Calavo Growers, Inc., a global avocado grower and marketer as well as provider of value-added fresh food, reported its financial results for the first quarter ended January 31, 2021.

- First Quarter Highlights

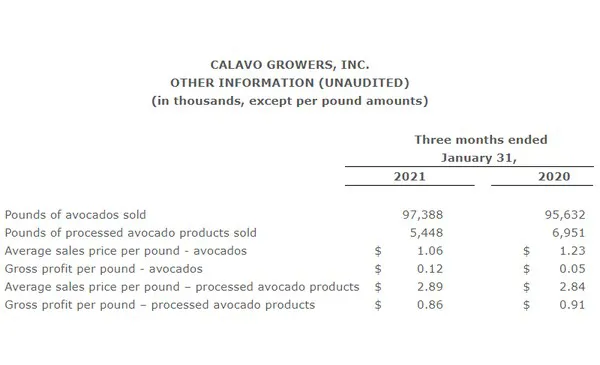

Total revenue of $220.6 million, a 19% decrease year over year, reflecting 2% growth in avocado volume offset by lower avocado prices and lower revenue in the Renaissance Food Group (“RFG”) and Foods segments. - Gross profit of $17.8 million, or 8.1% of revenue, compared to $15.8 million, or 5.8% of revenue, for the comparable period last year. The increase in gross profit margin percentage was attributable to improvements in the Fresh segment.

- Net income of $5.3 million, or $0.30 per diluted share, compared to net loss of $0.9 million, or ($0.05) per diluted share for the comparable period last year. Adjusted net income was $3.0 million, or $0.17 per diluted share, compared to $0.8 million, or $0.04 per share last year.

- Adjusted EBITDA of $9.4 million, compared to $4.5 million for the same period last year.

- Renewed credit agreement adding $20 million of availability and five years to its term. The facility is now a $100 million, syndicated senior unsecured revolving credit facility (with a total facility size of $150 million when including the exercise of its $50 million accordion feature).

- Paid $1.15 per share dividend ($20.3 million in total), which is an increase of 4.5% over prior year and is the 9th consecutive year of increasing dividends, and representing an approximate 1.5% yield to Calavo’s shareholders.

Management Commentary

“Our first quarter results reflect a continuation of trends that we experienced in the fourth quarter of last year,” said James E. Gibson, CEO of Calavo Growers. “Market demand for avocados is increasing, albeit at a slower pace due to the pandemic, and supply remains plentiful, given the strong crop out of Mexico. These dynamics weighed on prices, which on average, were down 14% year-over-year. However, we delivered higher avocado gross margins in the quarter, as we did a good job of managing our pricing spread and sales mix.

“Our RFG segment was impacted by a number of factors, including industry-wide delivery delays at most U.S. ports due to the implementation of additional safety measures related to the pandemic, which caused increased spoilage of fresh fruit and vegetables. In addition, we continued to be impacted comparatively by the closure in April 2020 of our Midwest co-packing partner. Our Foods segment continued to be adversely affected by lower foodservice demand resulting from the pandemic, offset slightly by favorable input commodity prices.

Click here to view the full Press Release.

For more information:

Calavo Growe rs, Inc.

rs, Inc.

1141A Cummings Road

Santa Paula, CA 93060

Tel.: +1 (805) 525-1245

E-mail: GrowerInfo@calavo.com