Ever since demand started to slide, and freight rates with it, carriers have struggled to pull enough capacity from the market to stop this bleed. As Chinese New Year (CNY) approached, the expectation was that carriers would use this as an opportunity to blank a substantial number of sailings, to reign supply back in. However, this only happened within 1-3 weeks of CNY; a very short window for shippers to properly plan supply chain contingencies.

This trend seems to continue in the 8 weeks post-CNY as well. Capacity scheduled to be deployed in those 8 weeks on Asia-North America West Coast will be roughly 353,800 TEU per week, 221,700 TEU per week on Asia-North America East Coast, and 314,900 per week on average on Asia-North Europe. All these figures are the highest for the respective trade lanes and represent a significant increase over not only 2021 (where demand was booming), but also a significant increase over the pre-pandemic baseline of 2017-2019.

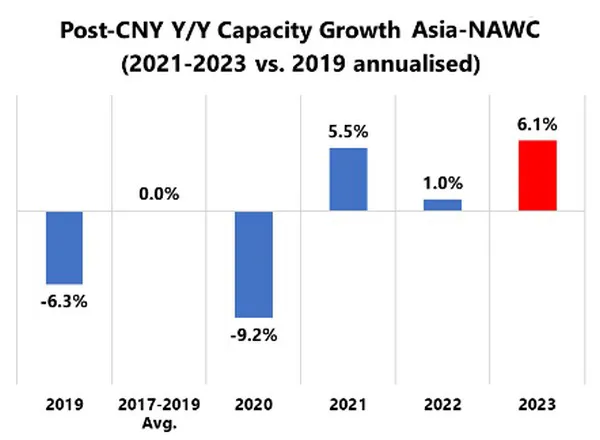

The figure above shows the Y/Y capacity growth rate for Asia-North America West Coast, with 2021-2023 shown as an annualized growth rate over 2019 (a traditional Y/Y growth rate would be misleading due to the drastic shifts in capacity across the pandemic years). The annualized growth rate of 6.1% is not only the highest, but in stark contrast to the pre-pandemic baseline. We have a similar case with Asia-North America East Coast with an annualized growth of 10.2%. Only Asia-North Europe however, the growth rate of 3.2% is well in line with the pre-pandemic baseline.

Absent any demand growth, it is very likely that the shipping lines will continue to blank sailings to keep capacity closer to pre-pandemic levels. However, it is also very likely that these decisions will be taken closer to departures, once again leaving shippers with very little time to plan proper contingencies.

For more information:

ia@sea-intelligence.com

am@sea‑intelligence.com

nhm@sea-intelligence.com