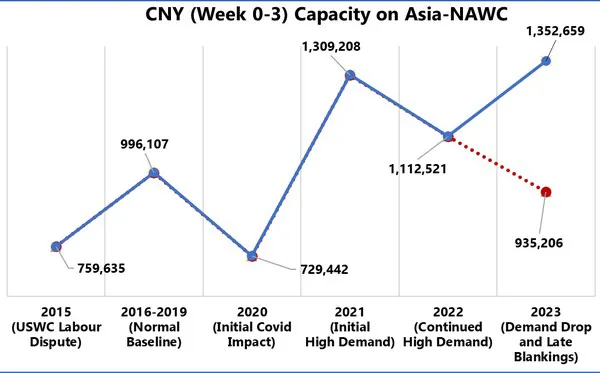

Five weeks ago, in week 50, we analysed the scheduled East/West capacity for the 4-week 2023 Chinese New Year (CNY) period, and we found the 2023 CNY capacity to be higher than past years, despite the slowdown in demand. With CNY now upon us, we did a follow-up to see whether carriers were able to bring capacity back in line with the historical levels.

The short answer: yes! As we can see in the figure above, carriers were able to bring scheduled capacity down by -18%, meaning that if the actual deployment stays like this, supply on Asia-North America West Coast across CNY 2023 would be in line with the pre-pandemic baseline. This was brought about by an increase in blank sailings from 7.6% to 35.8%. There was a similar trend on Asia-North America East Coast and Asia-North Europe, with the scheduled 4-week CNY capacity deployment decreasing by -11% and -6%, respectively, bringing both closer to the pre-pandemic baseline. The increase in blank sailings was also substantial in both cases.

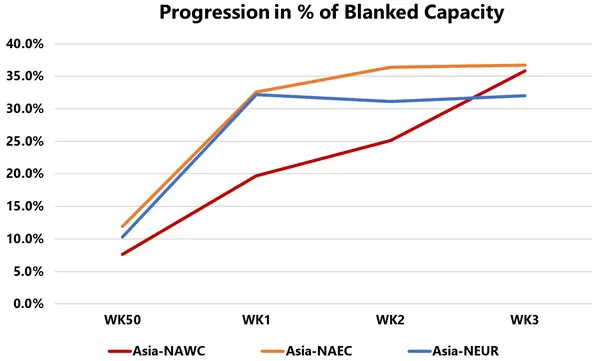

Even more interesting, was how this increase in blank sailings was achieved. The second graph shows the progression in the percentage of capacity blanked week by week, from week 50 to week 3 .

On both Asia-North America East Coast and Asia-North Europe, this new, higher level was more or less reached by Week 1. For Asia-North America West Coast, however, this level was reached in increments. This is an indication that perhaps the carriers are not as decisive on the Asia-North America trade lane than on the other two. That said, a window of 2-3 weeks before CNY for the brunt of the blank sailing is still very late.

For more information: sea-intelligence.com