Australia is currently in a year of evolution in terms of the grocery consumer landscape, after a few years of social disruption, according to major global consumer intelligence company NIQ.

Speaking at Hort Innovation's Consumer Outlook webinar, Director Customer Success Marco Silva shared a perspective on current consumption behavior and provided insights into what is becoming more relevant to different groups of consumers. He explained that in 2023, consumers are increasingly having to make choices about what they will consume to accommodate their budgets, thanks to the flow-on effects of an 'inflationary environment.'

Speaking at Hort Innovation's Consumer Outlook webinar, Director Customer Success Marco Silva shared a perspective on current consumption behavior and provided insights into what is becoming more relevant to different groups of consumers. He explained that in 2023, consumers are increasingly having to make choices about what they will consume to accommodate their budgets, thanks to the flow-on effects of an 'inflationary environment.'

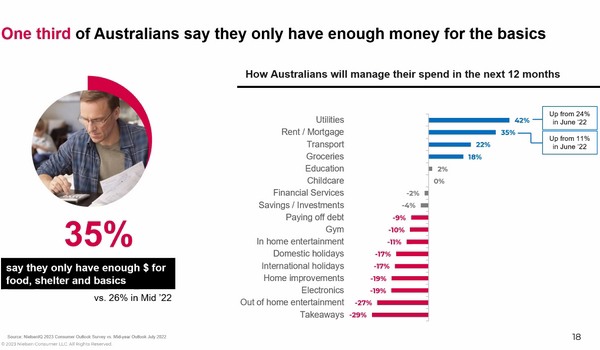

"Overall, the Australian consumers are feeling more unsettled about their finances compared to a year ago," Mr. Silva said. "There is a growing concern about the higher cost of living, and we are starting to see shifts in shopper behaviors to tighter budgets either from higher costs of groceries or housing/living costs. We are seeing more Australian consumers saying that they are now in a worse position than a year ago. The main reason is the increased cost of living, but most importantly, the biggest jump in concern compared to last year is regarding a rise in interest rates. We have lots of consumers who don't own their houses outright, they have a mortgage or rent, so the cost-of-living rises are impacting different people in different ways."

He added that consumers are buying less to manage grocery expenses, which he expects to continue until the inflationary pressures ease. In terms of fruit and vegetables, Mr. Silva also says shoppers are also likely to become more aware of what is in season and at an affordable price and purchase canned or frozen items.

"Customers will need to make some choices to save," he said. "This will bring implications to both channels and categories. So, first, looking at the channel side, we have seen that recessions are not that bad for the grocery channels because supermarkets tend to be more sheltered than other industries. There could even be some opportunities within the supermarket (industry) - as consumers will still need to indulge, and they could be more likely to buy premium products to replace an occasion where they would normally go out and spend money. It's also important to note that consumers are shopping more and looking for better prices at different stores - and this could benefit discounters and alternative channels, such as greengrocers."

With it being cheaper to eat at home than eat out at restaurants and cafes, Mr. Silva notes that food service businesses may suffer, as supermarkets also have the 'lever' of promotion. He says that Australia is the second biggest market in the world that utilizes promotion, with almost 40 percent of sales happening to 'promoted' or reduced products.

Nielsen also studied the top ten and the bottom ten fresh produce categories and found that the average price per unit was the biggest driver in sales. While the bottom categories most suffered declines in penetration and frequency, and the high unit price was not enough to offset these declines. In addition, only seven percent of consumers shopped solely at one retailer, meaning the majority shopped around.

"Consumers are worried about the higher cost of living," Mr. Silva said. "We have asked them what their biggest concerns are over the next six months, and rising prices were the biggest worry. But the biggest jump isn't the cost of living itself, but high-interest rates or debt repayments - and this could cause more inequality as consumers faced different realities due to their housing status. Almost half of the Australian consumers are saying they are in a worse financial position than the last time we ran this survey in 2022, when it was only one in three. The main reason is the increased cost of living, with 77 percent of households saying they are in a worse financial position due to the increased cost of living. We also found that one in three Australians only have enough money for shelter and basics. Again, this is much higher than in 2022. When we asked them where they expect to spend over the next 12 months, there is a significant mention of utilities, transportation, housing, and groceries - which are all non-negotiable things."

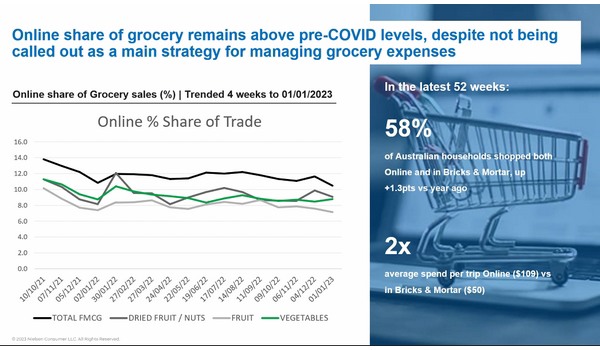

But despite the cost pressures, there are some opportunities across the fruit and vegetable retail space. One of those is online, during the pandemic, people picked up the habit of shopping online, but Mr. Silva says there is room to grow the frequency, especially in fruit and vegetable sales. While the sustainability message driver is still a strong one, despite the cost-of-living pressures.

"Quite often, environmental, sustainable, and locally-owned tends to resonate well in recessions overall," he said. "We know that this is common in a lot of countries that are in recession, people buy what is affordable, but also what is local because they feel like they are supporting their own community during the struggle that they are facing. Sustainability has always been important in Australia but has become more important with all the disruptions caused by COVID-19. We have 85 percent of Australians say sustainability is important, and more than half said it is more important than two years ago. Also, often businesses refer to sustainability as manufacturing or plastic, which is important, but it is also about reducing waste."

Click here for more information on Hort Innovation's multi-industry project Consumer behavioral data program (MT21004).