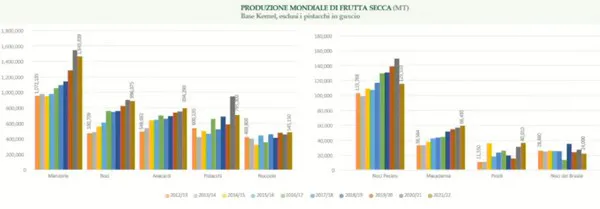

"Over the past decade, the global production of nuts has increased by 50%. Only the 2021/2022 season registered a 6% drop compared to the previous one - from 5.4 to 5.1 million tons.

Between the 2012/13 and 2021/22 seasons, the global production of nuts increased with an average annual rate of approximately 229,221 tons a year and it is maybe increasing at a faster rate than that of consumption," reported Alessandro Annibali, CEO at New Factor and Ambassador of Italy at INC (International Nut and Dried Fruit Council), as he remotely attended the "Il nocciolo e gli effetti dei cambiamenti climatici" (Hazelnuts and the effects of climate change) convention organized by Confagricoltura Cuneo and Cascine Piemontesi in collaboration with Ascopiemonte and Piemonte Asprocor.

Graph taken from Alessando Annibali's presentation on the global production of shelled nuts, excluding unshelled pistachios.

If we look at the leading nut categories (almonds, walnuts, cashews, pistachios and hazelnuts) and lesser popular ones (pecan nuts, macadamia nuts, pine nuts and Brazil nuts), we can see that, over the past ten years, hazelnuts have only grown by 16% - from the 469thousand tons of 2012 to the 545thousand of the 2021/22 season.

"Almonds increased instead by 53%, walnuts registered an 88% increase and cashews grew by 62%. The fact that hazelnuts did worse is partly explained by their industrial use, mainly for chocolate. Little has in fact been done to push this fruit as a healthy snack compared to almonds, walnuts and cashews, for example."

Graph taken from Alessandro Annibali's presentation on the global production of shelled nuts, excluding unshelled pistachios. Click here to enlarge.

If we consider the annual growth rates of the past ten years, macadamia nut, walnut, cashew, almond and pecan nut crops showed more significant linear variations.

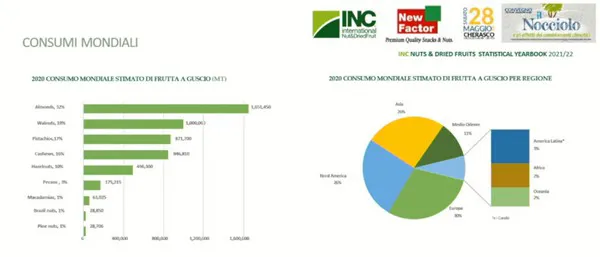

"Consumption goes hand in hand with production. In 2020, almonds and walnuts were the most popular nuts on a global level, with a share of 32% and 19% respectively. Pistachios, cashews and hazelnuts occupied the second, third and fourth place with 17, 16 and 10% of the share. After Europe, the leading global consumer (30%), North America and Asia occupy the second and third place with similar shares. The estimated consumption in the Middle East is 11% of the total."

Graph taken from Alessandro Annibali's presentation on the global consumption of nuts. Click here to enlarge.

