European physical markets

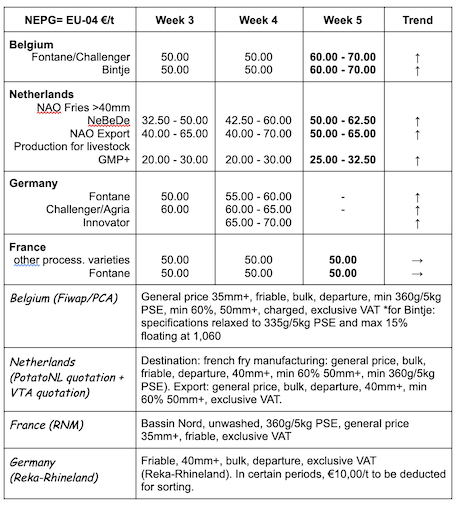

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: the direct needs of the factories remain low, but some are buying. The markets are more dynamic than in the previous weeks thanks to the demand for potatoes to complete the shortage of contracted volumes. The offer is low, which encourages buyers to offer higher prices.

Bintje, Fontane, Challenger: 6.00 to 7.00 €/q, with the highest prices charged to complete contracts. Firm markets.

Fresh market: the sales level in supermarkets stays good during this period of partial lockdown, which helps keep the December prices.

Firm flesh: top quality Charlotte and Nicola are difficult to find due to the low initial yields, high PSE and/or Yntn virus problems (Nicola). Firm prices for the highest quality at about 25 - 30 €/q, and 20 - 25 €/q for the lesser quality. For the other firm flesh varieties, the supply is reduced and prices are stable, between 18 and 25 €/q, depending on the quality (washability, hits, firmness when cooked).

Soft and mealy flesh: preparers remain demanding when it comes to defects (blue spots) and excessive PSE, so not all batches are suitable. The supply for the washable quality is not excessive and prices are stable between 10 and 15 €/q at the producer.

Bintje plant: little trade, but firm prices. The small calibers are difficult to find (almost no offer). Dutch/French/Belgian plant, class A, returned March 2021, by 10 tons, in big-bags, excl.VAT:

Caliber 28 - 35 mm: temporarily not quoted due to lack of offer;

Caliber 35 - 45 mm: 52.00 to 53.00 €/q, firm prices.

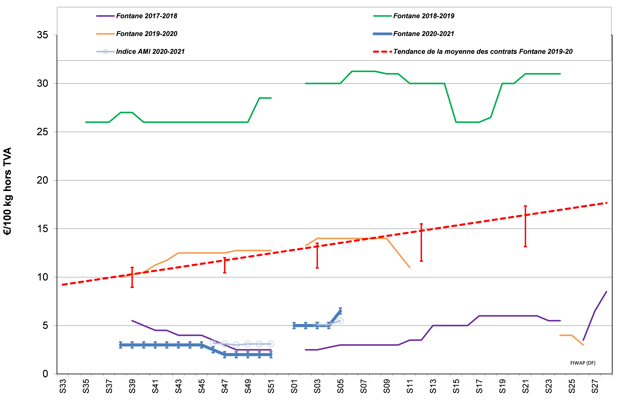

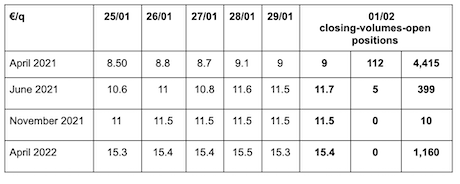

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

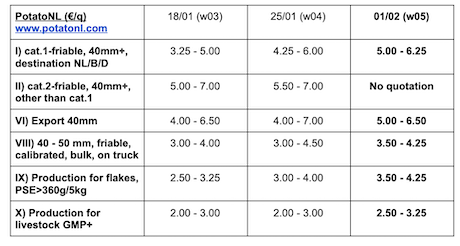

Netherlands

For the industry, the higher prices follow the trend observed in Belgium and in Germany. Some transactions between 5.00 and 6.00 €/q for immediate delivery reported last week for Fontane/Challenger. Some purchase offers for delayed delivery at 7.00 €/q for February, 8.50 €/q for the end of April, and 9.00 to 10.00 €/q for May and June. Innovator benefits from an additional euro. The domestic fresh markets are doing well thanks to the good retail sales, and prices are maintained. Export, however, is lacking volumes, which keeps the producer prices at a low level (4.00 to 6.50 €/q). Spain and Portugal are still interested, while Ukraine is getting some information without really buying.

France

Processing market: some purchases to replace the shortage of contracted volumes (at the producer directly or via intermediate trade). Not a lot of delays in the removal of contracts, which indicates that factories are working well. Most factories are buying on a basis of 5.00 €/q (all varieties), but some transactions at higher prices (6.00 €/q) were also reported. In export, the markets are (too) calm. The activity is slower to Spain, Portugal and Eastern Europe where the closure of restaurants weighs heavily on the market of non-washable potatoes.

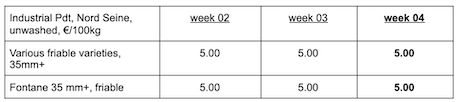

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Industrial activity (source: GIPT): French factories worked 565,000 tons from July until the end of December 2020, which is 9.6% more than in 2019. The decrease varies depending on the month, with only -3% in November, but -26% in December.

Germany

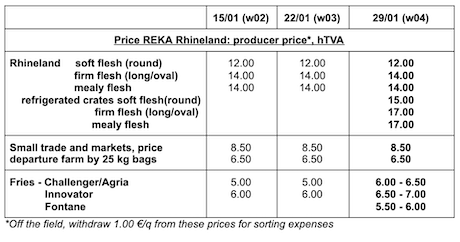

Fresh market (early and semi-early): unchanged prices for firm flesh: 10.83 €/q (10.83 €/q, before last quotation) and also unchanged for soft/mealy flesh: 10.25 €/q (10.25 €/q, before last quotation). The increase for the refrigerated crates is already visible in the REKA quotations (table below). In the southwest of the country (Saarland, Baden-Württemberg), the French origins are increasing, as they do each year in the middle of the winter.

Processing market: firm market and higher prices: 6.50 - 7.00 €/q for Innovator (6.00 €/q last week), as well as for Challenger/Agria at 6.00 - 6.50 €/q (5.00 last week), and for Fontane at 5.50 - 6.00 €/q. Some higher prices for the “Spitzenqualität” with a higher range for Innovator at 8.50 and for Agria/Fontane at 7.00 €/qt! Prices are up after the “disappearance” of the batches used for flakes, biogas and livestock in recent months. Firm price for the crisps varieties, between 7.00 and 11.00 €/q.

Organic potatoes: unchanged producer prices around 41.00 €/q (all varieties and markets combined), returned trade. Expected increase...

For more information:

FIWAP

www.fiwap.be