Schedule reliability is one of the many competitive elements in this industry, and as such, the relative performance of the shipping lines provides a view of their competitive positioning.

In a market that is at times accused of being purely a commodity, the relative performance of the shipping lines does indeed show quite a level of differentiation. This is not only true when comparing the shipping lines against each other but also when looking at the long-term trends for the individual lines themselves.

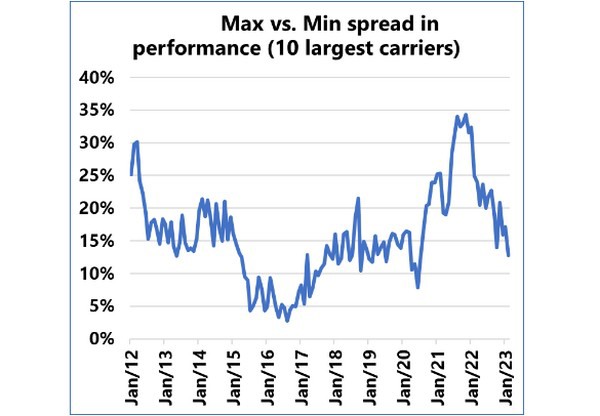

An interesting aspect however, was that while there was a lot of differentiation in the early part of the last decade (between 2012-2015), but when the industry became severely loss-making (most notably the price war culminating in 2016), this led to a temporary elimination of this differentiation. In the last few years, ever since freight rates started going through the roof, we saw the difference between the most and least reliable of the 10 largest shipping lines start to increase again. This is shown in the figure below.

In essence, it would appear that in favorable market conditions, we tend to see a larger diversity in reliability performance, whereas, in times of economic pressure, this leads to a much more uniform performance across the carriers. This leads us to the conclusion that shippers who want diversity in service offerings should, therefore, not hope for markets with extremely low freight rates, as we would most likely see a reversal to 2016-2017, where the difference between the most and least reliable top-10 shipping line had dropped closer to 5%.

For more information: sea-intelligence.com