The Covid pandemic has triggered four shifts in consumer behavior in Europe which continue to influence the fruit and vegetable industry. It has resulted in more online shopping for fresh produce, but a continuation of that shift to healthier consumption patterns cannot be taken for granted

1. Shift from offline to online; fresh deliveries to your doorstep

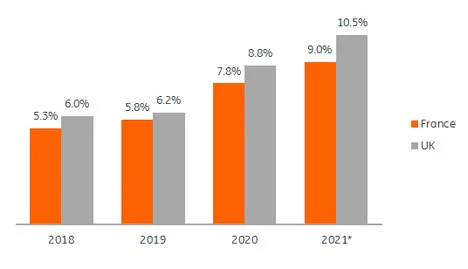

Online grocery shopping has experienced an unprecedented inflow of new customers since March 2020, leading to growth at omnichannel retailers, grocery delivery services and meal-kit companies. According to NielsenIQ, one in three households in Western Europe shopped online for groceries in 2020, compared with one in four in 2019. In terms of online market share, the UK and France stand out.

Online sales are growing rapidly elsewhere as well. In Italy for example, they grew by more than 40%, and in the Netherlands, they grew by more than 50% during the first half of 2021. Fresh produce is generally one of the largest categories for online grocers, indicating that online shoppers do not seem to be that bothered that they cannot pick their own produce.

Online groceries have continued to gain market share

Share of online groceries as part of total grocery sales in France and the UK:

Source: NielsenIQ, IGD, *France based on January to May, UK forecast for full year

2. Shift between out-of-home and at-home; balance has not been restored

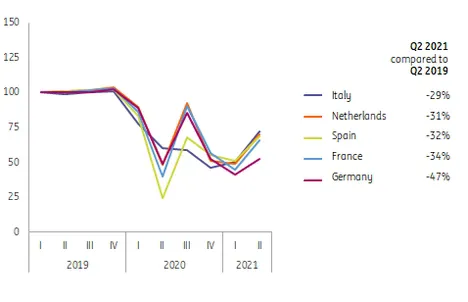

Given the lockdowns, 2020 was obviously a bumper year for at-home consumption, and even though most restaurants have reopened, it is interesting that the pre-Covid balance between out-of-home and at-home spending on food has not fully recovered.

In the five largest eurozone economies, turnover in out-of-home consumption, was still down by 30% to 50% in the second quarter of 2021 compared with the same quarter two years earlier. At the same time, retail food sales in the eurozone are still higher in 2021 and deflated turnover - turnover adjusted for inflation - was almost 6% higher in the year to July compared with the same period in 2019. Retail sales of fruit and vegetables have been on the rise as well. In the UK, fruit sales increased by 2.1% and sales of vegetables by 6.5% in volume terms, according to Nielsen. Meanwhile, GfK data for the Netherlands, show that fruit volumes sold in the first half of 2021 grew by 2.8% and vegetables by 4.4%.

Turnover in out-of-home eating and drinking was still much lower in the first half of 2021

Source: Eurostat

3. Shift to larger shopping trips leads to changes in the shopping basket

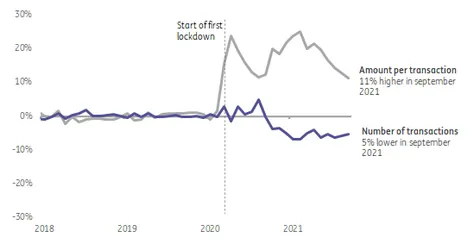

One-stop shopping is more popular since the start of the Covid-pandemic and people are still spending more per trip and making fewer trips to grocery stores. According to ING data, the total volume of debit card transactions in food retail in the Netherlands was down by 4% in July 2021, while value was up by 6% compared to pre-Covid levels. Although people visited stores less frequently, demand for typical ‘impulse’ fruit products (like berries) posted volume growth in many countries.

Outperforming the general upward sales trend were meal kits (due to more ‘cooking from scratch’) and products with a longer shelf life, such as carrots. Salad bowls and dry leaf salads underperformed. The initial stock up in March 2020 also led to a wave of interest in frozen vegetables and these are still experiencing higher demand compared with pre-Covid times.

Debit card transactions in food retail show Dutch consumers go less frequently but spend more per trip

Difference between actual and pre-corona trend levels, based on monthly and seasonally-adjusted data

Source: ING Research, based on ING data

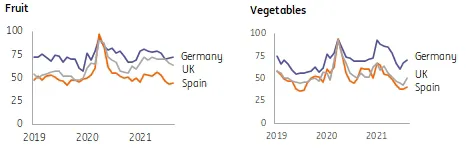

4. Shift to healthier diets; so far, the balance looks positive

Covid sparked interest in both healthier diets and the immune system. Google searches for ‘fruit’ and ‘vegetables’ peaked during the first wave and vitamin C-rich products like citrus fruits were in high demand in that period. General search activity in many countries is currently well below the peak, but still somewhat higher compared to pre-Covid levels. Meanwhile, studies such as the influential ZOE Covid study in the UK, indicate that most households reported some change in their intake of fruit and veg. While some households reported positive and other households negative changes, on balance, there was an increase in the daily consumption of fruit and vegetable portions.

Interest in fruit and vegetables peaked at the start of the Covid-pandemic

Search activity on Google on a scale of 0 (no interest) to 100 (maximum interest) in several countries, based on four-week periods

Source: Google, ING Research

Source: Google, ING Research

"We expect that some shifts in consumer behavior are here to stay, while others will gradually reverse, as consumer behavior evolves to a new normal."

