European physical markets

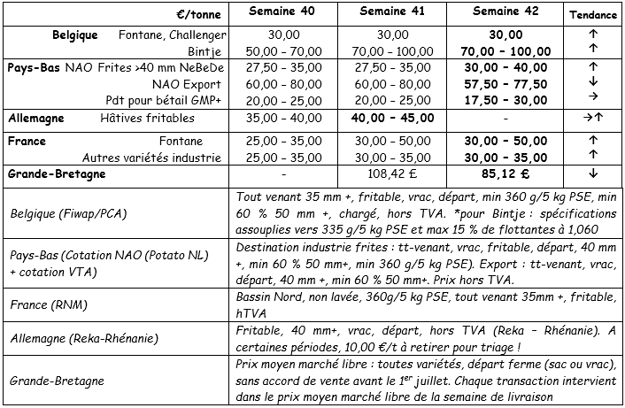

Prices overview €/t (source: NEPG):

Belgium

Market report Fiwap / PCA:

Industrial potatoes

Fontane Challenger: prices around 3.00 € / q, strong market; very few transactions in a practically inactive market due to a lack of demand (apart from a few often redundant lots) and supply (especially storage potatoes and unattractive prices). There has been a strongly reduced export activity.

Bintje: prices of between 7.00 and 10.00 € / q depending on the quality (mainly the size) and the possibility of harvesting them directly or at short notice. Very solid market.

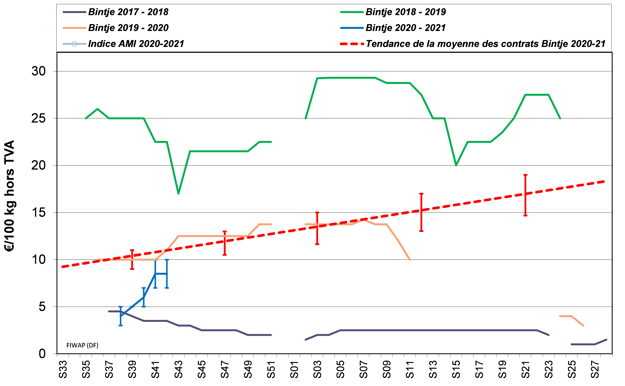

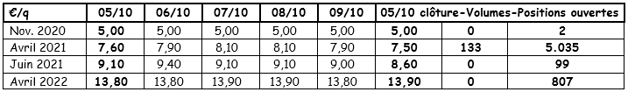

Long term market

EEX in Leipzig (€ / q) Bintje, Agria and related industrial varieties, 40 mm+, min 60% 50 mm+:

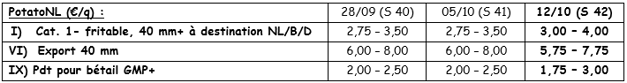

The Netherlands

Despite the difficult situation, harvesting could continue in the sandy areas, ensuring there was no risk to deliveries to the factories.

In the west of the country, however, it was barely possible to start with potato storage. For the industry, the demand remains lacking and the supply is also inactive.

The domestic fresh markets are very active, but prices remain the same and are between 10.00 and 12.00 € / q for floury varieties and between 16.00 and 22.00 € / q for firm cooking varieties.

The export activity is not very spectacular: the parties to African destinations continue to do well. This also applies to regular parties to the Caribbean. However, the prices have fallen and are between 9.00 and 11.50 € / q for potatoes sorted by size in big bags.

Source: www.potatonl.com

France

According to UNPT estimates, about 45% of the potatoes were harvested by the middle of last week. However, many growers think that they will not be finished harvesting in October and are increasingly concerned about this.

In the Hauts-de-France regular rain showers put heavy pressure on the industrial markets. Several important market participants indicate that this brought prices to between 5.00 and 6.00 € / q. The factories struggled to get their potato supplies and were considering closing their doors.

Demand on the fresh markets has declined and is focused on better quality potatoes. Spain demands a level of quality that is difficult to find, transport remains costly and this leads to a number of conflicts upon arrival...

The transactions took place on the basis of prices of between 12.00 and 13.00 € / q for potatoes directly from the field and prices of between 14.00 and 18.00 € / q for by size and in big bags for exported sorted potatoes.

The demand from other destinations is currently not great.

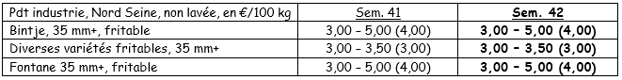

Industrial varieties, bulk, export, excl. VAT, Nord Seine, € / qt, min - max (average) (RNM):

Germany

In the south of the Rhineland - unlike in the north where it rained more - harvesting has generally continued at a good pace in recent days.

The same applies to the harvest in large parts of Lower Saxony, the "Kartoffelländer" itself! There is therefore more than enough supply for the various markets, both for the fresh market and the industrial market.

Fresh market (early and semi-early potatoes): the price for firm-boiling potatoes remains unchanged: € 10.83 / q (€ 10.83 € / q last week) and the same applies for floury potatoes: € 10.08 / q (10, 08 € / q last week). Potato sales in supermarkets are going well thanks to the autumnal atmosphere.

Organic potatoes: grower prices are around € 41.00 / q (all varieties and markets together) and are negotiable. The growers are disappointed that these prices are lower than the prices paid for recent yields.

It is estimated that 80 to 90% of organic products have returned throughout the Republic. The size of the yields and the quality of the potatoes are quite variable. There are once again problems in the form of Rhizoctonia, pinworms and damage. As a result, it is ultimately the net proceeds that will determine the market and the development of prices.

The number of organic ware potatoes sold in August and early September was disappointing and smaller than that in the same period last year. This was mainly due to the heat wave, which was not exactly beneficial to potato consumption.

However, the areas intended for the cultivation of organic potatoes increased in 2019, especially and again in Germany, but also in France. The total size of the surfaces amounted to about 32,900 ha in 2019.

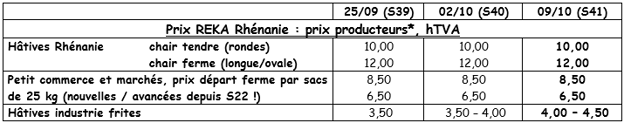

*If no work is done on the fields, 1 € / q in sorting costs must be deducted from the price

For more information:

FIWAP

www.fiwap.be