After being postponed from its usual February date, SEPC Southern Exposure 2021 kicked off this week. Yesterday featured the annual Power of Produce educational session, where Anne-Marie Roerink, President of 210 Analytics, discussed a few of the key point of this annual report which is available through FMI. Roerink was joined by a produce expert reactor panel – Mike Roberts, Director of Produce Operations at Harps Food Stores, Gary Baker, Sr. Director of Fresh Merchants Distributors, and Price Mabry, Director of Produce and Floral at Homeland Stores – who explained how the report’s findings played out in-stores.

From left to right: Anne-Marie Roerink, Mike Roberts, Gary Baker, and Price Mabry.

Main lessons and takeaways

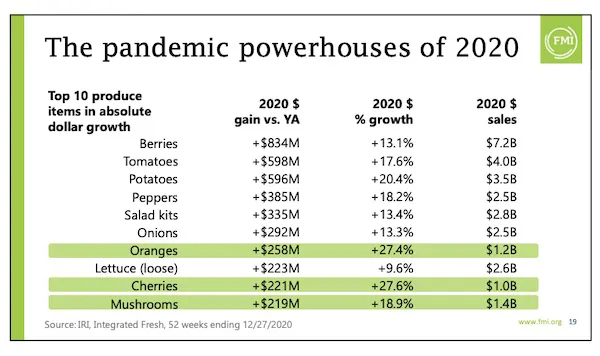

The growth of produce in 2020, as a result of the pandemic, has been a much-discussed topic. Roerink went over a few of the key points: “The total produce category grew by 11.4%, fruit grew by 8.9% and vegetables grew by 14.2%. This discrepancy between fruit and vegetable growth isn’t new and in the past year it can probably be accounted for by the fact that many consumers were cooking at home more and many recipes call for vegetables,” she says, adding: “In the ‘pandemic powerhouse’ products – the top 10 performance growth items – there were a few surprises: oranges, cherries and mushrooms. The oranges gained enormous popularity for their vitamin C content and the mushrooms likely grew because of the increased popularity of beef and home cooking. The growth in the cherry category represents the consumers’ desire for something that’s fun and different, and as a seasonal item cherries are perfect for that.”

The panel explained the main lessons they learned this past year. “The first thing I had to do was realize that I didn’t have all the answers,” says Roberts. “At the start of the pandemic, everyone was in unprecedented territory, and recognizing that, humbling yourself and going from there proved to be the right strategy. Now we have put systems in place to be prepared in the future – such as cross-training employees to bridge staff shortages and putting more emergency plans in place.” Baker adds: “For us, the key was communication with all involved parties. At the beginning, everyone was panicking; retail surged but foodservice disappeared overnight. Having a direct line of communication with them and try to reroute some of that product that no longer had anywhere to go was really helpful. So, communication is key.”

Merchandizing during the pandemic

The amount of produce being sold on promotion was down significantly, says Roerink. “Usually, about 40% of dollars and volume of produce is sold on promotion. In 2020, that was down to 34.3% in vegetables and 25.5% in the fruit category.” Roberts explains: “During the pandemic, we went five months without a circular or ads. The main reason was that it wasn’t what the consumers were looking for at that time. They were getting in and getting out as quick as they could, grabbing only what they needed. Now, we are again looking at new and innovative ways to engage with the consumer.”

One of produce’s main benefits is its visual beauty, and according to Roerink this is something that all retailers should leverage. “We saw some dollars from the fresh category flow into frozen and canned instead. One of the ways we can work on bringing these back is to take advantage of the fact that produce is the only category in the store where you can shop with all your senses: see, smell, feel, and (though not right now) taste. Emphasize that to draw the customers back in.”

Leverage produce's visual beauty in displays.

In the online space, there was, of course, a lot of growth in the past year. A big question for retailers is how to encourage impulse purchases on this platform. “We found a few of the biggest agitators for shoppers who make online orders. Addressing these agitators will help improve sales,” says Roerink. “One of the issues is that it’s hard to estimate weight online, so consumers prefer the products to be priced ‘per each’ rather than per weight. Different varieties are also difficult to find, and it’s hard for them to select products with varying degrees of ripeness like they would in-person.” Baker shares a few of his tips: “Creating excitement for seasonal items has always been a bit of a race for retailers, and this shouldn’t have to change with a switch to an online platform. It can be something that pops up as they’re shopping, or even as pop-up notification on people’s phones.” Mabry adds: “We are working on promoting seasonal items too – right now, we have a countdown on social media for the start of the Vidalia onion season which is always big.”

Health, wellbeing, and organics

The focus on health during the pandemic has grown exponentially, and this can be seen in the consumer shopping behaviors. One of the categories that has seen a lot of growth is organics. “For better or for worse, consumers associate organic products with health – whether it’s their own personal health or the health of the environment,” Roerink says. “We saw double-digit growth in the organic category last year. Simultaneously, however, we did also saw a decrease in the number of people who purchased organic, probably due to the economic pressure caused by the pandemic. So the people who did purchase organics purchased more of it – generally, about 1/3rd of consumers who buy organic products are committed to the category and the rest of the shoppers dip in and out,” she explains.

Retailers focus on all aspects of health, including environmental health.

With regard to the general focus on health, Roerink explains that there are different types of health that the consumer looks for. “It’s not just about ourselves, but also the health of the farmer, the environment, the animals, and more. It’s about the idea that a better you means a better world. So, stores pushing the reduction of food waste, or working to help increase worker fairness is also important to the consumer within this health trend. Still, the idea of personal health is still the most important focus within this trend. So highlighting the specific parts of an individual’s health that will be targeted by a specific produce product will really help push that item,” Roerink concludes.

If you would like to purchase the full Power of Produce report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com