The 13th edition of the Cool Logistics got underway this morning, the event is online for the second year with speakers from all aspects of the shipping and logistics trade and attendees from 6 continents.

The shipping industry has faced massive challenges since the beginning of the global pandemic. How are they going to manage this situation and how do they move forward from here?

The overall view was that this situation is not going to change in the near future, it may in fact get worse before it gets better. Shipping costs are not likely to go down soon as high reefer costs are being driven by the high demand for dry cargo and frozen goods mainly into China. This is also causing an imbalance in container flow.

Reefer cargo is higher risk and so less attractive and less profitable for carriers, so there is a risk that that they will not invest in the reefer trade. Also, large parts of the world remain unvaccinated and it only takes one part of the chain to fall before the congestion increases again, according to the panellists it will be a few years until any normality is restored, but even then shipping costs will remain high than pre-pandemic levels.

Rachel White CEO & Co-Founder, Cool Logistics Resources opened the first session by saying she was looking forward to the opportunity to debate the issues in what is the most challenging time ever faced by the logistic industry.

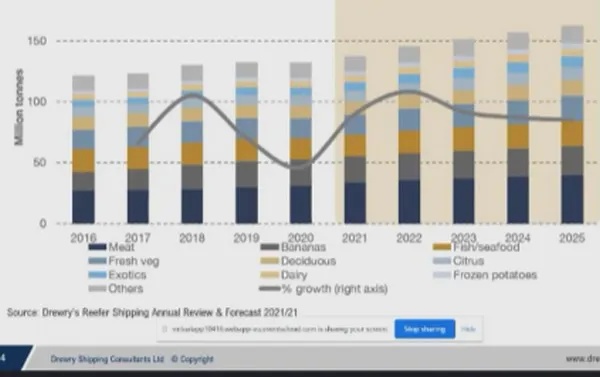

Martin Dixon, Head of Research Products, Drewry and Director, Drewry Group spoke about the market outlook for reefer shipping: Seabourn trade contracted by 0.4%, but was significantly lower for the overall perishable refer trade. This is due to less demand caused by hospitality closing, the closure of ports and disease in bananas coming from the Philippines.

The 4th quarter saw a strong recovery however, mainly on meat, exotics and citrus exports. He expects to see a growth of 4% over the next year.

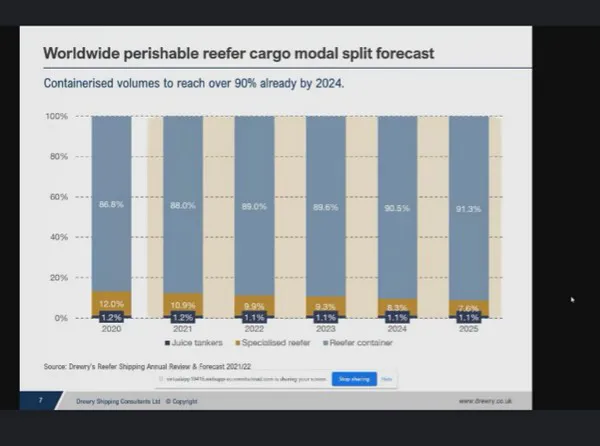

Container volumes will reach over 90% by 2024 driven by the decline in specialised reefer cargo, last year containerised volumes grew by 5.4 million TEU.

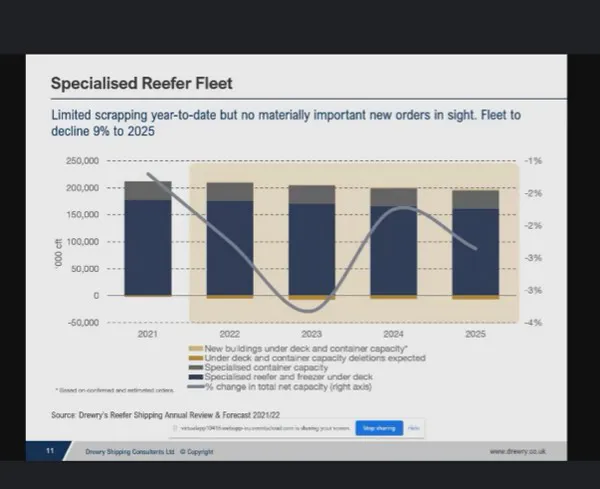

According to Martin capacity will decline by 9% in the next few years and there are concerns about the availability of equipment, there were concerns pre-pandemic but the situation is now even more concerning. This is despite a record production in containers which is up 15% in 2020 and expected to increase by a further 30% on 2021. He predicts that container availability will remain tight due to equipment being stuck inland or waiting at ports.

The is a large imbalance of trade mainly due to Asia being a net importer. Freight rates saw a large increase and doubled last year, it is expected that they will see a further 50% increase later in the year. There has been a large spike in the east – west trade routes, but less in the north – south routes. Average rates will continue to rise as the north – south routes play catch-up. With the average between 50-100% into next year.

Michel Looten, Director Maritime, Seabury Cargo gave an outlook on the reefer market:

The reefer trade is stable compared to the dry cargo trade as there has been a big demand for dry cargo in the Covid recovery period.

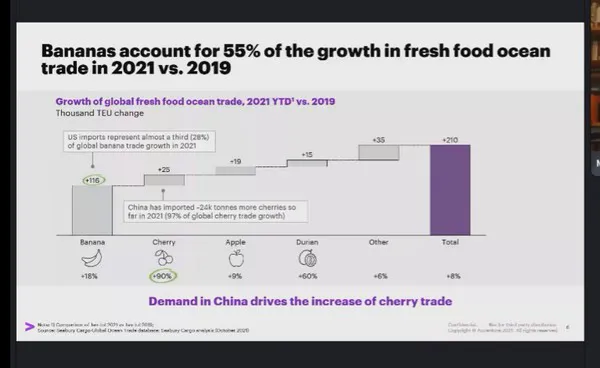

Fresh exports from Latin America to Asia have seen been dominated firstly by bananas and secondly by cherries. The increase in seafrieght demand for cherries is due to the shortage of air capacity as passenger flights were not longer available. For reefers into the US the banana trade is the major growth driver at 13% increase.

According to Michel due to the high demand for dry goods the reefer trade will suffer as it less attractive for carriers. There is a risk that lines will not invest in reefers and will move to the more popular shipping destinations.

Bruce Marshall, Head of Reefer Solutions, A.P Moller-Maersk said that shippers had to have good partnerships with customers and work together to understand the customer’s needs to make it a win-win situation, by understanding not only shipping requirements but also pre and post-harvest problems. Customers need to be clear on their requirements from the beginning and shippers have to deliver on these requirements.

He said that their demand was way ahead of capacity and that deeper understanding of customer needs will bring greater flexibility. There are various points where things can be delayed and all aspects of the supply chain needs to be managed.

He stressed that flexibility was vital and a good partnerships can help mitigate risks. Visibility was vital these days and customers are pushing for sustainability.

He thinks that the congestion situation will improve, but said that they don’t have all the answers but they are willing to make it better, but also cautions that this situation is here to stay. It is no longer ‘just in time’ but now ‘just in case’

Thomas Eskesen, Founder, Eskesen Advisory said that is a most exceptionally complicated time and next year will be more so.

The big issues are port congestion and transit issues, the refer trade is no longer the golden business for shippers. Consumers would also have to realise that they will need to pay more for produce.