In MY 2022/23, Mexico’s tomato sector is expected to maintain its current productivity, assuming normal growing conditions and continued strong demand from the U.S. market, with sources projecting that production will remain at 3.7 MMT.

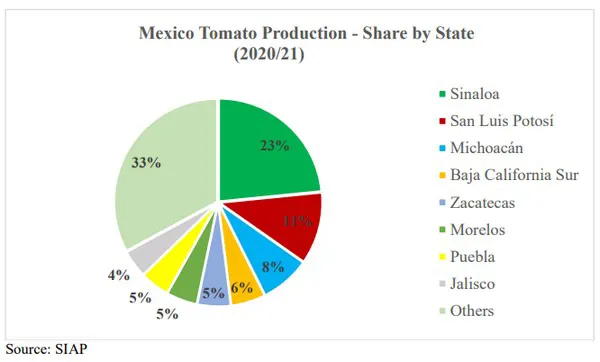

Tomatoes are grown across Mexico throughout the year with two important production/harvest peaks that overlap: from December to April, with fruit from the state of Sinaloa, Mexico`s largest tomato producer, dominating the domestic market and exports to the United States; and from May to November the major suppliers in order of supply are San Luis Potosi followed by Michoacan, Baja California Sur, Zacatecas, Morelos, Puebla, and Jalisco.

At the time of this report, production for MY 2021/22 is estimated to be 3.72 MMT based upon higher yields as the sector continues to expand in the greenhouse and other technological methods of production. This is occurring in both current major producing areas as well as lower volume states. The official production figure for MY 2020/21 is 3.03 MMT, according to Mexico’s Agrifood and Fisheries Information Service (SIAP). In MY 2020/21, Sinaloa produced over 709,000 MT followed by San Luis Potosi with 343,670 MT, Michoacan with 237,841 MT, Baja California Sur with 164,507 MT, and Zacatecas with 158,970 MT.

Trade

In MY 2022/23, Post forecasts Mexico’s fresh tomato exports at 1.9 MMT due to expected rising supply, limited growth in domestic consumption, and robust U.S. demand. Mexico continues to be the largest supplier of fresh tomatoes to the United States and is the world’s largest exporter of fresh tomatoes as a result. Based on available data and the pace of trade, experts estimate exports for 2021/22 to reach 1.7MMT, a marginal decrease from the year prior. Although exports to the United States are year-round and consistently above 100,000 MT per month, the largest volume of exports generally takes place from January to March.

Click here to read the full report.

Source: apps.fas.usda.gov