The 13th edition of Cool logistics is taking place this week. In Tuesday's afternoon sessions, Diego Barriga, Director Lancaster Logistics and Foodcareplus spoke about how perishable products can’t get into ports and said additional service are needed. The vessel delays in combination with delays at ports create big challenges for day to day operations.

He said that it is a challenge to ship low value products such as fresh produce and the retail price does not reflect the increase in logistical costs, on the other hand the high value products such as avocados and mangoes can take the price increase but not the longer shipping times. He has seen more damage and claims in the last 16 months than ever before and this needs to be minimised.

Port centric operations need to be increased as it was more difficult to change things from the supplier side. He also said we need to be more efficient in moving produce and this will be the challenge in the next 3-4 years.

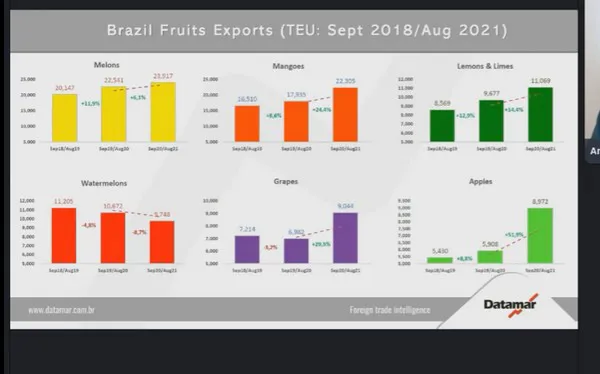

Andrew Lorimar, CEO, Datamar spoke about the huge increase in exports from Brazil in recent years.

Exports from Brazil had been steady until recent years when there was drive to increase the exports. In the last 3 years there has been a steady increase and this year will see record export volumes. Fruit exports account for 18% of overall exports.

The figure above represents export until August 2021, but is more reflective of last year’s exports as the main months are September and October.

Since August last year melon exports have increased by 6.1% and grapes are up by a huge 30% on last year, with limes up 14.4%. The figures shown for apples are more up to date as the export season peaked in March. They show a 52% increase on last year.

This increase in exports also poses a problem as Brazil exports a lot more than it imports meaning there are a lot empty containers leaving the ports.

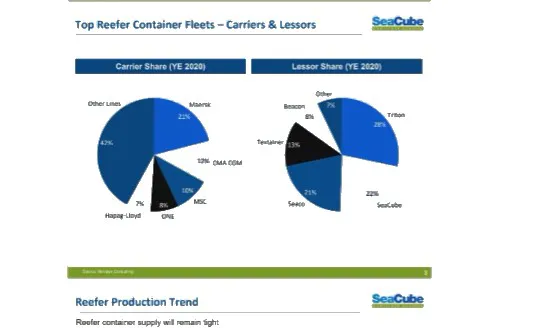

Robert F. Sappio, CEO, SeaCube Containers LLC said that despite all the challenges the industry has proved to be very resilient with containerised refers seeing a 5% growth. Leasing companies have been investing in refrigerated containers and have even overtaken shipping companies in this respect.

By September 2021 340,000 TEUs of refrigerated equipment has been built and by the end of the year it will reach 360,000 TEUs. The cost of equipment has also increased, last year it was $7700 for a container, this year it is over $10,000. Smart containers are becoming ever more popular and it is estimated that by 2025 65% of the fleet will smart containers.

He stressed shortages will continue as shipping lines are using refrigerated equipment for dry product and but the main reason for the shortages is congestion.

Sarah Schlueter, Senior Director Niche Products, Hapag-Lloyd AG echoed the challenges already outlined by others and said everything came together with the shipping lines. The external challenges faced by them included capacity at the ports, mainly the plug capacity, 6-9 months ago it was only a problem at some ports but now it is everywhere. The bottlenecks around the world impact schedules and affect reliability. She said it was not possible for ships to sit outside ports for three weeks, this is not positive for the customer as perishables come from all over the world. There is also the case that a pharmaceutical delivery comes and needs to get into port quickly. These issues will take time to resolve.

Internally the challenges are very different to a year ago when reefers took priority over dry, but now it the other way around. As a shipping company everything needs to be considered, working in the best interests of the customer and trying to find the best solution for everyone.

The last session of the was the Global Cool Shippers Forum moderated by Ole Schack-Petersen, Executive Officer, Broom Group

Chris Swartz, Director Global Transportation and Logistics Services, AJC International started the session by looking back at the start of the pandemic, his company exports a lot of (frozen) meat products, as well as some fresh produce to China and had to reposition 500 containers. He said it took about eight weeks to shift through the change in destinations and change in demand as food service closed. The company took on a lot of storage space for the frozen products. He said that we are not through this yet and the biggest problem is the congestion, trucking issues are a weak link. He sees communication with all partners in the chain as a vital way forward. Increased costs will stay and we must learn to deal with them and be transparent with partners.

Chris Swartz, Director Global Transportation and Logistics Services, AJC International started the session by looking back at the start of the pandemic, his company exports a lot of (frozen) meat products, as well as some fresh produce to China and had to reposition 500 containers. He said it took about eight weeks to shift through the change in destinations and change in demand as food service closed. The company took on a lot of storage space for the frozen products. He said that we are not through this yet and the biggest problem is the congestion, trucking issues are a weak link. He sees communication with all partners in the chain as a vital way forward. Increased costs will stay and we must learn to deal with them and be transparent with partners.

