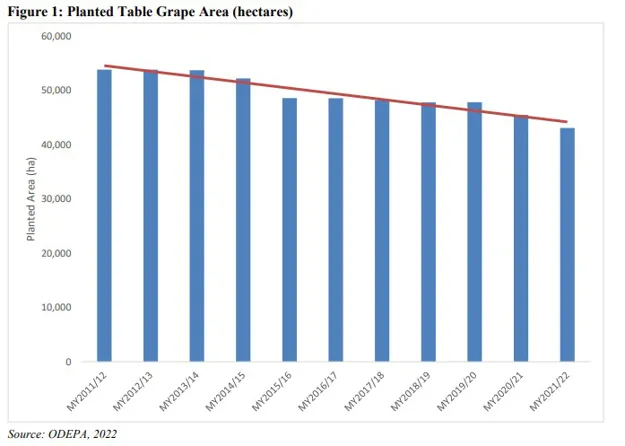

In MY 2022/23, FAS Santiago (Post) estimates that table grape production will decrease by 7.1 percent reaching 732,000 metric tons. The decrease in production is caused by a decrease in table grape area planted (Figure 1). Planted table grape area decreased from 53,851 hectares in MY 2011/12 to 43,104 hectares in MY 2021/22. Post estimates that planted table grape area in MY 2022/23 will total 42,500 hectares, a 1.4 percent decrease from MY 2021/22, as grape producers continue to face tight margins.

According to industry contacts, production of new varieties is taking the place of traditional varieties such as Red Globe. While new varieties like Allison, Arra-15, Timco, and Sweet Celebration are growing in area, more traditional varieties are decreasing at a faster rate.

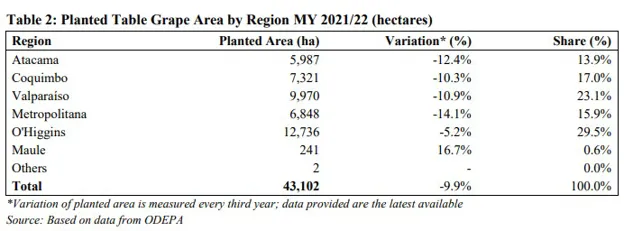

Table grape production is trending downwards because of drought and competition from more profitable crops. Drought has caused a decline in table grape production in recent years; it is considered a structural problem that will persist in the upcoming marketing years. Notably, rainfall in MY 2022/23 was abundant and may have mitigated more serious declines in grape production; however, those gains are not expected to be long-term. The most recent data from the Chilean Ministry of Agriculture’s Office of Policy and Studies (ODEPA) shows a decrease in planted area across all regions (Table 2).

Consumption:

Post estimates that in MY 2022/23 fresh domestic consumption of table grapes will reach 171,800 metric tons or 23.5 percent of commercial production. This level of consumption represents a 7.6 percent decrease in fresh domestic consumption from MY 2021/22 and is explained by the decrease in fresh table grape production. In MY 2021/22, consumption increased due to the increase in table grape production and overall higher supply of table grapes on the domestic market, decreasing domestic prices.

Trade:

In MY 2021/22, Post estimates export volume to decrease by 7.1 percent totaling 565,000 metric tons due to the decrease in total table grape production.

In MY 2021/22 year-over-year table grape exports increased by 15.7 percent in volume, totaling 608,110 MT (Table 3). In MY 2021/22, between March and May, table grape exports increased significantly over the same period in MY 2020/21 (Figure 2). MY 2021/22 was characterized by general problems in logistics and delays in ports.

The United States is the main market for Chilean table grape exports. In MY 2021/22, table grape exports to the United States increased by 21.7 percent accounting for 310,033 MT, which represents 51 percent of Chilean table grape exports. (Table 3). China is the second largest market for Chilean table grapes accounting for 77,610 MT in MY 2020/21, which represented 12.8 percent of total Chilean grape exports.