Twenty months into the pandemic, fresh produce retailing remains in flux. IRI, 210 Analytics and the Produce Marketing Association (PMA) have documented the changing marketplace.

Meals continued to be home-centric in October. “According to the October IRI primary shopper survey, the share of meals prepared at home is back to late spring, early summer levels,” said Jonna Parker, team lead fresh with IRI.

The first 10 months of the year brought $577 billion in food and beverage sales — now up 1.0 percent over 2020 and 15.5 percent over the 2019 pre-pandemic normal. However, inflation played a significant role with year-on-year units still down 3.6 percent.

Fresh produce prices are higher than last year. Year-to-date, prices for total fresh produce are about 6 percent higher than they were last year. Inflation for fruit is above average at +7.9 percent year-to-date through October 31st. Fruit prices during October 2021 were 10.5 percent higher than in October 2020. “I certainly remember other times of high inflation for produce but the level of media attention to the food supply chain supply challenges has shoppers ever so aware today,” said Joe Watson, VP of membership and engagement for PMA.

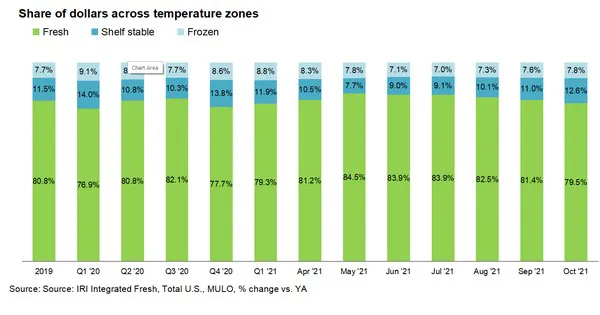

While fresh sales are strong, the produce department isn't capturing all the demand that returned to retail recently. “The share of fresh fruit and vegetable dollars across the store reached a high in May 2021 and has dropped slightly since,” said Watson.

While fresh sales are strong, the produce department isn't capturing all the demand that returned to retail recently. “The share of fresh fruit and vegetable dollars across the store reached a high in May 2021 and has dropped slightly since,” said Watson.

In frozen, fruit represented 20 percent of October sales. Frozen fruit sales increased 1.0 percent year-on-year whereas frozen vegetables declined 6.7 percent. “On fruit, the top 10 players in dollar sales change with the season,” said Parker. “Berries are not only the biggest seller but also one of the fastest growers at +15.9 percent. This underscores the dominance of berries. Apples and grapes are having a very strong month as well.”

Others with above average growth are melons, mixed fruit and pineapples. The only top 10 seller that did not manage to grow dollars year-on-year were mandarins. “Vegetables’ performance was more mixed than fruit,” said Watson. “Several areas trailed the October 2020 performance, including tomatoes, lettuce, peppers, carrots and mushrooms.”

“Vegetables’ performance was more mixed than fruit,” said Watson. “Several areas trailed the October 2020 performance, including tomatoes, lettuce, peppers, carrots and mushrooms.”

What’s next?

The IRI primary shopper survey points to some normalcy for Thanksgiving. Findings include:

- More people are celebrating Thanksgiving this year with 60 percent saying it will be the way they celebrated before COVID-19.

- 36 percent hosting/attending a party with guests beyond their own household; 25 percent are preparing a meal for just their household.

- Eight percent are also doing a “Friendsgiving” meal.

- 22 percent expect to spend more on Thanksgiving than last year.

- 36 percent also plan to shop earlier.

The next report will be released in mid-December. Please click here for the full current report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com