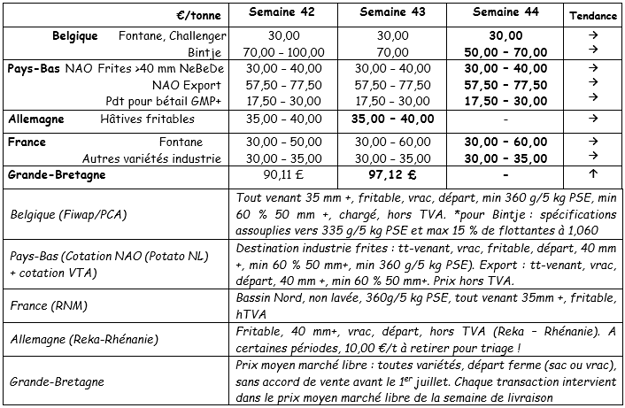

European physical markets

Price report (source: NEPG):

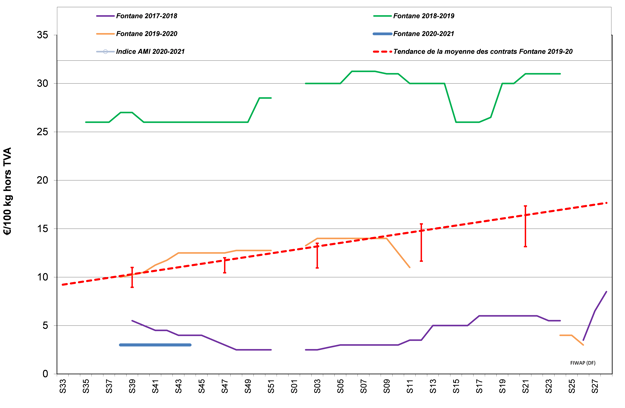

Belgium

Fiwap / PCA Markets Report:

Industrial potatoes: Anti-COVID-19 measures reduce the demand (except for french fries) and increase uncertainty in the short and medium term. The overall demand remains almost inactive (some industrial buyers have withdrawn from the market). The supply is sufficient with the harvests in progress, despite the difficulties to carry them out. Exports are very limited.

Fontane, Challenger: mainly € 3.00 / q, quiet market; very few transactions in an inactive market due to lack of demand.

Bintje: from € 5.00 to € 7.00 / q depending on the size; demand for peeling reduced due to the closure of hotels, restaurants and cafes. However, fryers continue to do well.

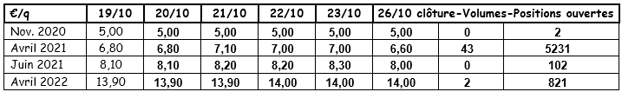

Futures market

EEX in Leipzig (€ / q) Bintje, Agria and varieties intended for processing, 40 mm+, min. 60% 50mm +:

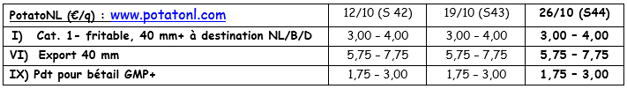

The Netherlands

Prices are not changing; the supply that leaves the fields is enough to cover the little or no needs of the industry in the free market. Surplus tons are paid for at the quoted prices. In the domestic market for fresh products, the closure of hotels, restaurants and cafeterias is taking a toll on sales, while trade through large retailers is still good and prices quite stable, with € 10.00-12.00 / q for the varieties with a soft flesh, and € 16.00-22.00 / q for those with a firm flesh. Exporters have been able to maintain a good flow with Africa and the Caribbean, while intra-European trade remains slow. Prices are falling down to 5.50-8.00 for the producer, depending on the variety and quality.

In the field, the harvests are moving forward at a good pace. But in places where it has rained more than 200mm since September 25 it may still be necessary to wait, or the harvests are developing very slowly. It is estimated that 75 to 80% of the national harvest has already been completed. The regions where the completion level is lowest are the Southwest (50-60%), West Brabant (70%) and Northwest of the country (65%).

France

Announcements are expected to be made by the authorities regarding health measures, so the global market has been waiting to see what's going to happen. An increasing number of buyers may appear, but the trade volume is constant at best. The free market is non-existent and there are difficulties in the delivery of some contracts, which could within a few weeks lead to conservation issues for the batches concerned. Some manufacturers report a temporary stoppage of processing lines. Among the finished products, those intended for take-out are meeting the growing consumer demand, but account only for a small share of the processing market. In this context, prices are stable, and only a few lots for peelers or even a few batches of superior quality manage to rise above average prices.

In the fields, the calm weather has allowed the large-scale resumption of the harvesting. The supply to processors remains tight. Prices above quotations (5.00 - 6.00 € / q) have been paid for the immediate delivery of specific batches.

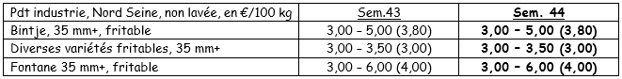

Unwashed industrial potatoes for export, excl.VAT, North Seine, € / qt, min - max (avg) (RNM):

Slower factory activity (source: GIPT): French factories processed 281,000 tons from July to September. This volume is down by 7.2% compared to last year, ie - 21,000 tons. Almost 77% of this supply was carried out under contract.

Germany

While the harvest of varieties for the fresh market is almost finished, and the supply has little weight on the market, the sector is affected by uncertainty. Will the return of the pandemic stimulate purchases of "the good old potato", or will the market decline following the re-closure of the restaurant and hotel industry? In any case, consumption in September was not good, with an "increase" of just 0.2% compared to September 2019. It is also reported that the quality problems already reported are only getting worse, thus widening the gap between the gross harvest and the net paid one. On the industrial market, the harvest is developing more or less quickly depending on the region, type of soil and amount of rainfall.

In August (compared to August 2019), there was an increase of potato shipments to the Benelux (with 4% more to the Netherlands and 61% more to Belgium!) Because of early contracts with the industry, fresh shipments to Italy and Poland fell by 20%, those to the Czech Republic by 40%, and those to Romania and Austria by 56%.

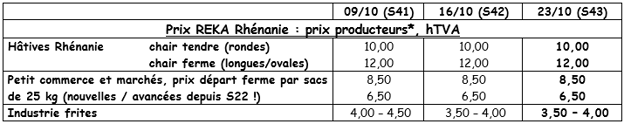

At the time of shipment from the field, € 1.00 / q must be subtracted from the prices for selection expenses

At the time of shipment from the field, € 1.00 / q must be subtracted from the prices for selection expenses

Fresh market (early and mid-early): the price of both firm fleshed potatoes, which cost € 10.83 / q (€ 10.83 / q last week), and soft/floury ones, with € 10.08 / q (10.08 € / q last week) remains unchanged. Supermarkets sales are good thanks to the autumn weather.

Processing market (mid-early / industrial conservation): unchanged market: 3.50 - 4.00 € / q. The industry is mainly focused on its contracts. Organic potatoes: producer prices amount to around €41.00 / q (all varieties and markets combined).

UK

Most markets are quiet. For packaging, interested buyers find the supply coming from the field insufficient, but the demand goes away as soon as the lot has some defects, and the conditions remain difficult for the harvest. Prices oscillate from £ 80-130 / t to £ 170-180 / t for red varieties or Maris Piper. As for the industry, everything is standing still, with a very low demand and just a few transactions at prices ranging from £ 70 - 90 / ton to £ 140 - 150 / t for the best quality Markies, Agria or Ramos. Exports to the Canary Islands continue at a better level than previously expected.

For more information:

FIWAP

www.fiwap.be