Offline to online shift is expected to be very sticky

The growth of online grocery sales is slowing down after a year-long rally. In June 2021, total online grocery sales in the UK even fell for the first time on a year-on-year basis. "In our view, this fall can also be linked to food retail losing some revenue to out-of-home channels," the report stated. Nevertheless, online grocery spending remains elevated compared to pre-Covid levels and a decline of the online market share within total grocery sales seems unlikely.

On the demand side, more consumers have become used to ordering online and there are more options that cater for their specific needs. The rise in online sales of non-food products also shows that once people have changed their habits, they tend to stick to them. The supply side continues to be very dynamic, thanks to investment by both multichannel retailers and pure players. Examples include recent funding rounds for rapid delivery companies and the €600 million funding for the Dutch-based company, Picnic.

At-home consumption will retain some market share

The balance between at-home and out-of-home spending on food is gradually returning, but out-of-home still has a lot of lost ground to make up over the coming years. For many people, working or studying from home is here to stay, at least to some extent, and business travel also is not expected to recover completely. Both trends lead to fewer out-of-home consumption occasions. However, earlier we pointed out that there will be regional differences because the share of the population that can and will work from home is generally higher in Northern and Western Europe than it is in Southern and Eastern Europe.

Necessity for larger shopping trips fades

The impact of restrictions and curfews on the size of the average shopping basket has largely disappeared. What is left are requirements to wear a face mask in indoor places in some countries and the possibility of the re-introduction of some restrictions. Because the surge in larger shopping trips was primarily born out of necessity, it is less likely to stick post-Covid. At the same time, smaller shopping trips to (convenience) food retailers may remain under pressure due to reduced work and tourism-related footfall.

Healthier diets; will policymakers step up efforts to retain progress made?

The fact that Covid is still around at the start of the flu season could be beneficial for fruit and vegetables as a healthy diet can add an additional ‘line of defence’ to the immune system, but compared to 2020, many people can now also rely on vaccines to protect them. The big question is whether people will keep adhering to the recommended daily fruit and vegetable intake once Covid-fears fade. That remains to be seen, especially because our day-to-day food environment has not changed much. In the long run, much will depend on whether policymakers use the current momentum to implement measures aimed at nudging people towards a healthier lifestyle.

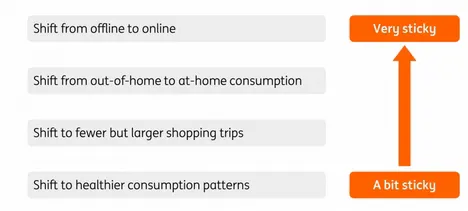

Shifts in consumer behavior have a different level of ‘stickiness’ in a post-Covid situation

Four shifts and their likeliness to persist

Source: Source: ING Research

Fresh produce companies are gearing up for the next phase. Consumer habits have changed as a result of the pandemic and people's behavior will continue to evolve although the pace of change is likely to slow. Following the four shifts the report has already mentioned, there are also four areas of strategic interest for fruit and vegetable companies.

1. E-commerce creates new opportunities

Fresh produce companies realize much of their online growth by growing together with the multichannel retailers they were already supplying. At the same time, online players such as Hello Fresh, Ocado, Picnic and Rohlik have become a ‘new’ sales segment, especially for fresh produce suppliers with a wide assortment. More e-commerce means the market for fruit and vegetables moves towards an even more just-in-time situation as online retailers often place their final orders when goods are already sold. While online sales are still relatively small, the segment provides opportunities for innovation including the possibility of selling more exclusive products because of the lower risk on waste.

2. Companies reconsider exposure to at-home and out-of-home

The uplift in volume sales in retail during the last year and a half has mostly been positive for the larger players in the fresh produce industry because they are generally focused on supplying the retail channel. Many suppliers have been seeking closer cooperation with retailers and that cooperation was much needed during the first wave to keep shelves stocked. The shift towards at-home was negative for many dedicated foodservice suppliers. It seems likely that fresh produce companies will increasingly direct their investment towards the retail channel while capacity geared towards supplying segments like catering will face pressure.

3. Fresh produce plays a central role in competition between retailers

Consumers who opted for larger shopping trips tended to favor certain supermarkets. During 2020, growth at full-service retailers outpaced that at discounters in Germany and the Netherlands. Elsewhere, like in Spain, (regional) retailers with stores in closer proximity to consumers did better than hypermarkets. Some retailers will focus on turning these tides and regaining lost market share. In doing so, they are likely to pay more attention to their promotional activity in fresh produce to attract consumers.

4. Grab the opportunity to make healthier diets stick for longer

In terms of marketing, fresh produce companies have been able to ride an unprecedented wave of free publicity, but this will fade. However, the impact of the pandemic, in health and financial terms, provides the fruit and vegetables sector with a strong argument to emphasize the importance of a healthy diet to policymakers. The backing of food policy is a key element to making the shift to healthier diets stick for longer.

Apart from the highlighted developments on the demand side, prices and consumption of fruit and vegetables are also, of course, influenced by the seasonal availability of produce. Poor harvests due to adverse weather, and supply chain disruption, such as rising transport costs and labor shortages, also have a big impact on the availability and final consumption. That was already the case before Covid, but it became even more apparent during the first wave of the pandemic. Now we are on the road to recovery, those important factors are starting to play a larger role and they will continue to impact the sustainability and durability of these noticeable consumer shifts.

Source: ING