After a period in which the low supply of pineapples from Costa Rica drove prices up, the rest has returned to the market. Some European traders even talk about surpluses. In the U.S., there is a considerable supply which is pushing prices down. In Latin America, this appears to be a minor concern. Declines in production are reflected in the export figures of Costa Rica and other countries in the region are investing in pineapple cultivation. On the other side of the Pacific, producers in the Philippines are taking advantage of growing demand from China. Malaysia is also looking at this huge market, which is currently dominated by the Philippines. Australian growers have had a decent season so far.

Malaysia wants bigger share of world market

The Malaysian pineapple sector aims to grasp a 5% share of the world market, as announced by the Malaysian Pineapple Industry Board (LPNM) earlier this month. The acreage should grow to 15,000 hectares, which should yield an annual production of 700,000 tonnes of pineapples. Of this, 3,500 hectares should be set up in Sarawak, with a production of 150,000 tonnes per year. The acreage in Malaysia currently stands at some 10,319 hectares which yield a total of 412,720 tonnes. The pineapple exports focus on the Asian market, on countries like Japan and South Korea. Additionally, work is being done by the sector to access the Chinese market, but the Middle East also represents good opportunities for pineapple producers. An exporter says that about twenty percent of their sales go to Islamic countries. The direct transport link and the halal label are an advantage for this exporter.

Filipino pineapples popular in China

The market for pineapples has been good since October. Major export markets include China (Shanghai) and the Middle East. An exporter says that ten to fifteen containers are now shipped weekly to Iran, while in the past they exported only three to four. A series of public holidays in Iran contributes to greater demand. China receives around sixty containers per week, according to the exporter.

After a period in which the impact of El Niño reduced the production, cultivation is now back to its former levels; therefore, pineapple prices have dropped compared to a few months ago, when they reached up to seventy dollars per carton in Dubai. The island group produces around 160 containers per week. Between July and September, production stood at less than fifty containers, while in the same period of the previous year it amounted to around 100 containers, explains the trader. The high demand from countries such as China means that production will continue to grow. "There is currently demand for 300 to 400 containers per week, and the Philippines can only supply between 150 and 160 containers per week."

Vietnamese export season over

A Vietnamese grower explains that they grow two varieties exclusively for the fresh market: Smooth Cayenne and Natal Queen. However, the production costs of the Natal Queen are quite high, which means more and more are switching to the Smooth Cayenne. The season runs from April to September. The grower cultivates pineapples on 3,000 hectares in the south of Vietnam, namely in Tien Giang and Long An. An exporter states that they market about 40,000 tonnes, with the main export destinations being the U.S., Japan, South Korea, the UAE, Saudi Arabia, Qatar, Russia and the EU.

Chinese imports rising

Chinese pineapple imports are on the rise. The Philippines is the leading supplier, with a market share of 88 percent; Taiwan stands second with about 12 percent. There are also some small players, such as Thailand, with a market share of 0.3 percent. Between January and May, the country imported 24,931 tonnes from the Philippines, which is 65 percent more than a year earlier. Filipino pineapples have a longer shelf life than the Taiwanese, which gives a competitive advantage to the archipelago. Furthermore, the Philippines is able to offer a year-round supply, while the Taiwanese season runs from May to October. The price this year is averaging around 90 yuan (12.80 Euro) per 12 kilo box.

Costa Rica also aims to gain access to the Chinese market. Negotiations have been running since 2014 and in October a Chinese delegation visited the Central American country.

Australia: surplus due to overlapping seasons

The pineapple season has not been favourable for everyone. A grower just north of Brisbane says the harvest has been disappointing. The producer harvested 500 tonnes instead of the 600 tonnes that the plantation usually yields. Prices were also two to four dollars lower per box in Sydney. The weather played tricks on this grower. Last year, between October and January, there was a heat wave, which was then followed by a period with plenty of rainfall in August and the mercury dropped below freezing point; far from ideal conditions for the pineapples. In northern Queensland, the pineapple harvest is in full swing, although drought is still a concern for growers. In recent months, there has been a quarter of the normal average rainfall, with the consequent threat of water shortages. In the coming weeks, the harvested volumes in the region will fall until the season comes to an end in January.

The market is currently affected by oversupply due to an overlap in the production seasons in the south and north of the country; however, prices remain higher on average.

While Australian growers were concerned a few months ago about the possibility of diseases arriving with the imports from Malaysia, things have now gone back to normal. Imports from Malaysia have stopped and growers state they have heard nothing more about the diseases.

More pineapples in Latin America

Besides Costa Rica, pineapples are also grown in other countries in the region. Panama is a small player with a stable market share. Ecuador is making progress. The export figures for September 2015 amount to 43,326 tonnes. For the whole of 2014, exports stood at 57,380 tonnes. Since the EU and Colombia signed a free trade agreement, more Colombian pineapples have also been arriving to Europe. Importers in Europe, however, are not satisfied with the fruit's quality.

