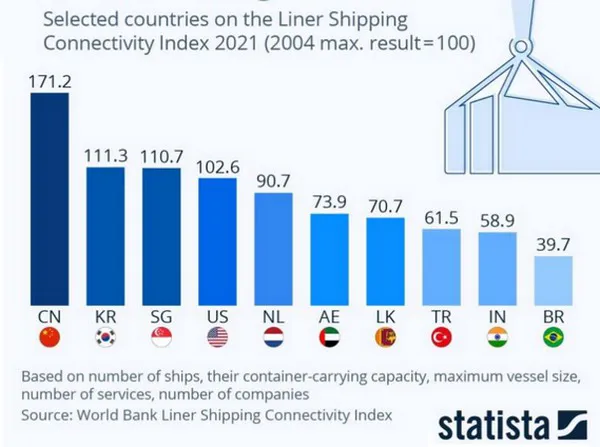

Liner shipping connectivity is key to the handling of container volumes and maintains a major chunk of the pie in global trade. The liner connectivity index affixes a rating point for each nation. The higher the points, the better the rating.

It is no surprise that the World Bank-powered index finds China, South Korea, Singapore and the United States in the top four positions. China handles gargantuan volumes, thanks to its successful infrastructure capabilities backed by hinterland-level strategy planning right from the state and port levels. The arteries of inland waterways further boost connectivity, placing it well ahead of South Korea and Singapore.

What could be a surprise to some, is to find South Korea ahead of Singapore. South Korea's operational efficiency and the burgeoning China-South Korea trade along with it being a vital cog in the Far East trade, puts the country well on the connectivity index. Singapore being the vital cog in South East Asia and the Oceania islands in the Pacific, is a key feeder hub comes close with the US in fourth place.

While not exactly a surprise, India has been pipped by the likes of Sri Lanka, Turkey, Egypt and Morocco in the liner connectivity rankings. A number of factors could be attributed to this rating. A key issue in Indian ports remains the lack of proper deep-water ports. The lack of proper bunkering hubs is another issue, since India has never been an oil major. As if to complement them all, none of India's ports are on the ιnternational shipping route either. It is also understood that crew changes haven't been easy either, with the sailors mostly restricted to the port-berth premises, something that the sailing fraternity has nοt had problems with in many other nations.

But, with its new title as the world's largest population, expected to continue growing up to 2050, there is still a sky-high level of consumption remaining in the backend to knock on the global trade doors. With a major portion of Indian transshipment trade still reliant on Colombo, it will be the job of new terminals such as Vizhinjam, Trivandrum to convert opportunities.

Meanwhile, the Indian government has now invited bids for the building of an International Container Transshipment terminal at Andaman and Nicobar for an estimated US5 billion to develop a deep water international port that can cater to the transshipment needs of South East Asia.

For more information: container-news.com