The fourth quarter of 2021 was disrupted by high levels of COVID-19 cases, high inflation and continued supply chain disruption.

“Americans are very aware of inflation, with 43 percent perceiving prices to be a little higher and 48 percent perceiving them to be much higher,” said Jonna Parker, Team Lead for IRI Fresh, citing the December wave of IRI’s primary shopper survey. “Produce is the second most frequently mentioned example by consumers of products with elevated prices.” In 2022, IRI, 210 Analytics and the International Fresh Produce Association (IFPA) will continue to team up to document the changing marketplace.

Meals remained home-centric in December. According to the IRI primary shopper survey, the share of meals prepared at home remained at 80 percent.

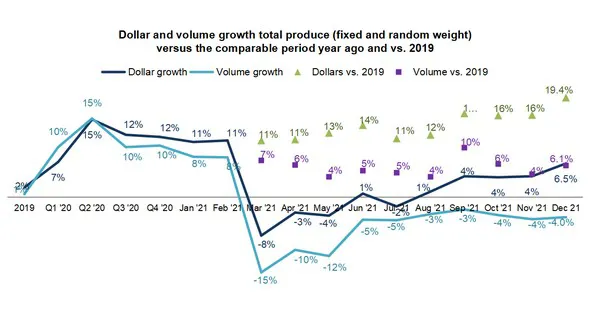

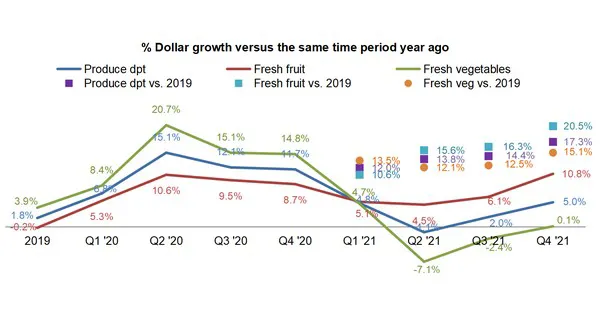

Fresh produce prices are also higher than last year. In 2021, price per volume (pound) for total fresh produce increased by 6.5 percent— pulled down by much milder inflation early on in the year. When regarding inflation in December 2021 only, a comparison to 2020 shows a 14.7 percent increase for fresh fruit. December inflationary levels are much lower for vegetables, but still average +4.6 percent. “Inflation like this affects volume sales and we are a volume-driven business,” said Joe Watson, VP, retail, foodservice and wholesale for IFPA.

Fresh produce prices are also higher than last year. In 2021, price per volume (pound) for total fresh produce increased by 6.5 percent— pulled down by much milder inflation early on in the year. When regarding inflation in December 2021 only, a comparison to 2020 shows a 14.7 percent increase for fresh fruit. December inflationary levels are much lower for vegetables, but still average +4.6 percent. “Inflation like this affects volume sales and we are a volume-driven business,” said Joe Watson, VP, retail, foodservice and wholesale for IFPA.

Rolling up the October through December results sees fourth quarter vegetable sales back in positive year-on-year growth territory. Vegetables had the stronger performance in 2020.

Despite above-average inflation for fresh produce, its share of dollars fell in December. Shelf-stable fruits in particular had a strong December with sales gains of 9.4 percent year-on-year, hand-in-hand with unit and volume gains. Both frozen and shelf-stable are heavily impacted by supply chain disruptions.

Comparing the three calendar years shows that fresh lost significant ground in 2020 when shoppers looked to shop less and have inventory on hand to last during lockdown. In 2021, the fresh produce share of dollars recovered to typical levels, but above-average inflation played a role.

Comparing the three calendar years shows that fresh lost significant ground in 2020 when shoppers looked to shop less and have inventory on hand to last during lockdown. In 2021, the fresh produce share of dollars recovered to typical levels, but above-average inflation played a role.

The top sellers in 2021 reflect a mix of fruits/vegetables. Berry sales were nearly twice that of the number two, apples, and tomatoes were the biggest seller in vegetables.

Not all top 10 sellers grew sales in 2021. Tomatoes, potatoes and peppers lost a little ground compared with 2020 records.

What’s next?

Marketplace disruption is likely to continue through the first quarter of 2022 at a minimum.

- In December 2021, 38 percent of shoppers encountered issues with availability of items they had planned to purchase.

- 18 percent stocked up on items for other reasons, including rapidly rising inflation. This could affect fresh produce sales with dollars shifting to canned/frozen.

The next report, covering January, will be released mid-February. Please click here for the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com