Costa Rica back into production

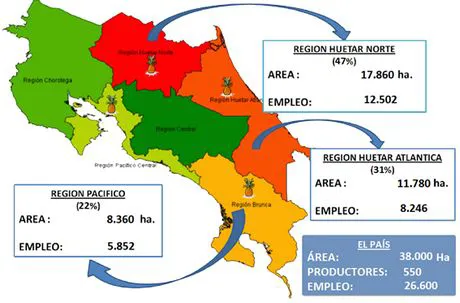

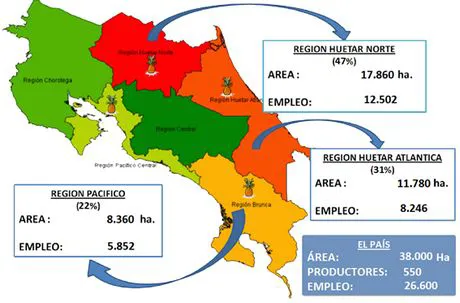

The lower supply from Costa Rica, which affected the mood on the world market in autumn, is reflected in the export figures. The downward trend compared to 2014 had already started in June, when exports were worth $ 68.9 million, compared to 76.2 million dollars a year earlier. The country has a total of 170 exporters who ship mainly to the U.S.; a market which accounts for 53 percent of the exports. The EU is a close second with 44 percent. The country has 550 producers and a total area of about 38,000 hectares.

Production regions in Costa Rica.

Exporters in Costa Rica believe they can obtain good prices in Europe, despite the changes in the dollar-euro exchange rates. According to the association of pineapple exporters, the value of exports has increased by 7.5 percent this year, while the volume has grown by 8 percent. Growers in Costa Rica are planting more, which will probably result in a higher production again in 2017.

Large supply affected Belgian market

A pineapple oversupply has affected the mood on the Belgian market. There are large volumes available in all different price ranges. Whether supply will stay at this level in the coming weeks is difficult to predict, according to a trader. The global shortages registered several weeks ago are history. "For the past two weeks, the market has made a full turn. Due to the large supply, there is a serious pressure on the market," said a trader, which entails lower prices. After the turn of the year, a decline in supply volumes is expected.

The Netherlands: more supply after a period with shortages

In the autumn, the low pineapple supply resulted in good prices for the traders. For quite a while, the prices paid have remained above ten Euro per box. Just like in Belgium, the situation now is reversed; a large supply in December has pushed prices down. Ahead of Christmas, prices should grow and importers are hoping for an increase in demand around the holidays. The bad prospects in Costa Rica are driving some importers to other producing countries, such as Ecuador. Also, the negative trend, according to some importers, is exaggerated.

French market traditionally quiet

The demand for pineapples traditionally falls towards the end of November. This year it has been no different, but the attacks in the French capital pushed the mood further down. Traders had to hurry up to get the pineapple on the market before the quality was not up to scratch. This situation also applies to other fruits. The consumer seems less likely to go to the grocery stores. The cheapest pineapples cost between five and six Euro per box. "Those are the pineapples we throw away if we do not sell them, because they have already been on the shelf for a week," explains a trader. Newly arrived pineapples yield eight Euro per box. The market is expected to improve in January. "We hope things will get better around Christmas."

German market unpredictable

In recent weeks, pineapple prices have dropped significantly, which has been partly due to a large supply. How the market will behave in the run-up to Christmas is hard to predict. "Factors such as the marketing, the weather or a ship delayed can lead to quick changes in the market," explains a trader. Several importers expect supply to fall in the first quarter of 2016.

Swiss company presents Fairtrade pineapple

The Swiss company HPW, which in 2003 introduced the first Fairtrade pineapples from Ghana, will be marketing the first Fairtrade pineapples from Panama this year. To this end, the firm is working together with Tropical Fruit Company. In January, the first shipment will arrive in Rotterdam, which will be followed by new ones every week. The main customer is the Swiss supermarket Coop.

Large supply pushes prices down in the U.S.

The steady supply of pineapples from Costa Rica has been keeping prices low in the U.S. Low prices apply to imports from Central America, but also to pineapples arriving from the east coast and from Mexico. The market conditions are expected to remain stable until the end of the year, although everyone is ready to face possible drops. The large supply from Costa Rica makes it difficult for Mexican producers to compete. Lately, the market has been flooded with pineapples from Costa Rica and Honduras, argues a trader. In combination with low demand, this results in lower prices, of between 5.50 and 7.50 dollars for Mexican pineapples and of $ 8 for pineapples from Costa Rica, Ecuador and Panama. Over the past four to five years, the market has been unstable, reports a trader. Prices shoot up and down and predicting how the market will behave is a difficult task. "The market has been like a roller coaster in recent years."

Each week, FreshPlaza and AGF.nl publish an overview of the market situation of a given product in a global context. With these articles we offer a picture of a world market that is getting smaller by globalisation. Next week, we will focus on sweet potatoes.