The last 20 years have seen significant growth in area harvested and production of cherries and this should continue over the next 20 years.

This was the takeaway from Desmond O’Rourke, founder and chief executive officer of Belrose at Hazel Tech's recent 2022 Cherry Quality Summit, held virtually. O’Rourke noted that in the last 20 years, area harvest has grown about 37 percent and production about 47 percent. “Turkey and China had very large growth as has Chile. The U.S. and the European Union had very modest growth. There’s been dramatic changes in fortune amongst the different producing countries,” he said.

He added that Chile has also had dramatic growth in exports between 2010 and 2020, as has Turkey. The U.S. has also been relatively successful while other growing countries such as Spain have seen minor growth.

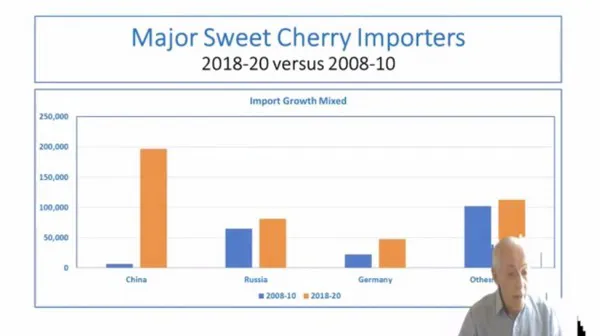

Desmond O'Rourke (above) says on the import side, China has been the most significant importer, followed by Russia and Germany.

Desmond O'Rourke (above) says on the import side, China has been the most significant importer, followed by Russia and Germany.

“On the import side, China has been the most dramatic performer in the import sector and Russia has also been an important growth market. Germany was the third largest. With the problems in Russia-Ukraine right now, the market in Russia could be down substantially for the next few years. For most other countries, imports have been fairly flat,” said O’Rourke.

Progress in the orchard

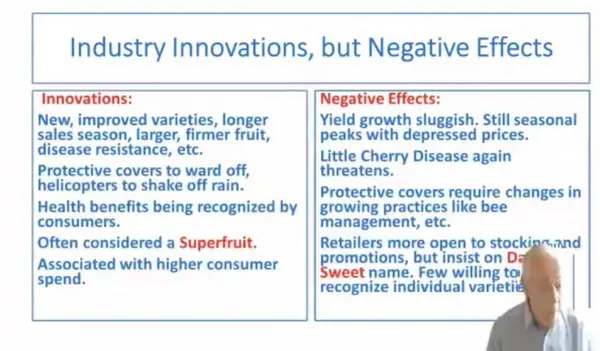

Developments are also being seen at the orchard level, starting with the proliferation of new varieties giving the industry a longer season with larger, firmer fruit that’s better at resisting disease. “We also have protective covers applied more and more widely, the use of helicopters to shake off rain and even in the market, we’ve had considerable innovation in that the industry has persuaded consumers of the health benefits of sweet cherries. They’re now considered a superfruit--a fruit you can eat in small quantities and have a strong health effect,” he said.

Yet, yield growth has been sluggish. “The hope that newer varieties would remove some of the seasonal peaks with depressed prices has not actually happened. We also have Little Cherry Disease which again could affect yield and production,” says O’Rourke.

However on demand, retailers prefer classifying cherries under the “dark, sweet” name. “So the industry has not been able to use new varieties to extend market opportunities as it has with apples and pears,” he said. “But as long as global incomes keep rising, global prices have continued rising. However per capita utilization has been sluggish in many sweet cherry consuming countries including United States, France, India and Japan. Even though the analysis shows positive demand, the per capita consumption has not borne that out.”

He also adds that major countries such as India, Indonesia, Brazil, Mexico, Egypt have very very tiny per capita availability of sweet cherries and the industry is missing out on large market opportunities.

O'Rourke adds that there are a number of cherry industry innovations, but they also come with some negative effects.

O'Rourke adds that there are a number of cherry industry innovations, but they also come with some negative effects.

And retail demand in the U.S. is still elastic. “As you increase volume, your total revenue at retail continues rising. At the FOB level, the Pacific Northwest sweet cherry demand is becoming less elastic than at retail. So we’re getting to the point where an increase in shipments will start reducing prices unless we expand the promotion for Pacific Northwest sweet cherries,” O’Rourke said.

China ahead on demand

On export demand, China is still far ahead of other markets and tends to prefer off-season southern hemisphere sweet cherry varieties which makes it challenging for U.S. exporters. “And there’s also increasing competition from Turkey and Kazakhstan. Turkey for example has had a dramatically lower exchange rate in recent times,” he said.

However best bets for demand opportunities are Canada, Taiwan and South Korea, all of whose demand has grown fairly steadily. “And up and coming markets are Malaysia, Thailand, Vietnam and Mexico. But in many countries, demand is still weak,” O’Rourke said.

Looking ahead, area harvest is anticipated to grow 16 percent between now and 2030, a number that will slow to about 10 percent growth between 2030-2040. “We expect average yields to rise as the new technologies and new varieties kick in more around the world. So average yield will go up about 20 percent in the next decade and then about 14 percent the following decade. Overall production should grow by about 40 percent in the next decade and by about 25 percent,” he said. “We’re going to have an awful lot more cherries on the world market. So with the potential growth in production and some of the difficulties with demand, the sweet cherry industry faces many challenges in the next two decades.”

Next, Joe Cataldo, head of field operations and grower relations for Lodi, CA-based Delta Packing Co. took a look at the upcoming California season. “We’ve had a very interesting spring. We had some extreme frost a few weeks back and looking at the way the crop is setting up throughout the state, I think it will on the lighter side,” says Cataldo. “Last year we had a 10 million box crop even with the heat and labor issues. Between all of that, we could have packed 12-13 million boxes. But there’s going to be plenty of good sized marketable fruit this season weather permitting and hopefully we can make it until the end of June.”

The summit involved a discussion with (left to right, clockwise): Deidre Baumgarten; Barry Foley, business development manager for Hazel Technologies, who moderated the discussion; and Joe Cataldo.

The summit involved a discussion with (left to right, clockwise): Deidre Baumgarten; Barry Foley, business development manager for Hazel Technologies, who moderated the discussion; and Joe Cataldo.

Trial discoveries

Deidre Baumgarten, PNW account executive for Hazel Technologies touched on the goals of the trials Hazel is conducting around post-harvest cherry protection. “Consumers want to purchase great looking cherries with green stems and they shop with their eyes. The goal is to protect the stem quality in the cherry and any time there’s a cold chain break, the stems are going to start to turn,” she says. (Mario Cervantes, director of business development-ag tech for Hazel, later discussed more details about Hazel’s trials around maintaining green, healthy stems and added that these trials translate to the real world shipments to farther flung destinations which can have cold chain challenges, such as North or South America to China.)

Finally, the discussion switched to the implementation of technology solutions throughout the industry and Cataldo noted that Delta has put in a new packing line which doubles its capacity. From a growing perspective, he also noted that developments are being seen in new planting systems--namely, smaller trees, higher density plantings and trellis systems.

Baumgarten added that much of the automation in the past decade has also been around packaging which have helped fruit protect quality. This includes moving away from zip lock-style bags to pouch bags, clamshells and top seals.

For more information:

For more information:

Hazel Technologies

Tel: +1 (559) 321-2146

media@hazeltechnologies.com

www.hazeltechnologies.com