European physical markets

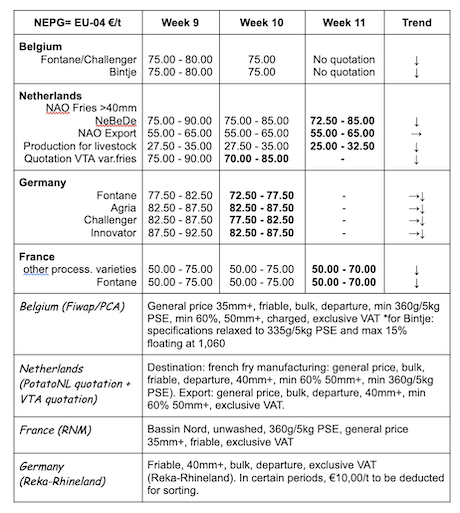

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: calm markets, with a low offer and especially (very) few buyers, from factories or from export.

Bintje, Fontane, Challenger: no quotation due to lack of transactions. We observe mostly interest for purchases for delayed delivery.

Bintje plant: no quotation, end of season.

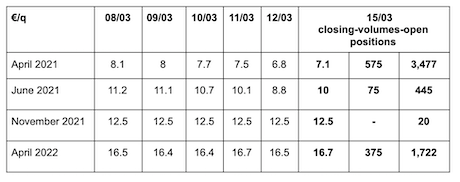

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

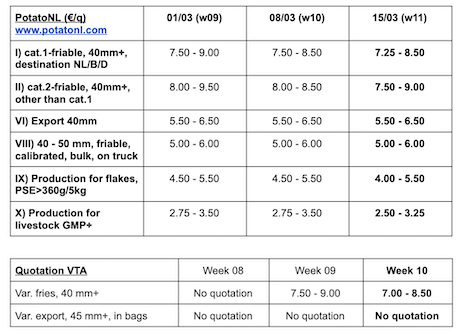

Netherlands

For the industry, prices decreased slightly last week, but the quotations have lost only +/- 0.25 €/q on a not-so-dynamic market. Larger price range depending on variety and quality: from 7.25 to 9.00 €/q for friable varieties for immediate delivery with transactions for delivery in April at 10.00 €/q, and up to 10.50 €/q for delivery in May. Export continues to the usual destinations (Spain, Caribbean, Africa) but the European destinations are missing the most (Eastern countries) such that volumes are deceiving. It is difficult for exporters to buy at the current prices on the export market, which is 5.00 to 6.00 €/q at the producer). The domestic fresh markets are regular with prices under pressure and down, around 12.00 - 18.00 €/q for firm flesh, and 9.00 - 14.00 €/q for soft flesh. In the field, the planting of early potatoes started in the Tholen and Flevoland regions (as well as in Germany (Rhineland-Palatinate), France (Brittany) and Belgium (West Flanders)), but the surface areas are minimal. Large-scale planting of early potatoes for the industry is delayed due to the weather forecast for the coming days. Severe frost in Poland (-10°C) with damage to the first plots planted.

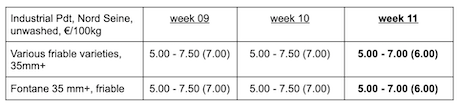

France

The volumes bought on the free market are low, with a supply coming from batches that cannot be kept much longer.

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Germany

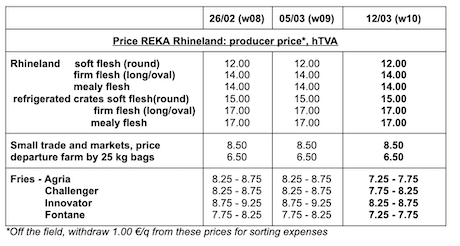

Fresh market (early and semi-early): unchanged prices for firm flesh: 11.00 €/q (11.00 €/q, before last quotation) and also unchanged for soft/mealy flesh: 10.33 €/q (10.33 €/q, before last quotation). But the merchandise from refrigerated crates-pallets is 3€ higher (see REKA prices in table below!). The market is influenced by high offers, especially from Lower Saxony, Germany’s “KartoffelLand” by excellence. Sales at the farm are good, the best batches benefit from the best prices, and the early potatoes from Israel and Egypt are not very present yet in supermarkets. Low demand for peeled potatoes, while shipments to the south and southeast of Europe are difficult due to the competition from neighboring countries.

Slight decrease on the processing market: 8.25 - 8.75 €/q for Innovator (8.75 - 9.25 € last week), as well as for Agria at 8.25 - 8.75 €/q (8.25 - 8.75 €), Challenger at 7.75 - 8.25 €/q (8.25 - 8.75 €), and Fontane at 7.25 - 7.75 €/q (7.75 - 8.25 €/q).

Stable but firm prices for the varieties for crisps/chips: 9.00 to 13.00 €/q.

Organic potatoes: unchanged producer prices at 40.00 €/q (all varieties and markets combined), returned trade. In January, consumers bought 7.4% more organic potatoes than 12 months before. Some supermarket chains decided to continue with German potatoes until May-June, knowing that the quality is and will be the limiting factor. In Bavaria and in the southwest, the first early potatoes have been planted, with protective tarps. Some breeders report an increase in plant sales which could lead to an increase in planting. New surfaces are made available for organic potatoes, on farms that mostly grew cereals up until now.

Great Britain

Average price free markets for the week ending on March 6th: 139.85 £/t (+/- 154 €/t), which is a 7.81 £/t increase (+5.9%). This increase is due to a larger presence of varieties of higher value. The composition of the open purchase sample is more skewed towards this higher variety for this week’s packing markets.

The less restricted economy and the nicer weather are bringing some optimism back. There is hope that the demand can be revived as we approach the end of the 2020/21 campaign. The reopening of schools last week in England stimulated the demand, although limited, on the free market. The entire sector is anticipating the reopening of restaurants, but the demand is still relatively low on the free market, the needs first being covered by contracts.

On the wholesale markets, the friable quality is around 9.35 - 13.20 €/q, and up to 16.50 - 17.60 €/q for the top-quality Agria, Markies or Maris Piper. Obvious interest from the industry for the friable quality, and prices are firm between 8.80 and 14.30 €/q, up to 16.50 €/t for friable Maris Piper for peelers, processing and even export.

For more information:

FIWAP

www.fiwap.be