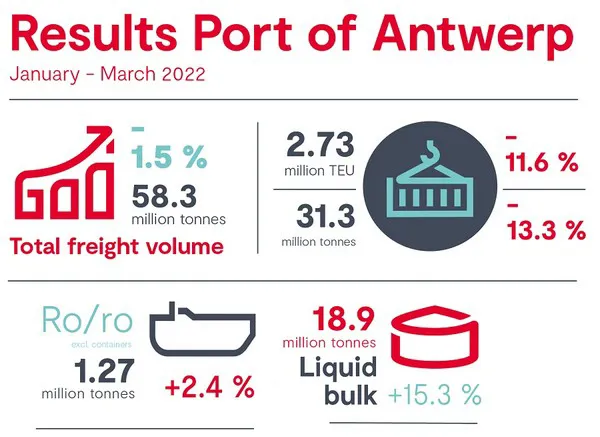

The total throughput of Port of Antwerp amounted to 58.3 million metric tonnes in the first quarter, a drop of 1.5% compared with the same period last year. On the eve of the merger with Port of Zeebrugge, these quarterly figures confirm the importance of responding to the current challenges collectively and further reinforcing the position in the international logistical chain. Furthermore, the drop in the container segment, which is partly the result of capacity problems, underscores the urgency of extra container capacity.

Container segment under pressure due to worldwide congestion

Despite difficult circumstances, the container segment held firm in 2021. In the first quarter of 2022, however, container traffic saw a fall of 11.6% in TEU compared to the same period last year, the second best quarter ever for containers. The disruption to container liner trade, delays and high import call sizes (number of containers unloaded by ships) are posing protracted operational challenges, which are making the operation of the container terminals more difficult. Moreover, the Russia-Ukraine conflict and the sanctions imposed also put pressure on the number of containers handled.

Conventional general cargo: continued growth

Conventional general cargo grew by 49.1% compared to the weak first quarter of 2021,. Steel, the major category of goods within this segment, is holding firm on the export side. The sanctions prohibiting the import of steel from Russia and Belarus since mid-March are having only a limited effect on throughput. After all, these flows are being replaced by imports from other countries because the EU has redistributed the import quota for steel from Russia and Belarus across other steel-exporting countries.

RoRo: disruptions due to production of new vehicles

RoRo saw slight growth (+2.4%), but there has been a significant fall in tonnage since the strong last quarter of 2021. The problems with the production of new vehicles are still affecting the throughput volumes.

Rise in dry and liquid bulk

After a strong 2021 in which Q1 was one of the best quarters ever, the throughput of fertilisers is dropping (-19,6%), which is due in part to the sanctions in respect of Russia as well as the sharp rise in prices. Thanks to the rise in the throughput of ores, coal and particularly grain, the dry bulk segment grew by 11.1% compared to the same period last year.

Figures confirm importance of merger and extra container capacity

The announcement of these quarterly figures comes on the eve of the merger with Port of Zeebrugge. Compared to the first quarter of 2021, all the cargo types are showing growth except for containers. .

For more information:

Port of Antwerp

Havenhuis

Zaha Hadidplein 1

2030 Antwerp - Belgium

Tel.: +32 492 15 41 39

press@portofantwerp.com

portofantwerp.com