Lamb Weston Holdings, Inc. announced its fiscal second quarter 2021 results and provided a business update for the third quarter of fiscal 2021.

“We delivered solid financial results in the quarter, and we remain encouraged by the resiliency of consumer demand and the resourcefulness of our employees and our customers in adapting to this challenging environment,” said Tom Werner, President and CEO.

“We are optimistic that the availability of COVID-19 vaccines will enable a gradual return to normalcy as the year progresses, but we expect to continue to face difficult and volatile operating conditions until the virus is broadly contained. Specifically, we expect demand will remain soft in the coming months, especially at full-service restaurants, as governments continue to impose broad social restrictions and as colder weather limits outdoor dining. That said, we expect demand at quick service restaurants and at retail outlets to offset some of that weakness.”

“Despite these near-term pressures, we believe that restaurant traffic may approach pre-pandemic levels later this calendar year if vaccines and other measures are successful in helping to broadly contain the virus and restrictions on restaurants and other venues are lifted to permit a large-scale return to on-premise dining. In the meantime, our business fundamentals – pricing, capacity utilization, and potato supply – remain solid, and we continue to manage through the pandemic’s impacts on our manufacturing operations. We believe our recently announced increase in our quarterly dividend and the planned resumption of our share repurchase program reinforce our conviction in the long-term strength of the category and our business, as well as our ability to support customers and create value for our stakeholders.”

Q2 2021 Commentary

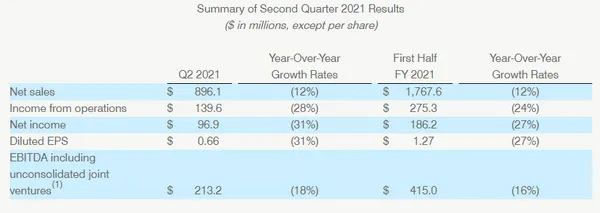

Net sales declined $123.1 million to $896.1 million, down 12 percent versus the prior year quarter. Volume declined 14 percent, predominantly reflecting decreased demand for frozen potato products outside the home following government-imposed restrictions on restaurants and other foodservice operations to slow the spread of the COVID-19 virus, as well as the effect of colder weather, which limited outdoor dining traffic across many U.S. markets. In addition, the volume decline reflected the benefit of additional shipping days related to the timing of the Thanksgiving holiday in the prior year quarter. Price/mix increased 2 percent, driven by improved price in the Foodservice and Retail segments, and favorable mix in the Retail segment.

Income from operations declined $53.9 million, or 28 percent, to $139.6 million versus the year-ago period, reflecting lower sales and gross profit. Gross profit declined $61.6 million, driven by lower sales and higher manufacturing costs, which were largely due to incremental costs resulting from the pandemic’s effect on the Company’s manufacturing and supply chain operations, costs related to processing raw potatoes out of storage longer than in prior years, and input cost inflation. The decline was partially offset by a $1.2 million change in unrealized mark-to-market adjustments associated with commodity hedging contracts, which includes a $5.1 million gain in the current quarter, compared with a $3.9 million gain related to these items in the prior year quarter.

Selling, general and administrative expenses (“SG&A”) declined $7.7 million, largely due to lower incentive compensation expense accruals and a $3.5 million reduction in advertising and promotional expenses. The decline in SG&A was partially offset by investments to improve the Company’s operations and information technology infrastructure, which included approximately $5 million of non-recurring expenses (primarily consulting and employee training expenses) associated with implementing the first phase of a new enterprise resource planning (“ERP”) system.

Net income declined $43.5 million to $96.9 million, primarily reflecting a decline in income from operations, partially offset by an increase in equity method investment earnings. The decline also includes $4.6 million of higher interest expense, which reflects an increase in average total debt resulting from the Company’s actions to enhance its liquidity position, as well as the write-off of $1.0 million of debt issuance costs related to paying off a term loan facility that was due in November 2021.

Diluted EPS decreased $0.29 to $0.66, primarily reflecting a decline in income from operations and higher interest expense, partially offset by an increase in equity method investment earnings.

EBITDA including unconsolidated joint ventures(1) declined $47.7 million to $213.2 million, down 18 percent versus the prior year period, as a result of a decline in income from operations, partially offset by an increase in equity method investment earnings.

The Company’s effective tax rate(2) in the second quarter of fiscal 2021 was 24.8 percent, versus 23.3 percent in the prior year period. The effective tax rate varies from the U.S. statutory tax rate of 21 percent principally due to the impact of U.S. state taxes, foreign taxes, permanent differences, and discrete items.

For the full financial report, please click here.