The share of meals prepared at home remained elevated in October, at a consumer estimated 78.4 percent of all occasions, according to the IRI survey of primary grocery shoppers. Jonna Parker, team lead, fresh for IRI explained that a big contributor to more meals being prepared in the home is the lunch occasion.

Inflation is the major undercurrent for many of the changes in grocery shopping and consumption patterns.

- The IRI October survey found that 95 percent of shoppers feel they are paying more for groceries than last year. As a result of the higher prices, 80 percent of consumers shopped for groceries differently.

- 15 percent included lower-cost retailers and 18 percent visited multiple stores to get the best deals.

Citing IRI’s Integrated Fresh Household Panel, Parker said channel shifting has had a substantial impact on the dollar share distribution of fixed and random-weight products across all the stores in which consumers shop for retail food and beverages.

“Traditional grocery’s share has eroded 2.7 percentage points since 2019. If proportional to produce, that means with annual sales of $74.5 billion, that shift alone reflects a $2 billion change in the channel dollar distribution,” said Joe Watson, IFPA’s VP, retail, foodservice and wholesale.

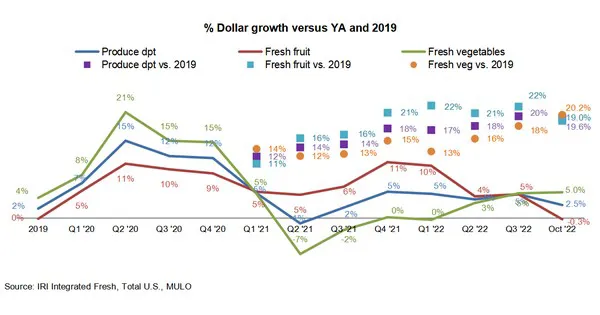

Fresh produce prices were also up from last year, at +5.3 percent level on a per-unit basis and +7.0 percent on a per-pound basis. This is far below the total store average and the lowest rate of increase seen in many months. The deceleration is driven by fruit, for which prices increased a low 3.8 percent. Vegetable inflation did remain in the double digits year-on-year.

Fresh produce prices were also up from last year, at +5.3 percent level on a per-unit basis and +7.0 percent on a per-pound basis. This is far below the total store average and the lowest rate of increase seen in many months. The deceleration is driven by fruit, for which prices increased a low 3.8 percent. Vegetable inflation did remain in the double digits year-on-year.

October 2022 fresh produce sales reached $6.8 billion, surpassing the record set the prior year by +2.5 percent. However, looking beyond dollars that were highly affected by inflation, unit and volume declined versus October 2021 by around 2 percent-3 percent. “Volume declines were much steeper than unit declines,” said Parker. “This may point to consumers moving to smaller pack sizes.” Fresh produce sales remained remarkably stable during the five October weeks, at around $1.35 billion.

Fresh produce sales remained remarkably stable during the five October weeks, at around $1.35 billion.

“Vegetables are taking over as the top area of growth,” said Watson. “The much lower levels of inflation in fruit are no longer offsetting the year-on-year drop in volume which is leading to sales declines.”

“The fresh share of total fruits and vegetables dropped further in October 2022,” Watson added. “Different levels of inflation certainly play a role, but the share of pounds were very similar so that does not explain the recent pressure.”

The next report, covering November, will be released in mid-December.

Please click here for the full current report.

Note: The October data reflects a substantial data restatement across all areas of the store. 2019-Q3 2022 reflects the prior data universe.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com