One key challenge to coffee farmers in Uganda is access to finance. During the cooperative assessment performed in November 2018 by Agriterra’s cooperative advisors, it was identified that 70 percent of the farmer members need advanced cash to be used for input labour, school fees and other expenses before the end of the harvesting season. That’s why many sell their coffee to middlemen at flowering phase to get advanced cash, leaving farmers with less income and Kasaali with few farmers supplying coffee berries (less than half of the members supplied coffee berries to the cooperative).

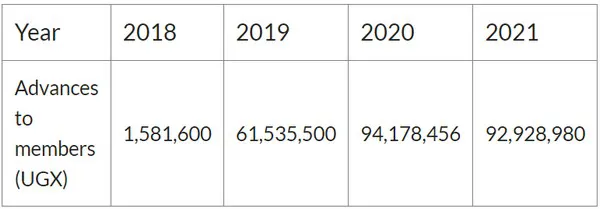

Since the cooperative does not provide credit, farmer members are easily swayed to sell their coffee to middlemen traders, identifying the provision of advanced finance to farmers by the cooperative as a great opportunity. At the time Kasaali run a small financing operation, thus, Agriterra advised the cooperative to analyse the possibility to expand and professionalise its financing business to provide more advance payments to farmer members to boost coffee supply and farmers’ loyalty.

In, September 2020, as part of an exchange visit to the local coffee cooperative Kibinge to learn about coffee export markets, Kasaali learned the importance to diversify the services provided to members. For instance, Kibinge had integrated a savings and credit unit as part of the cooperative business, providing loans to farmers during the planting and harvest season, with a check-off system to settle their debts by supplying their coffee production to the cooperative. This was an eye-opener for Kasaali, which included the creation of a separate savings and credit unit as a key milestone in its strategic plan.

As such, in 2021, Agriterra co-financed the salary of a cashier and credit officer, their training and the development of an operational manual to kick-start the savings and credits business. As a result, in May 2021, Kasaali received the registration approval of its savings and credit cooperative (SACCO) as an official entity and started to run the new business unit. Initially, Kasaali has provided a room in the existing compound and other basic resources (furniture, motorcycle) to operate the SACCO until the operation becomes financially feasible to stand on its own.

In 2022, Agriterra followed up its support by co-financing, again, the cashier and credit officer’s salaries and their training in the use of the accounting software, in addition to auditing the SACCO’s financial statements and hiring an experienced consultant, manager of a SACCO, to coach the cooperative to operate the new business unit.

For more information: Agriterra

Agriterra

agriterra@agriterra.org

www.agriterra.org