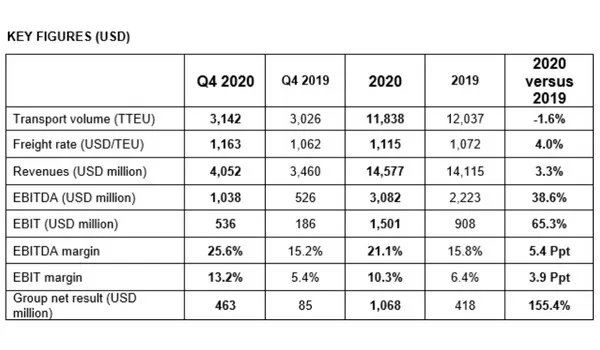

Hapag-Lloyd published its annual report with audited business results for the 2020 financial year today. In the reporting year, Hapag-Lloyd’s earnings before interest, taxes, depreciation and amortisation (EBITDA) increased to more than USD 3 billion (approx. EUR 2.7 billion). Earnings before interest and taxes (EBIT) rose to roughly USD 1.5 billion (approx. EUR 1.3 billion). The Group net result improved to around USD 1.1 billion (EUR 935 million). The main drivers were cost savings of more than USD 500 million (approx. EUR 450 million) as well as slightly improved freight rates and lower bunker prices.

“In 2020, our business was strongly influenced by the coronavirus pandemic. But we took early countermeasures on the cost side and successfully implemented our Performance Safeguarding Program. After transport volumes plummeted in the second quarter, we were able to benefit from unexpectedly strong demand for container transports in the second half of the year. Therefore, we have concluded the year with a much better result than that of 2019, and after the significant improvements achieved in previous years, we have been able to earn our cost of capital for the first time in a decade,” said Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

Revenues increased in the 2020 financial year by around 3 percent, to roughly USD 14.6 billion (approx. EUR 12.8 billion). This is mainly owed to a roughly 4 percent increase in the average freight rate, to 1,115 USD/TEU (2019: 1,072 USD/TEU). The transport volumes at the end of the year were slightly below the level of the previous year, at 11.8 million TEU (2019: 12.0 million TEU) or minus 1.6 percent, but clearly above the level anticipated at the beginning of the pandemic.

In addition, around USD 1.3 billion of financial debt was repaid on balance (excluding IFRS 16) in 2020. The leverage ratio (net debt to EBITDA) decreased to 1.8x and is thereby significantly below the prior-year level of 3.0x.

In light of this very successful financial year, the Executive Board and Supervisory Board of Hapag-Lloyd AG have decided to propose to the Annual General Meeting that a dividend of EUR 3.50 per share be paid out for the 2020 financial year.

Looking ahead, Hapag-Lloyd expects that the EBITDA and EBIT for the 2021 financial year will clearly surpass the prior-year level. This is based on the assumptions that the transport volume can be slightly increased and the average freight rate significantly increased compared to the previous year. Moreover, a significant increase in the average bunker consumption price is anticipated.

Looking ahead, Hapag-Lloyd expects that the EBITDA and EBIT for the 2021 financial year will clearly surpass the prior-year level. This is based on the assumptions that the transport volume can be slightly increased and the average freight rate significantly increased compared to the previous year. Moreover, a significant increase in the average bunker consumption price is anticipated.

Click here to view the full press release.

For more information:

Hapa g-Lloyd AG

g-Lloyd AG

Ballindamm 25

20095 Hamburg

Tel.: +49 40 3001 – 2529

E-mail: presse@hlag.com

E-mail: Nils.Haupt@hlag.com

Tel.: +49 40 3001 - 2263

E-mail: Tim.Seifert@hlag.com

Tel.: +49 40 3001 – 2291