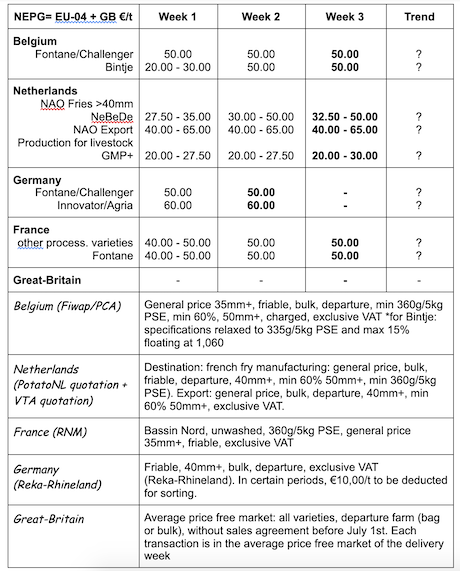

European physical markets

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

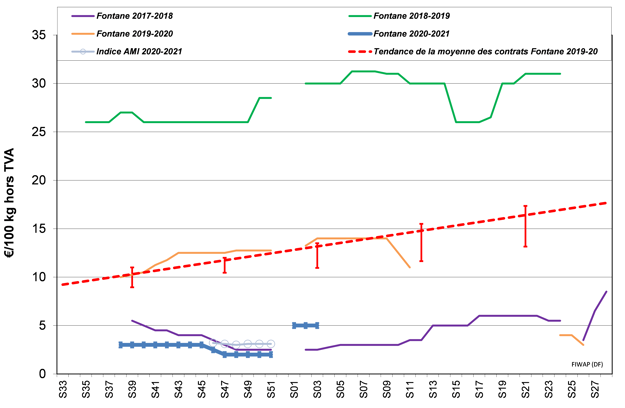

Potatoes for processing: several factories are still buying actively on the market for a global demand of small volume, with an offer also limited by the low prices. The market trend is stable.

Bintje: 5.00 €/q

Fontane, Challenger: 5.00 €/q.

For the 3 varieties, some formal purchase proposals and transactions at higher prices are still observed for immediate delivery.

Bintje plant: little trade, but prices are firm. The small calibers are difficult to find (almost no offer). Dutch/French/Belgian plant, class A, returned March 2021, by 10 tons, in big-bags excl.VAT:

Caliber 28-35 mm: around 70.00 €/q;

Caliber 35-45 mm: around 45.00 €/q

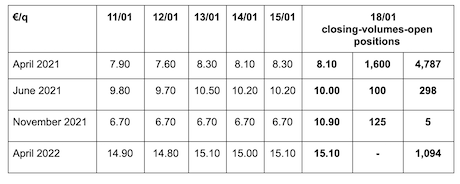

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

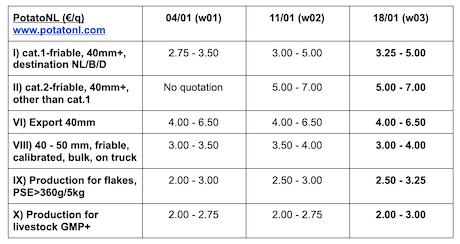

Netherlands

The increase in prices is confirmed, and the atmosphere on the market is improving under the influence of a better demand. It is evident that during the first part of the season, the offer and the demand remained very weak, and the volumes marketed at very low prices mostly supplied the livestock, flake, biogas and starch markets. Since the New Year, the factories’ interest for the free market has brought prices to 5.00 - 6.00 €/q, which is hampering these alternative outlets. Will the upward trend last? Nothing is certain given the constant uncertainties related to the Covid-19 pandemic, but factories seem to be counting on a revival of the demand for finished products in 2021. The current period is also crucial for the 2021 surface areas. The Dutch contracts are not out yet, and the price lists will determine the final decisions to be made. On the fresh markets, trade is proceeding very well, with a stronger consumption due to the lockdown. Producer prices remain firm, between 10.00 and 14.00 €/q for soft flesh varieties, and between 13.00 and 18.00 €/q for the firm flesh varieties. Export remains slow, around 4.00 to 7.00 €/q at the producer, and 8.00 to 12.00 €/q, sorted calibrated and packed for departure.

