The mandarin season is at its peak in the Mediterranean. The climate has slowed down the production in Spain and Moroccan traders have benefited from it. In Italy, the season is starting later, but as usual with difficulties. In Germany, the market is good, with a slight increase in demand. The Belgian market is quiet, going through a holiday period. Chile has invested in mandarin cultivation and expects growth next season. In the U.S., the season has also started well. Rainfall is slowing down the harvest in Southern China and import flows may be able to disrupt the market. In Australia, there is big competition between growers from the north and the south. South Africa expects a prolonged period of drought, which undoubtedly will affect the citrus campaign.

Spanish growers threatened by climate change

Climate change is having major implications for Spanish mandarins. Over the past three years, the growing season has been marked by extreme weather, combined with too little rainfall and the impact of hailstorms. This year, estimations point to the loss of about twenty to thirty percent of the production. The start of the season was actually good. The market was empty and overseas imports were scarce. After a good start, prices dropped. The quality is below average due to the weather.

Other countries around the Mediterranean are its major competitors, but according to Spanish exporters, Egypt and Morocco are unable to compete with the Spanish Clementines and Clemenules. Furthermore, relatively new varieties, like the Orri, have become popular. The product must be packaged immediately after harvesting and cannot be kept in cold storage. Additionally, increasingly more packing stations in Valencia are switching to mandarins with leaf.

Italy expects good season

About half of the 400,000 tonnes of clementines grown in Italy are produced in Calabria. Up until 15 years ago, they grew mainly the Common Clementine, a medium-large easy peeler which still accounts for around eighty percent of the clementines and has a shelf life of 45 days.

To extend the season they have identified a number of early and late varieties, which have made it possible to extend the season, that now lasts from October to February. The harvest in Calabria and in Metaponto kicked off in the first week of November. The volume seems to lie in line with the normal production rates. Italian clementines are always smaller than the Spanish, and Spanish clementines also have the advantage of an earlier start to the season, in September. The sale of the first clementines from Calabria has been difficult, with prices ranging from 0.50 to 1.20 Euro, but this is a normal situation for the first Italian mandarins hitting the market.

Quiet market in Belgium and France

The Belgian market became quiet last week due to a holiday period. Consequently, the lower supply volume did not result in higher prices. The market situation was quite uneventful, says a trader. While the Oronules campaign is coming to a close, the first Clementines are reaching the Belgian market.

On the French market, mandarins are mainly imported from Spain. The price stands at around 1.10 Euro per kilo. The varieties available are the Clemenules, Oronules and Miro.

Growing demand in Germany attracts suppliers

Last week, temperatures dropped in Germany, consequently boosting demand for mandarins. Citrus fruits are mainly imported from Spain, with some small supply also from Italy. Satsumas are purchased from Spain, Italy, Turkey and Croatia. Because of the increased demand, the growing supply has not resulted in lower prices. On average, prices for Spanish mandarins in week 45 were slightly higher than in the same week last year. The average spent on Satsumas was higher.

Israel: First easy peelers for domestic market

While the real season for easy peelers kicks off in January, some growers have already slowly started with the harvest. The mandarins harvested now are intended for the domestic market. There are also some Santina's available, but they go exclusively to the Russian market.

The real harvest campaign which starts in January continues until March. The fields are protected with nets to secure the quality, but an unexpected hailstorm could still affect the crops. "Last week, a producer was affected by a local thunderstorm that nearly destroyed the entire harvest," explains a marketer.

Before the arrival of the easy peelers, growers start with the mineolas, whose campaign begins in about three weeks. The main destinations for this citrus fruit are the Netherlands and Belgium.

Morocco benefits from Spanish shrinkage

Moroccan growers benefit from Spain's smaller harvest. There is plenty of fruit available and the quality is good, so more can be shipped to Europe and the U.S. The only problem is the quota for the Russian market. Exports go mostly to Russia, North America and the Gulf States.