Marc Evrard, Commercial Director, BFV Belgische Fruitveiling which grows, distributes and ships 25,000 TEUs of apples and pears around Europe, Africa, SE Asia and South America reiterated that congestion is the main challenge. At the start the biggest challenge was the lockdowns in the ports and in the Chinese markets whole cargoes had to be disinfected. He stressed that direct interaction with between all players in the chain was important. BFV built as task force which reacted very quickly to the new situations and they managed to ship everything that was planned, this was helped by the fact that they were already evolving to online sales so that when the market places closed systems were put into place to market the produce online.

Marc Evrard, Commercial Director, BFV Belgische Fruitveiling which grows, distributes and ships 25,000 TEUs of apples and pears around Europe, Africa, SE Asia and South America reiterated that congestion is the main challenge. At the start the biggest challenge was the lockdowns in the ports and in the Chinese markets whole cargoes had to be disinfected. He stressed that direct interaction with between all players in the chain was important. BFV built as task force which reacted very quickly to the new situations and they managed to ship everything that was planned, this was helped by the fact that they were already evolving to online sales so that when the market places closed systems were put into place to market the produce online.

He said all parts of the chain, the shippers, forwarders etc. need to put their heads together and work out a strategy of closer collaboration to make the industry more reliable and move away from losses in the supply chain.

Is recovery on it’s way? Mark comments that shippers are seeing positive financial results but shipping times are double that of a few years ago. He said this not progress, it is a lack of vision and there is room for progress to make sure produce is delivered on time.

Mark explained that even after giving a shipping line a detailed shipping schedule months before the date of the first shipment, just a week before the first shipment they were surprised to hear the shipping company was not aware of when or what was to be shipped.

Stefano Di Paolo, President and GM, Great White Fleet Ltd, Chiquita Brands mainly ships produce to the EU and the US from the tropics using their own vessels. In addition to the challenges of the pandemic, they had a vessel breakdown which added to the stress. The company harvests bananas every week and exports 900 containers each week, so a vessel breakdown was a major issue as there were no parts available, no replacement vessels. It was 10 weeks until the ship was back in action.

Stefano Di Paolo, President and GM, Great White Fleet Ltd, Chiquita Brands mainly ships produce to the EU and the US from the tropics using their own vessels. In addition to the challenges of the pandemic, they had a vessel breakdown which added to the stress. The company harvests bananas every week and exports 900 containers each week, so a vessel breakdown was a major issue as there were no parts available, no replacement vessels. It was 10 weeks until the ship was back in action.

Stefano said that this situation was of course unprecedented, but lessons have been learned – you understand who can operate under stress and who you can count on –“There is no time to cry or complain.”

Juan-Patricio Navarro, Directeur Général, ProEcuador explained that when Covid hit in Ecuador the country almost collapsed, the situation was chaotic. Workers have no access to state aid if they get sick or can’t work. If people in the rural areas can’t work then there is no production. He said that the new government in Ecuador changed the whole approach to the Covid situation and formed partnerships between the public and private sectors to keep production and export going.

Juan-Patricio Navarro, Directeur Général, ProEcuador explained that when Covid hit in Ecuador the country almost collapsed, the situation was chaotic. Workers have no access to state aid if they get sick or can’t work. If people in the rural areas can’t work then there is no production. He said that the new government in Ecuador changed the whole approach to the Covid situation and formed partnerships between the public and private sectors to keep production and export going.

Most of the country's exports go to the North America, the EU and Asia markets and in 2020 exports were affected but remained stable and most of the harvest was exported, in 2020 there were no bottle necks that we see today.

Exports from Ecuador were complicated but agreements were made to buy the produce. Peru is also experiencing rising costs and having the same supply chain issues as other countries.

Juan-Patricio also sees a conflict of interests between exporters and importers, people are pushing the prices down while expecting more corporate responsibility form the growers, he would like to see more shared responsibility he thinks that not all of the costs should be on the producers.

Juan Andres Ferrari, Director Perishables Supply Chain, ACF Global Sourcing said that no one has remained untouched by the pandemic and calls for more collaboration in the industry, especially between the growers and retailers in the US and Europe.

Juan Andres Ferrari, Director Perishables Supply Chain, ACF Global Sourcing said that no one has remained untouched by the pandemic and calls for more collaboration in the industry, especially between the growers and retailers in the US and Europe.

Rescheduling by shippers creates a big problem as fresh produce has a limited shelf life and income is lost in the supply chain.

He has had to deal with a lot of challenges such as putting produce on different routes and longer shipping times. He also asks for more collaboration.

He said this year they have got to know who their friends are, those who went the extra mile to help.

There is also a service problem to deal with. Retailers have their structure and only buy from certain vendors, they have also had to adapt. He said that the situation could have been lot worse with a lot more waste.

He says communication is now critical and people need to have those awkward conversations even if its difficult. They also have to understand that everyone works to make a profit – nothing is for free.