The pandemic changed everything about groceries. While grocery e-commerce had been an area of growth, online food and beverage sales exploded in 2020. IRI and 210 Analytics analyzed what drove growth.

Food and beverage e-commerce

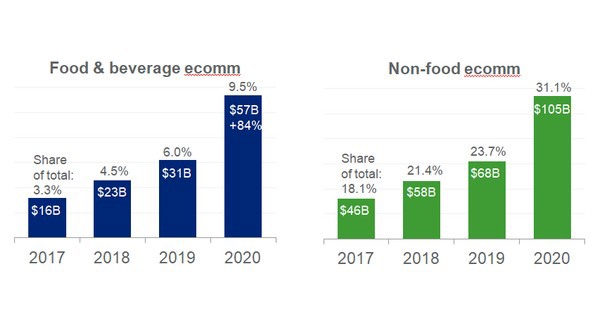

In 2017, the online portion of total food and beverage sales was 3.3 percent. Come 2019 that had grown to 6.0 percent or $31 billion. By the end of 2020, e-commerce made up 9.5 percent of U.S. food and beverage sales, reflecting annual growth of 84 percent, according to IRI.

Even so, online food and beverage sales trail non-food by a wide margin. Non-food CPG e-commerce reached $105 billion in 2020, now reflecting 31 percent of all dollars sold.

Even so, online food and beverage sales trail non-food by a wide margin. Non-food CPG e-commerce reached $105 billion in 2020, now reflecting 31 percent of all dollars sold.

Note: Based on 205 CPG categories currently tracked in e-commerce. Estimated 2020 e-commerce share for all CPG categories is 7.8 percent for edible/22.3 percent for non-edible, accounting for $175B total CPG e-commerce sales. E-commerce data is based on projected receipt-based sample and reported data with varying levels of granularity and accuracy available. 1. eMarketer U.S. Retail e-commerce Sales Share, by Product Category: percent of Total Retail Sales. Source: IRI Omnichannel, data ending 2/28/21. IRI Strategic Analytics forecasts.

E-commerce engagement

In 2019, 47 percent of consumers had purchased groceries online. In 2020, that rose to 64 percent, according to research by 210 Analytics.

However, many shoppers have increased their order frequency over the year. The share ordering online weekly rose from 5 percent in 2019 to 11 percent in 2020. The share ordering every two weeks increased from 4 percent to 9 percent. IRI found among new online shoppers as of the start of the pandemic, 50 percent continue buying online and about 20 percent have become heavy hitters.

Brand, or basket, loyalty

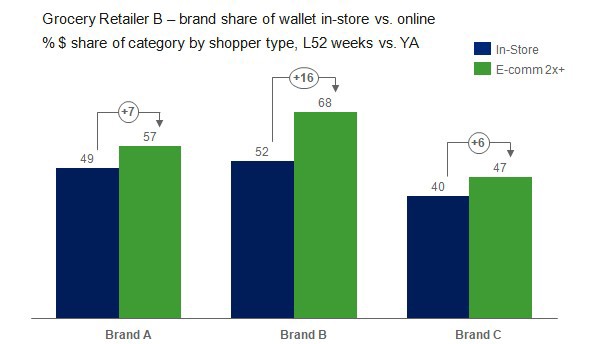

More than four in five online consumers (82 percent) start with past purchases when placing an online order, according to 210 Analytics research. The longer someone has ordered online, the more likely they start with favorites. This also has great consequences as it results in great loyalty. IRI studied a variety of brands and their share of wallet in store versus online. For each, online loyalty was significantly higher.

The who

210 Analytics’ research shows core online grocery shopper are older Millennials and younger Gen X-ers who tend to be in family-rearing, career-building years. Grocery e-commerce is best developed in urban areas in cities along the two coasts and clustered among high-income households.

Some crystal ball

While online grocery shopping isn’t for everyone, 79 percent of those currently doing curbside pick-up and 73 percent of those ordering groceries for delivery expect they will continue to do so the same amount or even more often post-pandemic.

For the full report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com