The week has been described as relatively quiet across the board, with many supplies across all sectors utilised mainly on contract.

Slight increase in demand for certain sectors as schools start again after many months of being shut. However, stakeholders within the industry say this is not necessarily being felt as we head into a conventionally quiet spell. Better weather this week has allowed growers to continue to lift, and many have reported they’ll start burning crops off in the coming weeks in preparation for lifting.

Packing

Maris Piper is still showing small premiums over other packing varieties this week.

Limited price movement week-on-week for free-buy, majority of material continues to be traded on contract.

Most growers now able to get back to lifting after heavy rainfall in previous weeks.

Bags

The relatively quiet bank holiday did not see a large increase in demand for ‘top up’ bagged chipping demand. The end of the Eat Out To Help Out scheme may well see some demand shift back to chip shops and takeaways.

Processing

There has been a slight increase in demand at the lower end of the market, supported by schools returning.

The Government’s Eat Out to Help Out scheme has drawn to a close, which had helped improve demand for some processing material.

Many restaurants are continuing similar promotions throughout September to try and maintain a level of demand for the food service sector.

Export

Export markets this week have reportedly felt some pressure, with prices constrained as people compete for trade.

We are only able to publish a price for the Canary Island exports. However, there have been reports of trade to Belgium and Ireland also.

The months ahead for the processing sector

Supply

Processing potatoes supply is still outweighing the reduced demand on the domestic market.

Given that most planting decisions had been made this year when the pandemic hit, this demand erosion has had minimal impact on the GB potato area. Indeed, the current estimate of 119Kha is only 1% back on 2019.

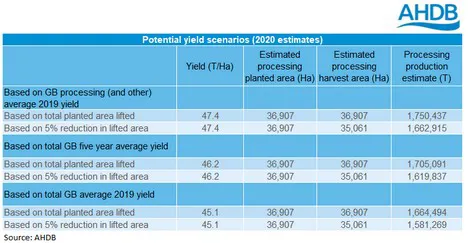

In recent years, the processing area has been increasing steadily, standing at 37.5Kha last year. Using the proportion the processing area made up of the total GB area last year (31%), we could estimate 2020 area to stand around 37Kha.

Based on this figure, and using a five year average yield of 46.2t/ha, we may see the volume of GB processing potatoes at around 1.7Mt this season if there are minimal area losses. As ever, there is still a large tranche of lifting to be completed, so any severe weather could knock this figure.

Reduced imports of processing material may limit availability to an extent, although this is unlikely to have too much influence on total supply levels. A risk does remain though that given the surplus of processing stock on the continent, there may be potential for pressure from a supply of cheap European substitutes.

Surplus stock from the 2019 crop is becoming unwanted by the market and alternative uses are having to be found. There is some demand for use in animal feed and bio-digestors although the prices being paid for this are limited.

Demand

Throughout the last 5 months the coronavirus pandemic has really framed the UK demand picture for processed potatoes. Whilst we have seen an uptick in demand for frozen potato products and crisps from the retail sector, we have seen a huge loss from the foodservice sector.

Unfortunately, it is predicted that the rises seen in retail have far from counteracted the losses seen in foodservice. Foodservice is estimated to account for 55-60% of the sector and it’s well know that the sector took a big hit at the beginning of lockdown due to the widespread closure of pubs and restaurants. Although this industry has “reopened” it has been slow and is still not back to “normal”.

CGA report that the first month of trading (July) saw Britain’s managed pub, restaurant and bar groups sales down 50% compared to July 2019. And that only 36% of restaurants had reopened, although this was much higher for pubs.

The government’s Eat Out to Help Out (EOTHO) scheme was introduced to try and boost this sector, but it’s not clear yet as to the true impact this has had. Early data suggests that footfall increased Monday-Wednesday in pubs and restaurants, but this may actually be taking away from weekend trade. Also, an increase in eat-in foodservice could potentially reduce the takeaway market. Therefore, the demand/consumption may just shift rather than increase for the overall potato industry.

Unfortunately for the industry, this trend of reduced demand is likely to continue. Consumers are going to take some time to return to normal habits both from a safety conscious point of view, but also from the financial impacts likely caused by the recession. How long a recession, and when we might see an upturn in the economy, remains a keen topic of debate amongst economists. Many factors coming down the pipeline could affect the nature of this.

Prices and possible market implications

On the back of reduced demand for processing material we have seen both a loss of free-buy market completely and then an erosion of prices.

There was some movement of processing potatoes into retail lines, but anything that could not or would not be accepted into the packing market almost ceased to find a home at all for some time. Not only had pubs, restaurants, cafes and the like closed, but so had schools and workplace canteens.

We know that a significant area of processing potatoes were grown on contract in 2019 (c.95%) and reduced demand meant contracted material generally covered it. This limited any opportunity for free-buy processing material to move into its intended market and has continued to weigh on the market throughout.

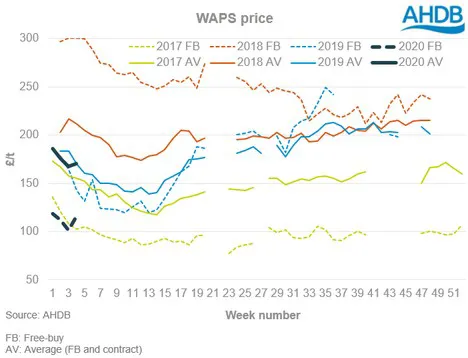

Our WAPS survey, covering all market sectors, demonstrates price trends throughout seasons. As demonstrated in the series below, prices generally slip from the start of the season through to October as lifting and “field sales” progress. Once crops are generally lifted into store we usually start to see some price support again. The supply and demand picture dictates where the free-buy price sits relative to the overall price (including both contracts and free-buy).

2020/21 pricing is currently following, albeit more exaggerated, trends seen in 2017 when the GB crop surpassed 6Mt. Although due to different reasons, we could see similar trends this season. As we know, price is function of supply and demand.

In 2017/18, a bumper crop resulted in surplus supply comparative to demand. This season we are facing a destruction of demand causing the potential for a surplus crop. While the end result of an oversupply is the same, and the pressure this can put on prices, the interventions used to address the imbalance will need to differ.

Similar to 2017/18 we have seen the season start with free-buy prices well below the overall average price. For week ending 29 August 2020 the WAPS free-buy average price is £54.57/t lower than the WAPS overall average price. And both have been dropping from the start of the season following normal trends.

If there is no detrimental weather event in the coming months and demand from foodservice remains suppressed, it is likely that the need for free-buy supply will remain somewhat limited.

Look out for our planted area update, due soon, which will give a split by sector and an indication of the contract/free-buy split to help understand the supply picture further. Our consumer insight team will also continue to monitor demand patterns across retail and foodservice in the coming months.

Source: AHDB