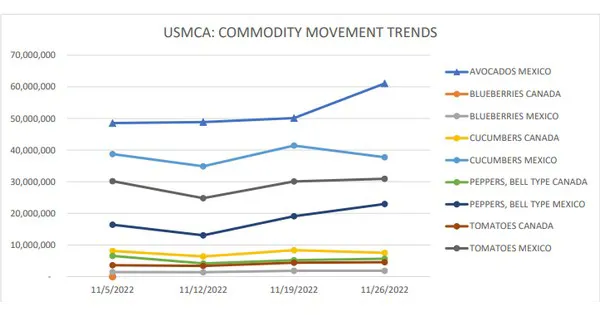

This report provides trend analysis of the volume and prices of Seasonal Perishable commodities. Volume represents current week and prices represent open (spot) market sales by first handlers on product of generally good quality and condition unless otherwise stated and may include promotional allowances or other incentives. The charts provide graphic representation of the volume and prices of the major commodities this week based on seasonal volume.

The recent events of a potential railroad strike have put the focus back on why it is important to have a strong and reliable supply chain system. Farmers and the agricultural industry depend on the railroads for transporting fertilizers, fuel, and many different types of chemicals. Any disruptions can cause slowdowns or even backups for these essential products. Farmers also rely on the railroads to deliver their agricultural products to their trading partners and global markets around the world. A strike of any kind, lasting from a couple days to a prolonged period of time will disrupt the U.S. economy and create problems to the global supply chains.

When you are in the business of moving perishable commodities, time is of the essence. Farmers and shippers have to adapt quickly and find smarter methods of transportation for their agricultural products. Railroads transport an estimated 40% of the country’s freight, including packaged food products that are destined for grocery store shelves across the country. According to Goldman Sachs analysts, if the strike does happen, it will have a substantial effect on the U.S. economy and companies will be forced to slowdown production and deal with much needed missing supplies.

Peru imports of blueberries through Philadelphia and New York City area ports of entry are expected to decrease as more growers are finished for the season. Trading moderate with prices unchanged. Flats 12 1-pint cups with lids large 14.00-16.00, 6-ounce large mostly 12.00-14.00. Quality variable. Movement of blueberries through Arizona, California and Texas is expected about the same. Trading slow with slightly lower prices. Flats 12 6-ounce cups with lids large mostly 8.00. Quality variable. Peru imports of blueberries through Southern California ports of entry movement expected to decrease as more growers are finished for the season. Trading moderate with prices unchanged. Flats 12 1-pint cups with lids large 13.00-18.00. Quality variable.

Movement of avocados crossing from Mexico through Texas is expected to remain about the same. Trading fairly slow with prices generally unchanged. Cartons 2-layer Hass 32-36s mostly 24.25-26.25 and 40-48s mostly 24.25-25.25. Extra services included.

Movement of cucumbers from Mexico crossing through Texas is expected to remain about the same. Trading large fairly active, others moderate. Prices large higher, others generally unchanged. 1 1/9-bushel cartons medium mostly 14.95- 16.95, large mostly 16.95-18.95. Supplies large light. Most present shipments from prior bookings and/or previous commitments. Quality is variable. Movement of cucumbers in Central and South Florida are expected to increase.

Trading moderate. Prices medium generally unchanged, others lower. Waxed 1 1/9-bushel cartons medium mostly 16.35 and cartons 24s 4.35-5.35. Supplies are light to fairly light and demand remained steady later in the week. Quality generally good. Cucumber movement from Mexico crossing through Nogales, Arizona is expected to increase seasonally.

For the full report from USDA, please click here.