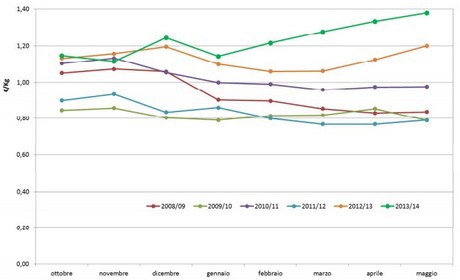

Prices

The good news is that prices of exported produce are quite high thanks to the high quality of the fruit. In the last two export campaigns, the value of exports grew more than the volume.

During the last campaign (October 2013-May 2014), for example, Italian kiwi exports increased by 1% reaching 316,000 tons. In terms of value, we are talking about €400 million, +11% with respect to the previous campaign. This was mostly due to an average price of €1.22/kg, 10% higher than the previous campaign.

Italian kiwi exports from October 2013 to May 2014 in comparison with the previous seasons (source: CSO processing of Istat data). Click here to enlarge.

In the last two campaigns abroad, prices always remained above €1/kg - monthly prices started well and increased from February onwards.

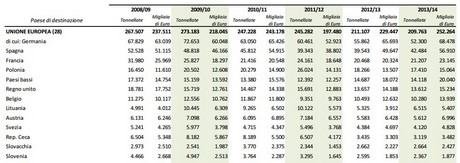

The best Italian client is struggling

Import trend in Spain per country of origin (source: Eurostat)

The fight over France

This is the fourth destination for Italian kiwis: demand is increasing (21,207 tons exported in 2013/14 with respect to the 20,550 of the previous campaign). Italy is still the main supplier, but the market share dropped below 40% due to competition from Spain and Greece. In addition, domestic productivity should also increase (+7%).

The thorn in the side and the Russian ban

This figure is even scarier if we think that the first export market for Greece was Russia, to which 22,915 tons were exported in 2013/14 and 32,651 the season before that. Now though, that market is off limits and these volumes must be reallocated elsewhere.

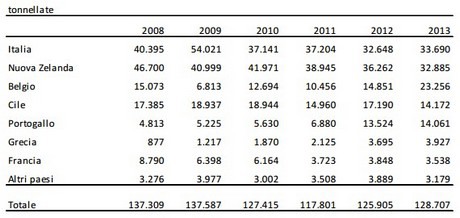

Italian exports to extra-European countries, Africa, Middle East and Oceania (source: CSO processing of Istat data). Click here to enlarge.

Outside of Europe

The most interesting news come from the extra-European market. Shipped imports to the US and Canada are increasing and the Italian market share has now reached 10%. Last year, 1,400 tons more were exported to North America with respect to the previous year.

The Asian boom

If we talk about the Far East, we can see how Italian kiwis are much appreciated, especially if we consider that, last year, 50% more produce was exported (from 13,659 tons of 2012/13 to 20,511 tons).

Things are actually even better in China as, in only one year, it went from importing 3,800 tons to 10,000, i.e. recording a +159%.

Italian exports to North and South America and to the Far East (source: CSO processing of Istat data). Click here to enlarge.