A new Southern Hemisphere sweet cherry season has started, with record volumes expected. The Rabobank Cherry Report estimates that exports from Chile will continue to increase. However, all cherry producers in the Southern Hemisphere will face similar challenges in increasing competition, declining prices and narrowing margins due to elevated production costs.

Chile, Argentina and Australia are also moving towards improving the efficiency in their processes, focusing on high-quality production and diversifying their destination markets. These countries will also continue to try to bring forward production to avoid the peak of supply in the Chinese market.

Global sweet cherry supply is characterized by two important sales periods: the Northern Hemisphere spans from late April to mid-September. The Southern Hemisphere supply runs from mid-October to mid-February with exports from South Africa, Argentina, Chile, Australia and New Zealand. This leaves two cherry-free gaps: one in March and the other in late September and early October. There are efforts in cherries to move into the first half of October.

Global sweet cherry supply is characterized by two important sales periods: the Northern Hemisphere spans from late April to mid-September. The Southern Hemisphere supply runs from mid-October to mid-February with exports from South Africa, Argentina, Chile, Australia and New Zealand. This leaves two cherry-free gaps: one in March and the other in late September and early October. There are efforts in cherries to move into the first half of October.

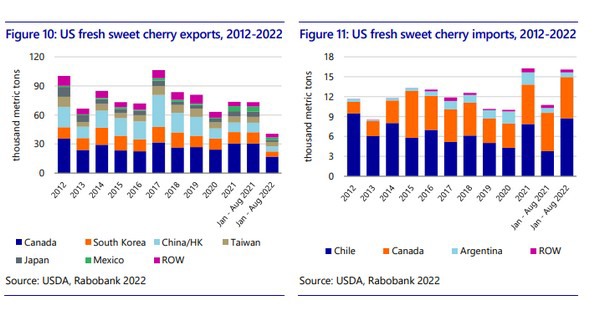

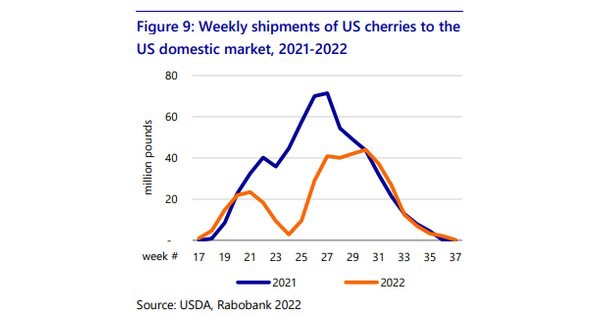

According to USDA figures, shipments of U.S. fresh cherries to the domestic market in 2022 were down 36 percent YOY. The primary reason for the decline in production was cold spring weather in the Pacific Northwest (PNW) which impacted pollination and the early stages of fruit development. As a result, the PWN season started later than usual, which created a significant gap in U.S.-grown cherries, particularly during weeks 22-26.

The lower U.S. production impacted exports. In May, during the California season, exports were within the range of recent years. June and July, however, saw considerable declines. Thus, through August 2022, U.S. exports were down 45 percent YOY, with significant declines in all major destination markets. On the other hand, U.S. imports of fresh cherries increased 50 percent YOY through August.

U.S. imports from Chile showed an uptick of 131 percent YOY, with record volumes in January and February 2022. Also, U.S. imports from Canada increased 8 percent YOY, reaching the highest volume since 2015. With November and December still ahead, and expected increasing volumes from Chile, U.S. 2022 imports are set to reach the highest volume in more than a decade.

The availability of fresh cherries in the U.S. has increased at a CAGR of about 3 percent over the past half-decade to roughly 1.3 pounds per person per year (589 grams), as per USDA calculations. According to industry sources, about 36 percent of U.S. households have purchased cherries within the past 12 months. The likelihood of purchase increases as the primary household buyer is older and as a household’s annual income increases. For example, the estimated likelihood of purchase is 29 percent for households with an annual income between USD 25,000 and USD 50,000, while it is 43 percent for households with an annual income over USD 100,000.

Click here to request a copy of the full report.

Lizzy Parks

Rabo AgriFinance

Lizzy.Parks@PadillaCo.com

https://research.rabobank.com/