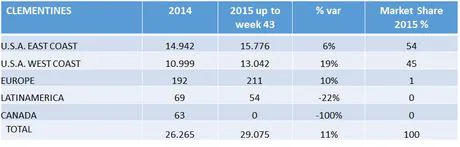

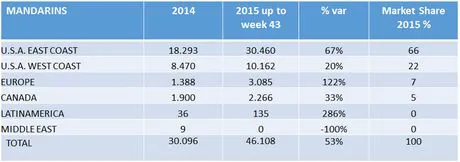

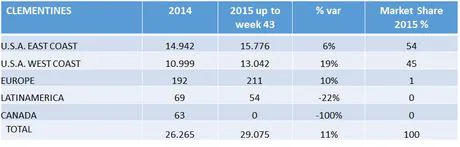

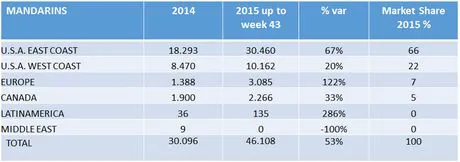

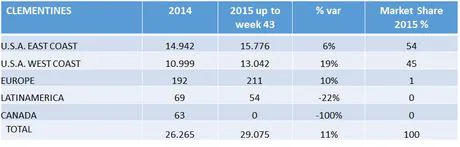

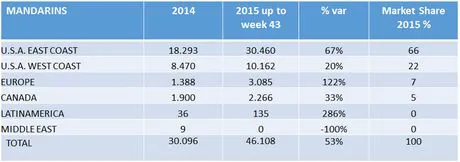

Chile mostly shipping mandarins and clementines

The Chilean season is already finished. The industry can look back on the campaign, which has been marked by a stable quality. The mandarin and clementine production in Chile is expected to grow, based on the growth reported in the acreage. The bulk of the exports go to the United States, which is where the entire clementine harvest and 93 percent of the mandarins are shipped. The most notable increase has been registered by the easy peelers, which have achieved a 35 percent growth. This year, the harvest amounted to 76,000 tonnes, and with an expected growth rate of twenty percent per year, achieving 100,000 tonnes seems within reach. Furthermore, the country is making investments to extend the campaign.

Source: EXPORDATA/ASOEX

South Africa preparing for drought

Drought threatens South Africa. After a dry period in the summer months as a result of El Niño, forecasts also point to a dry autumn. This may have consequences for the cultivation of citrus and other agricultural products. The Western Cape, where 15 to 25 percent of the citrus is grown, is struggling with low water reserves. A similar picture is true for other regions in the country. Growers are hoping for rainfall in the months of November to January. In recent years, the spring rain (September) has failed to materialise, which entails problems for many growers.

U.S. season starts earlier

Consumers are showing more and more interest in mandarins, with increased consumption figures in recent years. As a result, the Halos label, of Wonderful, is growing by twenty percent per year. The harvest has started in California and traders are hoping for a good market. The season kicked off earlier than usual and will last until around April.

Australian growers competing against each other

The official figures of the season have yet to be published, but the general mood is positive. However, there is a fair amount of internal competition between growers in Queensland and those in the southern regions, with mandarins from the north being offered at very low prices. Consumption volumes remained stable throughout the season. The average price has been below the level of last year, and this, in combination with the weaker Australian dollar, has been favourable for mandarin exporters. The acreage has remained stable this year, with some changes registered for the Afourer, Imperial and Honey Murcotts, which have done well.

Rain slows down harvest in China

The mandarin season begins in September and lasts until January. Production this year is five per cent higher, estimated at twenty million tonnes. New plantings have become productive and harvesting conditions have improved. Growing regions are Guangxi, Hubei, Hunan, Jiangxi and Fujian. The export season starts in October and the key markets are Russia and South East Asia.

The harvest in Nanfeng, southern China, has been delayed by rainfall during the past two weeks, since harvesting in wet weather conditions can affect the shelf life of the product. According to traders, the region will lose twenty percent of the harvest, and about seventy percent of the growers in the province cultivate mandarins. It has a total area of 47,000 hectares. The market conditions rely increasingly more on the volume of imports, and there is a threat of oversupply. Major suppliers are Australia, South Africa and Peru.

Pakistan: smaller harvest is not detrimental to export

The harvest in Pakistan is twenty to thirty percent smaller, but this is not expected to have an impact on exports; only in the domestic market, where supply will be reduced. Prospects even point to exports increasing by about eight to ten percent. The main destination for these shipments is Russia, with a market share of around forty percent. Belarus is an interesting newcomer, and China has also become an attractive market for exporters.

Each week, FreshPlaza and AGF.nl publish an overview of the market situation of a given product in a global context. With these articles we wish to offer a picture of a world market that is getting smaller by globalisation. Next week, we will focus on bananas.