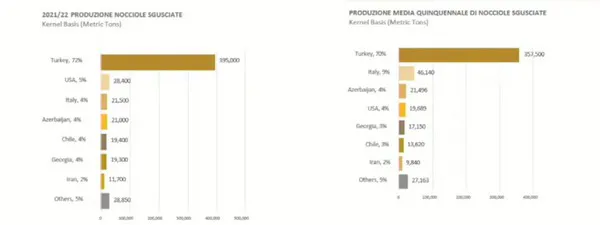

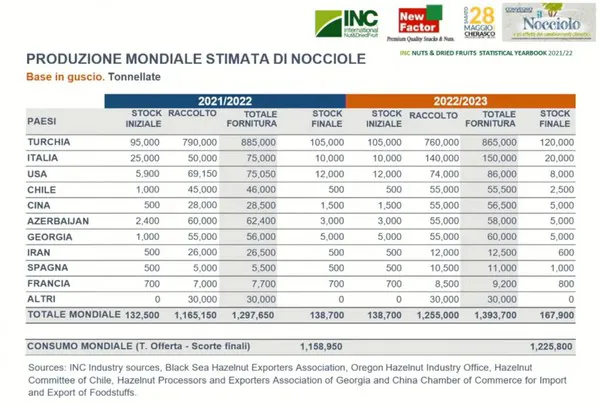

If we look at Italy, the year has been below average when it comes to hazelnuts. "The 2021/22 harvest in fact only reached 21,000 tons of shelled produce, behind the US figure. If we consider the five-year average, however, Italy us in second place after Turkey: approximately 46,000 tons of shelled produce a year against the 357thousand Turkish ones. In the past, Italy was the leading producer of shelled hazelnuts but, recently, it has been largely overtaken by Turkey which developed large surfaces and grows 72% of the global production of shelled hazelnuts. Productions in North America and Chile are also growing."

Graph taken from Alessandro Annibali's presentation on the global consumption of shelled nuts. Click here to enlarge.

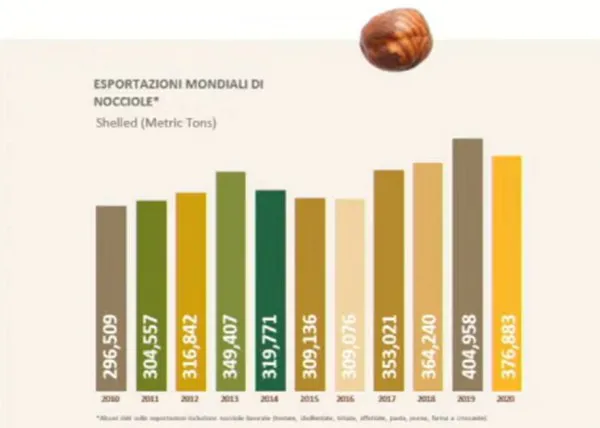

Global hazelnut exports

In 2020, total hazelnut exports amounted to over 376thousand tons, with Turkey being the leading exporter with a share of 75%. The main destinations for Turkey were the EU and the UK, with Germany and Italy contributing with 24 and 20% respectively.

Graph taken from Alessandro Annibali's presentation on the global exports of shelled nuts.

"Most Italian exports, approximately 93%, were destined to EU countries, especially Germany and France (50% and 20% respectively). In 2020, Italy exported over 25,000 tons, with a five-year average of 26,000 tons."

Where is the hazelnut market going

As for expectations regarding the 2022/23 season, Annibali stressed how carry-over stock should increase from over 138 thousand tons to around 168 thousand. "It is 21% more, and we should give it some thought. Concerning medium-term perspectives, the main topics are: marmorized stink bug, competition with other crops, sustainability and soil impact, reduction of pesticides, to name a few."

Slide related to expectations for the 2022/23 campaign, taken from Alessandro Annibali's presentation

The pandemic, the crisis of maritime transport, the war

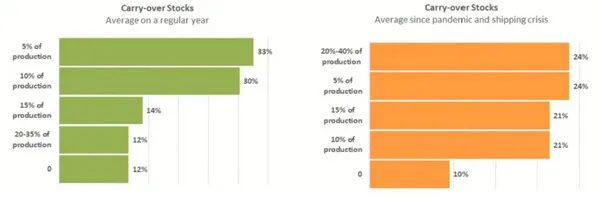

"From a study carried out on around 5,000 sector stakeholders comparing the carry-over stock of a standard year with that during the pandemic and the crisis of maritime transport, it emerged that 24% of stakeholders expects an increase of the production of nuts of 20 to 40%. The production expected over the next 5-10 years is between 1 and 5% for 47% of interviewees, while it is equal or above 10% for 34% of stakeholders."

The carry-over stock of a standard year compared with that during the pandemic and crisis of maritime transport (graph taken from Alessandro Annibali's presentation)

Annibali also stressed how, between February and April this year, there has been an overhaul of the costs affecting company profitability in light of the effects of the war in Ukraine: energy occupied the first place, followed by inflation and the Dollar/Euro exchange rate, transport, labor costs, raw materials, stocking and packaging and irrigation.

Slide concerning the main costs affecting profitability along the procurement chain, taken from Alessandro Annibali's presentation Alessandro Annibali

To conclude, the New Factor CEO stated that "today, agriculture is synonym with investments, efficiency, technology, innovation. We must therefore be capable of combining modernity with tradition. in this case, hazelnuts from Piedmont have a lot to say and I am certain that their future is bright with consumption on the up. For this reason, it is important to convey the difference between our hazelnuts and foreign ones to have our clients appreciate their unique characteristics."