“We continue to demonstrate that our unique strategic model of integrating with customers to create long-term, sustainable and stable relationships inherently secures stable growth in sales and profitability. Over the past two years, we have been able to accelerate the rollout of this strategy thanks to further professionalisation of the group. This professionalisation has equally facilitated economies of scale, best practices, and efficiency gains across both segments”. said Hein Deprez, co-CEO of Greenyard.

“Over the past two years, our focus has been to develop Greenyard for the next phase of its existence. The key words are resilience, agility and continued professional governance. With a management team committed for the long-term this will lead to solid and sustainable growth involving all stakeholders in the supply chain.” Marc Zwaaneveld, co-CEO stated.

Continuing positive results reflected in solid Q3 performance

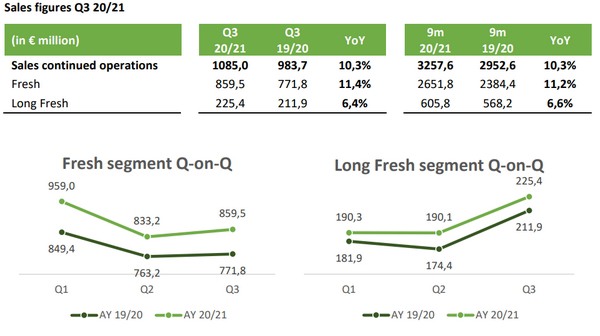

Sales increase: The positive sales results continued their pace in the third quarter of the financial year, resulting in a +10,3% year-on-year sales increase, both for the quarter and for the first nine months of the year.

Fresh: Fresh segment sales increased in Q3 by +11,4% versus Q3 of the previous financial year and by +11,2% for the first nine months of the financial year versus the same period of the previous financial year. The sales increase was predominantly driven by higher volumes arising from the long-term relationship.

Long Fresh: Long Fresh segment sales increased in Q3 by +6,4% versus Q3 of the previous financial year and by +6,6% for the first nine months of the financial year versus the same period of the previous financial year. Higher sales in the retail and food industry more than offset lower in food service sales.

Underpinning full year guidance

Based on the continued positive performance and on currently available information and forecasts, Greenyard reconfirms its previous adjusted EBITDA guidance of € 106m - 110m and expects to land at the upper end of that range for the full financial year 2020/2021.

The expectation of reaching the upper end of the range and improvement of cash generation driving down net financial debt, would also allow the company to further deleverage towards 3,5x net financial debt/adjusted EBITDA (before application of IFRS 16) by the end of financial year 2020/2021. The lower leverage takes into account a further decrease in nominal debt, among others by the repayment of the accordion debt, granted by its relationship banks in June 2019.

A basis for new long-term ambitions

After focusing on the Transformation Plan (as announced in the 15 March 2019 press release “Greenyard announces its Transformation Plan unlocking large untapped potential for a healthy future”), Greenyard is turning the page with revised long-term ambitions as set out in this section. These ambitions are based on current estimates, projections and assumptions.

An organic growth trajectory in both the Fresh and Long Fresh segment set out by Greenyard’s management, is the basis for a revised and ambitious plan for the next four years.

Greenyard’s ambition is to further increase its group sales, with an expected long-term CAGR of 2,5% over the coming four-year period.

Greenyard estimates the group’s adjusted EBITDA for the next financial year, ending March 2022, to increase towards € 120m. By the end of the financial year 2024/2025, Greenyard’s ambition is to grow the adjusted EBITDA towards € 150m, with a resulting adjusted EBITDA margin target of around 3,0%. In addition, this margin is considered to be more stable thanks to the higher proportion of sales in long-term contracted relationships.

Greenyard is aiming for an annual run-rate CAPEX over the next four years of between € 60m and € 65m, to structurally develop Greenyard’s asset base to execute and deliver on its ambitions.

For more information:

For more information:

Dennis Duinslaeger

Greenyard

Tel: +32 15 32 42 49

Email: Dennis.duinslaeger@greenyard.group

www.greenyard.group