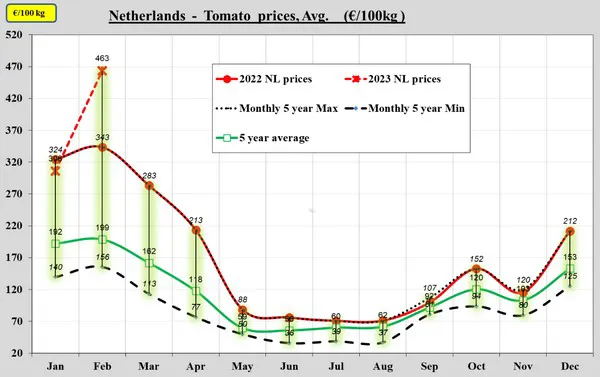

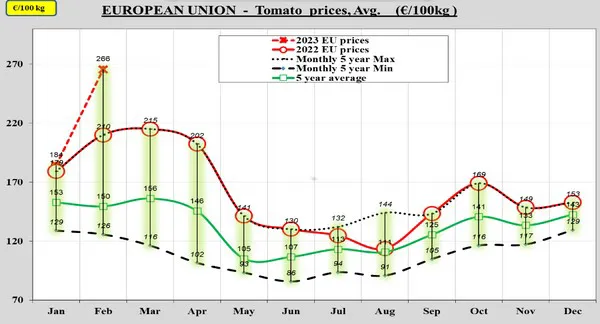

An average kilogram price of over €4.50 and a price increase compared to January of 171 percent: last month, tomato prices were extreme. The European Commission's tomato dashboard shows this once again. The Netherlands stands out in the new update with by far the highest prices and most extreme price increases.

The reason for all this was often mentioned last month: delayed crops due to the energy crisis and climate extremes in more southern growing areas.

As mentioned, the Netherlands stands out in particular. Only a handful of growers had an exposed crop. The first ripe fruits from unexposed cultivation are only now slowly coming out of the greenhouse, barring an exception with a geothermal contract or favorable gas contract. A small price rise of 3 percent on average has been common over the past five years, but this year saw a 171 percent increase over January. Exceptional.

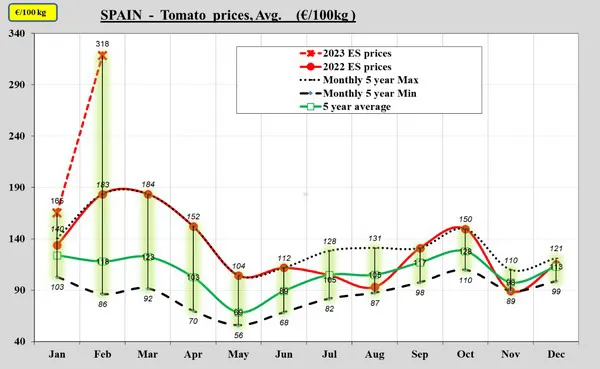

In Spain, the price is equally extreme. Here, the price usually drops 5 percent, but this year a 93 percent increase was achieved compared to January. On average, this brings a kilo of tomatoes to 3.18 euros.

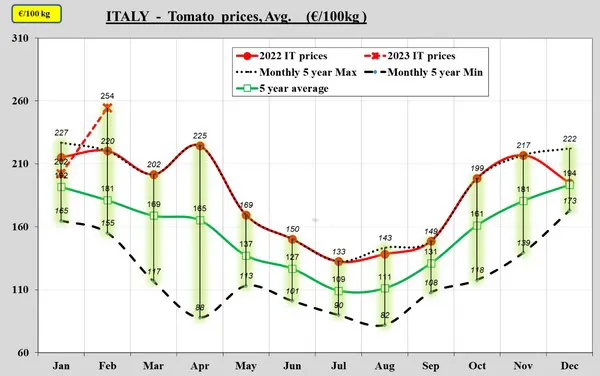

In Italy, the average kilo price lags behind the EU average of 2.66 euros. Nevertheless, an increase (of 38%) is also visible here, where normally a 6% decrease was common.

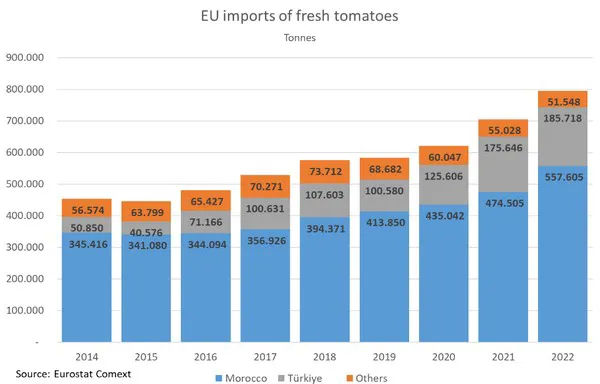

The dashboard also includes figures on tomato imports. Here, the European Commission does remain cautious of drawing conclusions, as it relies on supplied figures. Nevertheless, trends are broadly visible.

A big increase in imports from Morocco stands out, as does an increase in imports from Türkiye. On the contrary, slightly less tonnage of tomatoes came from other countries.

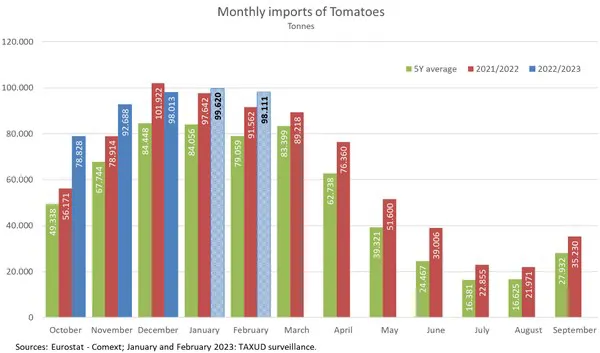

In both October and November, more tomatoes came this way compared to last winter season and the five-year average. In December, according to European Commission figures, the volume landed would then again be slightly lower than last winter. The peaks in Turkish imports are in October and February. Moroccan imports are more constant, but lag slightly behind last season in February.

The European Commission places a disclaimer on the above bar chart. Nevertheless, it does seem to indicate that in the past autumn months, more was imported than last winter season.

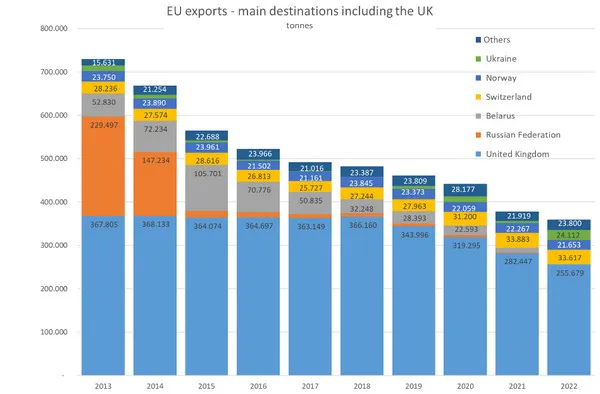

In terms of exports, it stands out that more was exported to Ukraine outside the EU. The reason is obvious: the war. It also appears that, especially in December, there were significantly fewer tomatoes exported.