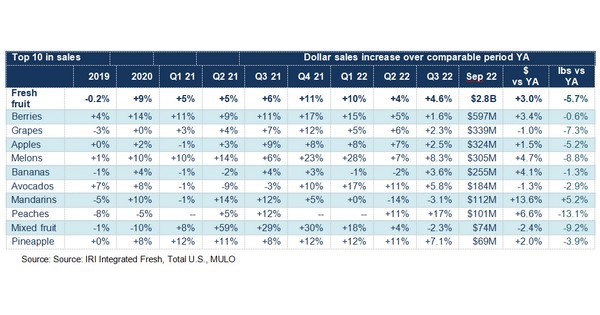

“The overall volume pressure in fruit is echoed by nearly all the big sellers with the one exception of mandarins,” Parker said. “Berries had a few months where volume was off, but sales levels have recovered to within one point of last year.”

“The overall volume pressure in fruit is echoed by nearly all the big sellers with the one exception of mandarins,” Parker said. “Berries had a few months where volume was off, but sales levels have recovered to within one point of last year.”

“September saw big upticks in the sales of potatoes, lettuce and onions, though in all cases the boost was inflationary driven,” said Watson. “Cucumbers came the closest to year-ago levels.”

The next report, covering October, will be released in mid-November.

Please contact Joe Watson at jwatson@freshproduce.com with questions. Click here to read the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com