Container shipping demand remains strong heading into the fourth quarter. Ongoing COVID-19 flare-up however continues to present challenges across Asia Pacific, with Vietnam extending the lockdown in its manufacturing heartland around Ho Chi Minh City until mid-September, New Zealand imposing national lockdown and China suspending aircraft operations in Shanghai International Airport. The unprecedented disruption caused by the pandemic coupled with surging demand is affecting schedule reliability at a much lower level than we expect.

Container demand growth continued to run ahead of supply growth in Q2 2021. The combination of strong US goods consumption, higher throughput capacity and re-opening in Europe are expected to drive average year-on-year container demand growth at around 2%-4% for the second half of 2021.

The global composite purchasing managers’ index hit 56.6 in June 2021 driven by expansion in both the manufacturing and services sectors. The manufacturing orders to inventories index hit the highest level in June since 2010 indicating continued restocking, while the export orders index also climbed to 53.2 in June, the highest since 2010.

These gains were reflected in an 18.7% increase in global container trade in the second quarter which continued to outpace capacity and leading to elevated freight rates. Many regions including inbound North America, intra-Asia, west Central Asia, Latin America and Europe saw double-digit growth in container trade growth after a very weak second quarter 2020.

From the supply side, increase in net deliveries along with a sharp reversal in idling has pushed up effective capacity in the first half of 2021 relative to the first half of 2020. Surges in demand for cargo space keep the fleet active and global idling container ship fleet remains low. But uncertainties over the easing of capacity constraints, equipment shortages and port congestions make it challenging to predict when the disruptions and imbalance in demand and supply will normalize.

Global schedule reliability has been largely consistent in the past few months, albeit at a much lower level than expected. Schedule reliability has fallen dramatically in 2021 driven by various factors, particularly by stronger-than-expected demand, operational disruptions and continued port congestions.

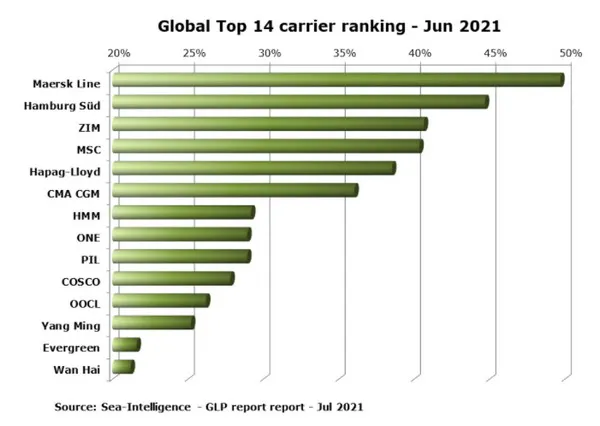

Maersk has continued to maintain its industry leading position for schedule reliability, according to the latest Sea-Intelligence Global Liner Performance Report in June, however schedule reliability for the industry as a whole remains much lower than we expect. Maersk fully acknowledges that it is still far away from achieving the reliability levels that its customers expect from them and the company claims to have been continuously working to add vessels to absorb delays, rationalize service coverages and collaborate with terminals to minimize the impact.

Click here for the Maersk Asia Pacific market update - 2021 August

For more information:

Baylie Zhang

Maersk - Asia Pacific

Tel.: +86 2123062351

Email: baylie.zhang@maersk.com