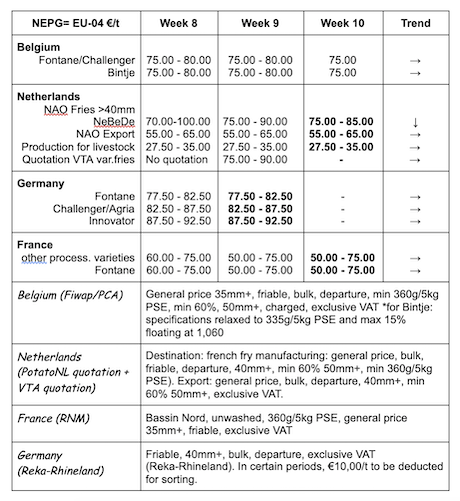

European physical markets

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: the market is not very lively, with some supply and limited demand. Very little export trade observed: Eastern countries have certain needs but do not place orders due to the current prices.

Bintje, Fontane, Challenger: mostly 7.50 €/q. Calm markets; slightly higher prices (up to 8.00 €/q) for fresh friable varieties (Bintje, but also Challenger).

Innovator: 8.00 €/q (generally excess contracted tons)

For delayed delivery in May-June, firm offers between 13.00 and 14.00 €/q, mostly for Fontane.

Bintje plant: trade is ending. Prices remain firm. Small calibers are difficult to find (almost no offer). Dutch/French/Belgian plant, class A, returned March 2021, by 10 tons, in big-bags excl.VAT; supply completed with Danish plant.

Caliber 28 - 35 mm: between 100 and 110 €/q, very disparate prices due to the very low availability.

Caliber 35 - 45 mm: 60.00 - 70.00 €/q, firm prices.

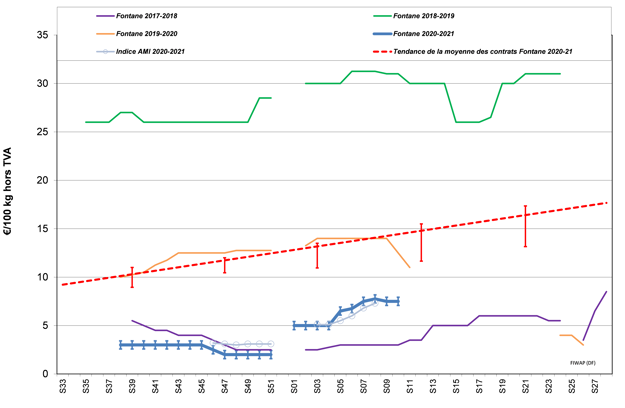

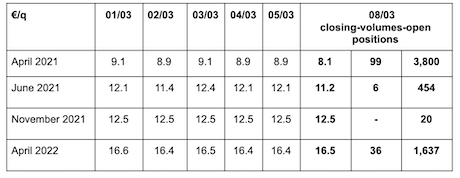

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

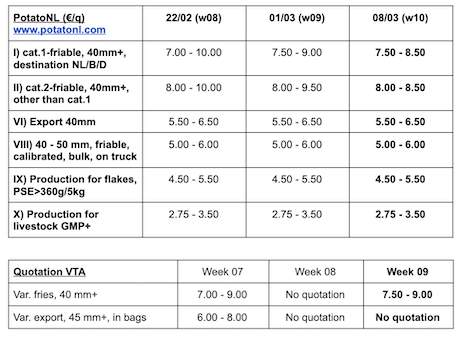

Netherlands

For the industry, prices stopped increasing last week with the withdrawal of most buyers (industry, trade and even producers, to complete the missing volumes under contract). The market conditions have not really changed however, but there is no new impulse while work has started in the field. The weather this week may calm things down. Factories continue to focus on signing 2021/2022 contracts because not everything is signed yet. Export is not revived yet: regular volumes leave for the Caribbean and Africa, and some for Spain and Portugal, nothing else. Eastern countries and Ukraine also place orders but at very questionable prices.

France

Prices have recovered since last week in France after 2 weeks of decline compared to the other national quotations. The demand came from the industry, but also from trade and from producers still looking for volumes to replace contracts. Prices observed between 7.00 and 7.50 €/q, and up to 10.00 €/q for delayed delivery. Many manufacturers seem to have difficulty finding the 2021/2022 contract volumes.

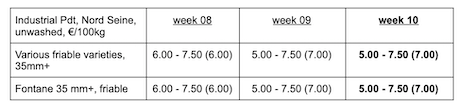

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Germany

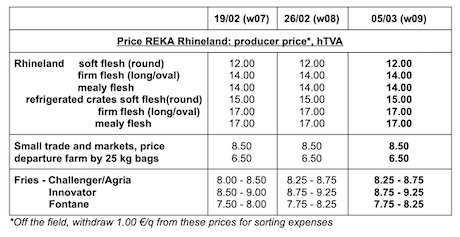

Fresh market (early and semi-early): slightly higher prices for firm flesh: 11.00 €/q (10.83 €/q, before last quotation) and also higher for soft/mealy flesh: 10.33 €/q (10.25 €/q, before last quotation). But the merchandise from refrigerated crates-pallets is 3€ higher (see REKA prices in table below!).

Processing market: firm but unchanged market: 8.75 - 9.25 €/q for Innovator (8.75 - 9.25 € last week), 8.25 - 8.75 €/q for Challenger/Agria (8.25 - 8.75 € last week), and 7.75 - 8.25 €/q for Fontane (7.75 - 8.25 € last week). Stable high prices for the crisps varieties: 9.00 to 13.00 €/q.

Organic potatoes: unchanged producer prices around 40.00 €/q (all varieties and markets combined), returned trade.

In the fields: the nice weather has finally allowed for good progress in planting (early potatoes pre-germinated and under tarp) in the main early regions. These crops are mostly for the fresh market, but also partly for the crisps/chips productions to be delivered in July.

For more information:

FIWAP

www.fiwap.be