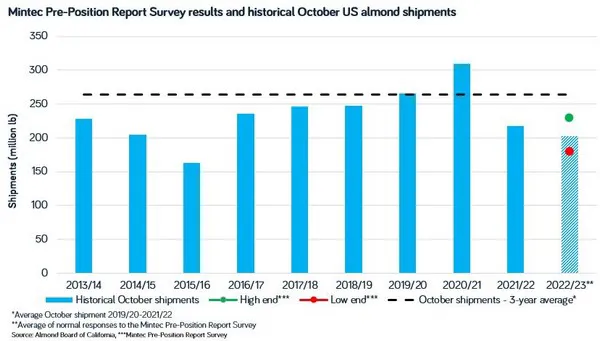

Market participants surveyed by Mintec were expecting shipments to have declined against last season’s levels. The survey was completed in the first week of November ahead of the official release of the October position report, on 11th November. Estimates were reported in the range of 180-230 million pounds, with most market participants returning figures of 195-210 million pounds. If realised, a figure within this range would be the lowest October shipment figure since the 2015/16 season.

“We know that Europe is going to be down. I’d expect India and the Middle East to be fairly flat against to slightly up against last year, but it’s unlikely to be sufficient to have moved the overall number high enough”, a US exporter disclosed to Mintec.

Several market participants expressed the view that even if shipments exceeded expectations, the market reaction would be limited.

“To have any significant boost in prices, I’d say shipments would have to be over 240 million pounds. Given that my optimistic scenario is 220 million pounds, it seems unlikely that anything will change after the report”, a US trader stated.

New commitments were also expected to be low, with several market participants pointing to a lack of engagement from both buyers and sellers.

“Sellers are waiting to see if prices go up, and buyers have been waiting to see how low the market gets before locking in stock, so neither side has been trading on the forwards that much at the moment. Given that buyers are shifting towards a more hand-to-mouth purchasing approach, I’d expect commitments to remain below normal levels throughout the season,” a US trader told Mintec.

To stay up to date on developments in the almond markets, subscribe to the Mintec Weekly Almond Report by emailing PRA@Mintecglobal.com. The report, which is released each Thursday, provides in-depth information on pricing and market dynamics.

Source: Mintec