Since 2019, due to Covid-19, a lot has changed in agriculture. But it is only since 2021, with the crisis of raw materials and marine logistics, that the dynamics that regulate global production have really worsened. We talked about this with Paul van Dijck, VP of Marketing and Sales at TomaTech/Nirit, an Israeli multinational seed company.

What is the current situation of the tomato fresh market in this challenging context?

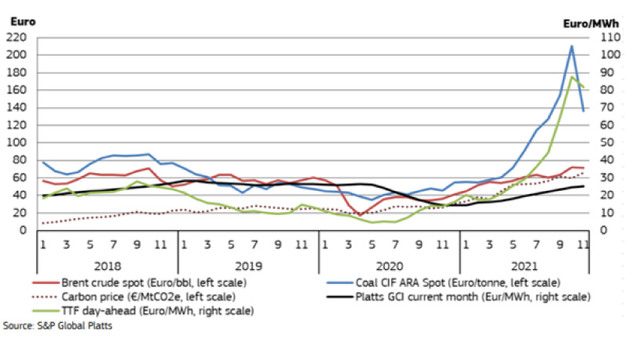

"These are hard times for any player in the fresh chain, particularly for the production sector. The Russia-Ukraine war has resulted in a dramatic economic domino effect worldwide, deepening financial instability, accelerating inflation, affecting the global food supply, and threatening food security. It must be said, however, that the war exacerbated an already ongoing upwards trend in gas and energy prices which started long before the Russia-Ukraine conflict in April 2021 and reached a record high level in December 2021. At the production level, such a dramatic rise in energy and fertilizers prices together with the high labor costs due to an endemic labor shortage are concretely preventing growers from acquiring the technical tools to carry out their own production processes."

Spot prices of oil, coal, and gas in the EU (click here to enlarge) Source: https://energy.ec.europa.eu/system/files/2022-01/Quarterly%20report%20on%20European%20gas%20markets%20Q3_2021_FINAL.pdf

In Northern Europe, tomatoes are produced in high-tech greenhouses, therefore, the impact of the increase in energy prices is greater. What are the strategies adopted by growers in this area?

"What we have seen so far is that different strategies have been implemented to counter such a disproportionate rise in production costs. In the Netherlands, many growers have postponed planting, others have switched to less energy-intensive crops or looked for other sources of energy supply (for example, geothermal energy). Some have not planted at all. At TomaTech-Nirit, we are observing the emergence of partnerships between growers from different production areas. Indeed, many growers from the north of Europe producing under artificial light, especially the ones most active in exports, are seeking collaborations with growers located in the Mediterranean that cultivate in nonheated greenhouses, mainly in Spain and Morocco. It goes without saying that their goal is to keep supplying their customers all year round, winter season included, minimizing their costs of production."

Premium specialty: Pom Sweet Candy

What role does TomaTech/Nirit play in this new production asset?

"Basically, our company is at the center of an under-construction network, serving as a bridge to connect growers from these different areas. We support them with the most adequate variety of choices that can serve as common solutions for all parties. Just to give some examples, we have focused on premium varieties that can be produced under any growing condition; this is the case of the already well-known Pom Sweet Candy, a high-brix red specialty with a distinctive drop shape, or other colored specialties like our Candy collection. At the same time, we supply different products from the same segment for complementary crop cycles (such as summer/winter) and diverse growing conditions. For example, in the cocktail segment, we provide our TT-910, which is suitable for high-tech greenhouses, and Dulcimor, better suited for passive ones. The same principle applies to the cherry segment with our TT-1004 and Spanish leader Korino. As for the TOV segment, some growers from northern Europe are beginning to grow Cosmostar in the south, compensating for the lack of cluster tomato in the winter season."

Cherry premium: Yellow Candy, Chocolate Candy, Orange Candy

Is it possible to make any short-medium predictions?

"Although inflation is expected to persist at least until 2023, it is not possible to predict how long it will take for food supplies to recover to their pre-conflict and pre-pandemic levels - if this ever happens. In times fraught with uncertainties and challenges, all of us are called to redesign the ways we work and behave, giving priority to new forms of cooperation to achieve shared common goals."

Cherry: TT-1004 and Korino

Cluster: Cosmostar

For more information:

TomaTech-Nirit

paul@tomatech.com

www.tomatech-nirit.com