France

Processing market: purchases were less sustained last week, and the resumption of activities varies depending on the factories, probably influenced by the stricter lockdown and curfew measures. The price base is at 5.00 €/q, with purchases via intermediate trade at 6.00 €/q, while there sometimes is a lack of offer for some contracted varieties. On the fresh markets, the demand remains high for the red varieties, while the white varieties benefit from some revival. Prices are generally stable, or slightly up. Export is turned to Spain, Italy and Romania, with some transport disruptions last week due to the snow.

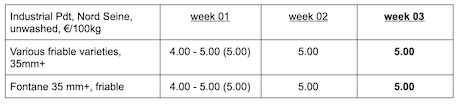

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

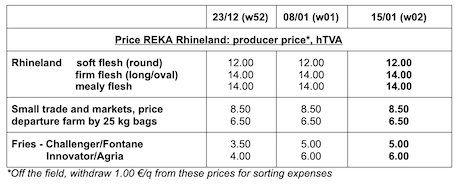

Germany

Fresh market (early and semi-early): unchanged prices for firm flesh: 10.83 €/q (10.83 €/q before last quotation) and also unchanged for soft/mealy flesh: 10.25 €/q (10.17 €/q before last quotation). The market is more calm, which is usually the case after the holidays. Supermarkets are running promotional actions to increase their sales. On the other hand, sales at the farm are down. After the crisis, peelers are celebrating, although hospitals and retirement homes remain their main and good clients. At the beginning of February, storage in crates will begin to take over from bulk storage. With the high level of defects and the costs of antigerminatives, the profitability on the fresh market is becoming limited, while producer prices are decreased less than on the processing market.

Processing market: firm market and stable prices: 6.00 €/q for Innovator/Agria (6.00 €/q last week), as well as for Challenger/Fontane at 5.00 €/q (5.00 €/q last week). Despite the higher number of defects and batches going to livestock, biogas, flakes.., prices remain stable. Firm prices and slightly up for the crisps varieties. Between 6.00 and 10.00 €/q.

Export: shipments reported to the Czech Republic and Romania.

Early potatoes 2021: after a difficult 2020 season for early potatoes (damage from frost, average yields, no free market for the excess tons…), producers are reluctant to sow as much as last year. Some “potato” fields could be used for corn and vegetables. It is extremely difficult to know how the market will be in 6 months, but trade seems to show a certain nervousness about the volumes early in the campaign.

Organic potatoes: unchanged producer prices around 41.00 €/q (all varieties and markets combined), returned trade. Organic consumption was up in October (+13%) and in November (+22%) 2020, compared to October and November 2019. This increase in sales does not translate yet into higher producer prices. The sector, especially the producers, are quite confident that prices should increase in the coming weeks/months. Despite the initial 2020 harvest higher than in 2019, there is a higher number of defects and the net volumes paid will be lower (than in 2019). The second lockdown has stimulated purchases from households, especially for organic products.

Great Britain

Fresh markets: a slow start of the month for trade on the free market. Packers continue to meet the demand, mostly under contract, which is not unusual for the month of January, but seems more pronounced than usual. With the stricter sanitary restrictions all over the United Kingdom, trade for fries is described as a ‘day-by-day’ trade, because the uncertainty of a political change makes planning very difficult.

Trade for the processing industry is described as slow this week, with factories working at a lower capacity and excess contract supply over requirements in many cases. With the closure of schools and their canteens, there seems to be little hope to see the demand change until restrictions are eased.

The sales of finished products to retailers will probably remain solid as they have been throughout the pandemic, but it is unlikely that it will make up for the losses from the other sources. The average prices observed last week on a more narrow sample, showed Maris Piper at 8.00 £/q (+/- 8.80 €/q) and the white varieties at 4.30 £/q (+/- 4.75 €/q).

For more information:

FIWAP

www.fiwap.be