Greenyard has released its financial results for the first half of 2021. Hein Deprez, co-CEO said: “The financial results of this first half year underpin the successful roll-out of our strategy. We will continue to build and leverage our unique position in the healthy food ecosystem. Greenyard is in both segments right at the heart of the current transition towards more plant-based diets. Going forward, we truly have a unique opportunity to contribute to an enhanced health for current and future generations, and for the planet.”

Greenyard has released its financial results for the first half of 2021. Hein Deprez, co-CEO said: “The financial results of this first half year underpin the successful roll-out of our strategy. We will continue to build and leverage our unique position in the healthy food ecosystem. Greenyard is in both segments right at the heart of the current transition towards more plant-based diets. Going forward, we truly have a unique opportunity to contribute to an enhanced health for current and future generations, and for the planet.”

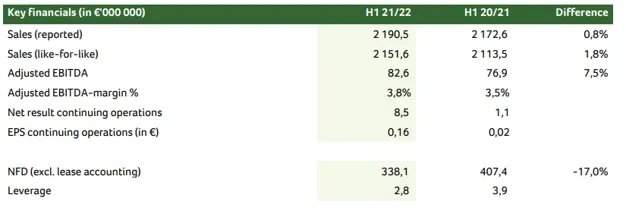

Sales: Greenyard achieved a 1,8% increase in sales (on a like-for-like basis) after last year’s double digit sales growth. Group sales increased year-on-year by € 38,1m, up from € 2 113,5m to

€ 2 151,6m.

Adjusted EBITDA: As a result of growth in sales, particularly arising from integrated customer relationships, and a continued focus on profit improvement initiatives, the adjusted EBITDA increased beyond the level of sales growth by 7,5%, up from € 76,9m to € 82,6m. Consequently, the adjusted EBITDA margin increased from 3,5% in the same period last year to 3,8% for the first six months of the financial year.

Net result. Greenyard reports a net result from continuing operations of € 8,5m for the first half of the financial year, compared to € 1,1m for the same period last year. In addition to a higher EBIT, interest expenses have been considerably reduced (-€ 6,2m) as interest margins decreased because of the refinancing at the end of last accounting year and decreasing debt levels. However, income taxes have increased in line with the increase of profit before tax and depleted carried forward tax losses in some entities.

The Fresh segment achieved a sales growth of 1,4% on a like-for-like basis (or 1,1% on reported basis), generating an additional € 24,9m in sales in the first six months of the financial year. The sales increase was mainly attributable to an expansion of the product and service offering within the integrated customer relationships which continues the growth path after the double-digit growth realised last year and which currently represents 74% of sales of the Fresh segment.

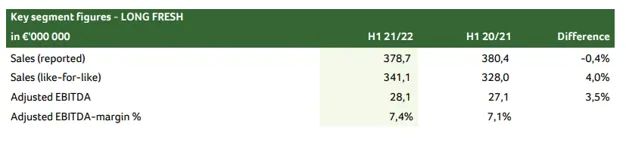

Long Fresh

Click on image to enlarge

Sales in the Long Fresh segment have increased by € 13,2m, compared with the same period last year, a 4,0% increase on a like-for-like basis (or -0,4% on a reported basis). The sales are growing steadily, due to a partial revival of food service (from 13% to 17% of Long Fresh sales), further growth with higher-end convenience and fruit categories and additional business unlocked by convenience investments. Nevertheless, sales in the UK were slowed down due to important post-Covid disruptions in the economy, and more specifically within supply chains.

For the full financial statement, please click here.