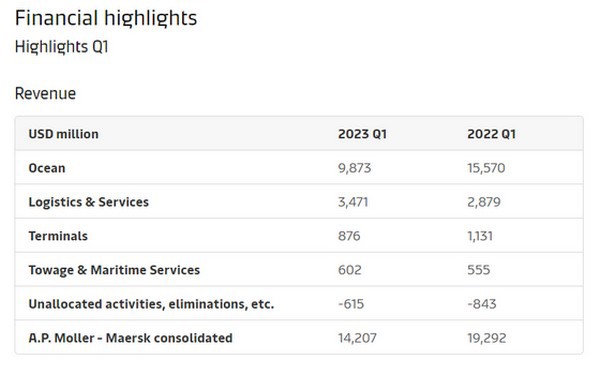

A.P. Moller – Maersk reports a first quarter of 2023 in line with expectations. Continued destocking and easing of congestions implied lower volumes across all segments. Revenue declined by 26% to USD 14.2bn from USD 19.3bn. EBITDA decreased to USD 4.0bn from USD 9.1bn, and EBIT to USD 2.3bn from USD 7.3bn. The full-year guidance remains unchanged, with Q1 expected to be the strongest quarter of the year.

Vincent Clerc, CEO of Maersk: "We delivered a solid financial performance in a challenging market with lower demand caused by a continued destocking. Visibility remains low for the remainder of the year and moving through this market normalisation, we remain focused on proactively managing costs. As we adjust to a radically changed business environment, we continue to support our customers in addressing their supply chain challenges. We are pleased to note that customers continue to value the integrated logistics solutions and close partnership we provide."

Ocean revenue decreased by USD 5.7bn to USD 9.9bn. Profitability for the quarter was significantly lower compared to Q1 2022, primarily due to lower freight rates and volumes, as demand softened. However, proactive cost containment measures have been successful, and the Ocean contract negotiation season is proceeding in line with expectations.

In Logistics & Services, revenue grew 21% to USD 3.5bn driven by the consolidation of acquisitions. Organically, Q1 was affected by lower volumes caused by inventory corrections, especially with North American and European retailers, which was partially offset by new commercial wins. Additionally, underlying business performance was impacted by lower rates in Air Freight and weaker demand in eCommerce.

In Terminals, the top line was affected by lower volumes and storage income, both a factor of lower demand and the release of port congestion. Revenue in Terminals decreased to USD 876m from USD 1.1bn, but strong cost control contributed to continued solid financial performance in Terminals.

Q1 was marked by continued destocking in Europe and especially North America. While it is difficult to predict the exact timing, Maersk expects volumes to gradually pick up in the second half of the year.

Guidance for 2023

Guidance remains unchanged and is still based on the expectation that inventory correction will be complete by the end of H1, leading to a more balanced demand environment, that 2023 global GDP growth remains muted, and that the global ocean container market will grow in a range of -2.5% to +0.5%. Ocean expects to grow in line with market.

In Q1 2023, A.P. Moller – Maersk recognised USD 374m of the previously communicated USD 450m impairment and restructuring charge for the A.P. Moller – Maersk brands.

Click here to read the Q1 interim report.

For more information:

Mikkel Linnet

A.P. Moller – Maersk

Tel.: +45 248211 96

Mikkel.Elbek.Linnet@maersk.com

Morten Buttler

Tel.: +45 28148202

morten.buttler@maersk.com