Post forecasts commercial table grape production in Egypt in MY 2021/2022 (October-September), to reach 1.48 MMT up three percent or 45,000 MT over the previous year. This year, weather conditions are expected to be favorable, and shall contribute to the steady production.

Grapevines are among the most suitable fruit crops for sandy soils and newly reclaimed land, as well as for the older Egyptian land traditionally farmed next to the Nile River. For this reason, cultivated areas of table grapes exist across the country. There is no non-commercial production of grapes in Egypt, so table grape production estimates in Egypt represent only commercial use.

Table grapes are second only to citrus in terms of production quantities in Egypt. Grape cultivation is spread geographically from Alexandria in the north to Aswan in the south, which combined with the production of early and late ripening grapes, enables the prolonged availability of fresh table grapes in the market from May to November. However, two areas in particular – Behira and El-Sadat – represent the overwhelming majority of grape exports to the European Union, Egypt’s largest table grape market.

Behira represents about 40 percent of the total planted area of grapes in Egypt and 18 percent of total production. Climate conditions, types of soil, and production technology are the main factors that give table grapes the ability to be grown all over Egypt.

Planting season begins the first week of February. Planting is done via cuttings, where they are planted in black polyethylene bags, filled with a mixture of peat moss and sand, and stored in greenhouses before the seedlings are transferred into the open field. The vines start bearing fruit in their third year.

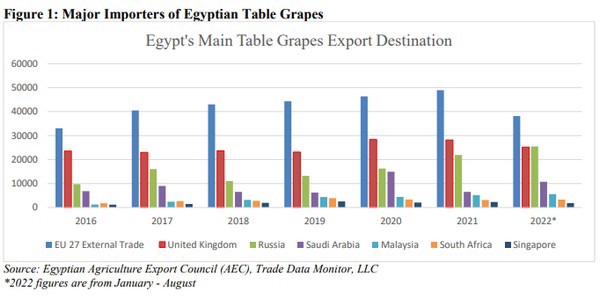

Harvesting season in Egypt for early grape varieties begins in late May and ends in September. Harvesting for late varieties begins in late June and ends by November. The Thompson and Flame seedless varieties dominate production as it remains popular in the EU market, the major importer of Egyptian grapes (see Figure 1). However, producers are expanding towards higher value varieties to supply other markets and meet the evolving palate of consumer tastes worldwide. The most popular of these other varieties include Early Superior, Superior, and Roomy.

Producers state that grapes are one of the most expensive crops to cultivate compared to other crops. In 2022, industries report a 35 to 40 percent increase in cultivation costs to reach almost $28,000 due to the challenges of US dollar liquidity and high inflation. In 2020, one hectare of grapes would initially cost approximately $15,000, not including land costs. In 2021, prices increased by 30 percent due to the COVID-19 pandemic-related supply chain disruptions that limited the availability of certain inputs.

In Egypt, investments in producing high value grape varieties usually offer good returns, especially for the producers who are targeting export markets. However, due to the Egyptian pound devaluation

(FOREX EGP 20.27 to USD ($1.00)) the high input costs decreased the revenues greatly. Post forecasts that the cultivated area remain unchanged due to the high tendency of grape cultivation. Lands increased in cultivation were met by reduction in cultivated areas due to increased costs and reduced revenues.

Consumption:

Post forecasts domestic consumption of fresh grapes in MY 2022/2023 at 1.3 MMT, a two percent increase from the previous year’s consumption level of 1.27 MMT. The local grape market is an important market for producers because grape imports are not very high and losses are quite considerable, which impacts the total availability. Large-scale, export-oriented producers and small-scale grape farmers who produce mainly for the local market experience wide disparities in the access to and the use of production resources, finance, and technology. Moreover, inadequate research and development, lack of cold chain and marketing infrastructures, and insufficient coordination among value chain stakeholders pose risks to grape quality and productivity, thus limiting exports only to producers who can make large investments.

Trade:

Post forecasts exports to reach 180,000 MT in MY 2022/2023, 5.8 percent higher than the previous year. The EU countries and the United Kingdom were the top export destination in CY 2022, accounting for 58 percent of total exports. Other important markets are Russia and Saudi Arabia, with 23 and 10 percent of the export market share, respectively.

Egypt imports very few quantities of table grapes. In MY 2022/2023, imports are expected to decrease by 18 percent to 6500 MT, a decrease of 1500 MT compared to MY 2021/2022. Post attributes the reduction in exports to the current economic conditions of Egypt regarding the challenges of US dollar liquidity, high inflation rates, and instability of importation procedures.

Egypt mainly imports table grapes from South Africa, Spain, Australia, Italy, and few quantities from the United States and the imports usually cover the window where there is no domestic production. The imported table grapes are typically sold at very high prices at specialty retail stores.