Fresh Del Monte Produce Inc. reported financial results for the third quarter ended September 25, 2020. The Company reported net income per diluted share of $0.37 for the third quarter of 2020, compared with net income per diluted share of $0.38 in the third quarter of 2019. Adjusted net income per diluted share was $0.35 in the third quarter of 2020, compared with adjusted net income per diluted share of $0.38 in the third quarter of 2019.

The Company's Board of Directors declared a quarterly cash dividend of ten cents $(0.10) per share, payable on December 4, 2020 to shareholders of record on November 11, 2020. This is an increase of five cents $(0.05) per share from the quarterly cash dividend of five cents $(0.05) per share paid on September 4, 2020.

“We were especially pleased to see an improvement in our fresh and value-added products business segment, through rapid adjustments to all aspects of our business, from farm to customer to meet the challenges caused by the pandemic disruption, particularly to adapt to the restaurant and foodservice markets during the third quarter, said Mohammad Abu-Ghazaleh, Chairman and Chief Executive Officer. "Swift implementation of working capital measures led to improved cash flow and our ability to reduce our debt. As a result we will double our dividends in the fourth quarter of 2020. We also continued to take every precaution to ensure the health and safety of our team members and their families allowing us to maintain the necessary workforce to continue to provide uninterrupted healthy, safe, and convenient products to our customers."

Mr. Abu-Ghazaleh added, "During the quarter, as part of our recently announced optimization program, we underwent a comprehensive review of all aspects of our business. We made the decision to sell non-strategic and under-utilized assets for a total anticipated cash amount of approximately $100 million, which we expect to achieve over the next 12 to 18 months. These assets consist primarily of underutilized facilities and land across multiple regions. In the meantime, we remain aggressively focused on optimizing our current cost structure, improving our profitability, and prioritizing our capital investments.”

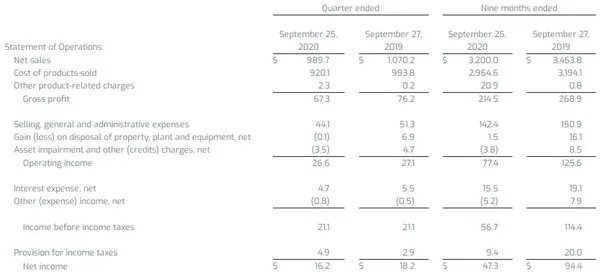

Net sales for the third quarter of 2020 were $989.7 million, compared with $1,070.2 million in the third quarter of 2019. The decrease in net sales of $80.5 million was attributable to lower net sales in all of the Company's business segments. The COVID-19 pandemic impacted net sales during the third quarter by an estimated $73.0 million, in the Company's fresh and value-added products and banana business segments, as compared with the Company's third quarter of 2019 performance for these segments. The estimated impact in net sales is primarily attributable to volatile supply and demand conditions resulting from the pandemic, as well as reduced demand in the Company's foodservice business and shifting demand at retail, as a result of continued government imposed mandatory restrictions and social distancing initiatives associated with the pandemic.

Gross profit for the third quarter of 2020 was $67.3 million, compared with $76.2 million in the third quarter of 2019. Adjusted gross profit in the third quarter of 2020 was $69.1 million, compared with $76.4 million in the third quarter of 2019. The decrease in gross profit was principally due to lower gross profit in the Company's banana and other products and services business segments, partially offset by higher gross profit in the Company's fresh and value-added products segment. Gross profit was also impacted by incremental costs, mainly related to other product-related charges of $2.3 million. These charges primarily consist of inventory write-offs due to volatile supply and demand conditions caused by the COVID-19 pandemic as well as incremental costs incurred for cleaning and social distancing protocols, also associated with the pandemic.

Operating income for the third quarter of 2020 was $26.6 million, compared with operating income of $27.1 million in the third quarter of 2019. Adjusted operating income was $25.3 million in the third quarter of 2020, compared with adjusted operating income of $25.1 million in the third quarter of 2019. The slight decrease in operating income was partially offset by lower selling, general and administrative expenses and lower asset impairment and other charges, net.

Net income attributable to Fresh Del Monte Produce Inc. for the third quarter of 2020 was $17.4 million, compared with net income attributable to Fresh Del Monte Produce Inc. of $18.1 million in the third quarter of 2019. Adjusted net income was $16.4 million in the third quarter of 2020, compared with adjusted net income of $18.3 million in the third quarter of 2019. The decrease was primarily the result of lower operating income and higher provision for income taxes, partially offset by lower interest expense.

More disclosures related to the COVID-19 pandemic and optimization program are available in the Company's Securities and Exchange Commission filings.

For the full financial report, please click here.