A.P. Moller - Maersk had an exceptionally strong start to the year, with strong earnings and growth momentum across all our businesses in ocean, port services and logistics. The company benefitted from strong demand in a market still influenced by the pandemic and significant disruptions in global supply chains.

Strong demand coupled with significant operational challenges such as bottlenecks, lack of capacity and equipment shortage in global supply chains drove freight rates up significantly. At the same time, customers’ demand for truly integrated supply chains and simple, self-service solutions has never been more evident and this provides momentum, especially for logistics and digital solutions.

“A.P. Moller - Maersk delivered an exceptionally strong performance in Q1 2021 with record profit for the quarter. The high growth and profitability were driven by solid demand across Ocean, Logistics and Terminals. Strong demand led to bottlenecks and a lack of capacity and equipment, which drove up freight rates to record-high levels,” says Søren Skou, CEO of A.P. Moller - Maersk, before adding:

“We remain focused on the long-term transformation of A.P. Moller - Maersk, prioritising customers’ demand for integrated logistics. Our integrator strategy was validated by strong customer support during Q1. As we change the conversations with customers from being short-term transactional to becoming long-term value-based, we lay the foundation for further, stable growth.”

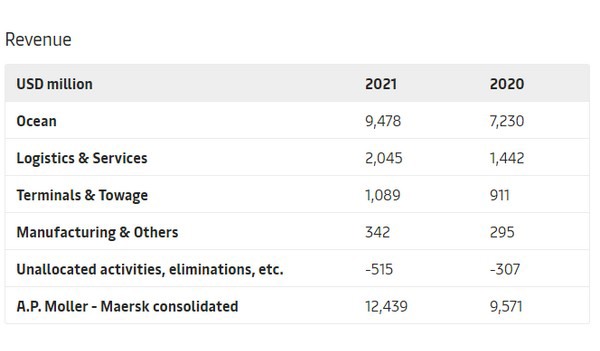

Overall in Q1, EBITDA increased to USD 4bn from USD 1.5bn year on year and EBIT to USD 3.1bn from USD 552m compared to same quarter last year, while revenue improved by 30 pct. to USD 12.4bn. The results reflect the high volumes, which are up 5.7 pct., significant increases in freight rates of 35 pct. and lower bunker fuel prices, leading to an EBITDA in Ocean of USD 3.4bn compared to USD 1.2bn in Q1 2020, and an increase in revenue to USD 9.5bn from USD 7.2bn.

Logistics & Services continued with strong growth momentum and revenue increase of 42 pct. in Q1 to USD 2bn, mainly driven by organic growth, but also with growth from the acquisitions of Performance Team and KGH Customs Services. EBITDA increased by 201 pct. to USD 205m compared to USD 68m, and EBIT increased to USD 139m compared to USD 29m same quarter last year, partly driven by margin expansion.

Also, Gateway Terminals had a strong Q1 performance, with revenue increasing by 24 pct. to USD 915m from USD 740m led by higher volumes and storage income, while EBITDA increased by 52 pct. to USD 323m from USD 213m.

The results came in a persistently difficult environment where countries are still contending with the effects of the pandemic.

For more information:

Signe Wagner

A.P. Moller - Maersk

Tel.: +45 2977 1815

Email: signe.wagner@maersk.com